(Restores missing words in eighth paragraph.)

* European stocks boosted by Q3 earnings

* Euro zone bond yields inch lower

* U.S. debate creates few surprises

* Graphic: 2020 asset performance http://tmsnrt.rs/2yaDPgn

* Graphic: World FX rates in 2020 http://tmsnrt.rs/2egbfVh

By Tom Arnold and Hideyuki Sano

LONDON/TOKYO, Oct 23 (Reuters) - Global stocks remained

within a tight range on Friday, less than two weeks before the

U.S. presidential election, with traders looking for a

breakthrough in stimulus talks in Washington.

The final debate between U.S. President Donald Trump and his

Democratic challenger Joe Biden on Thursday provided few

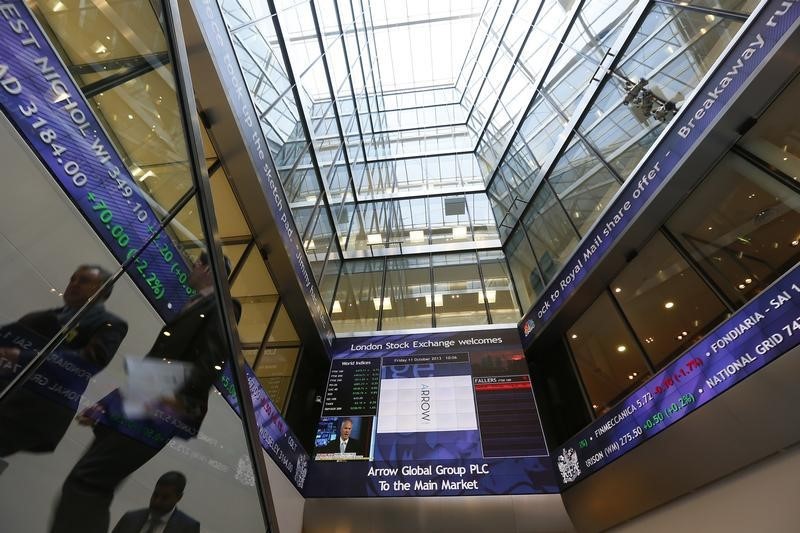

surprises. European stocks .STOXX pushed 0.8% higher for their best

day in five trading sessions. Strong third-quarter results

offset key business survey data showing patchy recoveries across

the euro zone's two largest economies, Germany and France.

Britain's main stock index .FTSE added 1.1% as Barclays

BARC.L reported stronger-than-expected third-quarter earnings

and British retail sales beat expectations in September.

The chief negotiators for Britain and the European Union

were set to meet on Friday for talks on a last-gasp trade deal

to avert a tumultuous finale to the five-year Brexit crisis.

U.S. S&P 500 futures ESc1 were up 0.1%, after dipping

following the debate. The underlying index had gained about 0.5%

the day before on hopes the U.S. Congress and the White House

would soon strike a deal on another round of COVID-19 stimulus.

Shares in Asia hardly moved, with MSCI's broadest index of

Asia-Pacific shares outside Japan .MIAPJ0000PUS 0.1% lower.

Japan's Nikkei .N225 ticked up 0.2%. The CSI300 index of

mainland China .CSI300 shed 1.3%.

The MSCI world equity index .MIWD00000PUS, which follows

shares in nearly 50 countries, was up 0.2% and set for its

biggest weekly fall in a month.

At Thursday's debate, Biden renewed his criticism of Trump's

handling of the coronavirus pandemic as Trump levelled unfounded

corruption accusations at Biden and his family.

"The market is not going to change significantly in the

short term," said Francois Savary, chief investment officer at

Swiss wealth manager Prime Partners.

"There is no reason for markets to take big long positions

as we have the election in less than 10 days, and combined with

COVID-19 uncertainty it's a time where people will take a step

back and wait for election developments before taking a bet on

the markets."

A widening lead in polls by Biden is prompting many

investors to bet on a Biden presidency and a "blue sweep", where

Democrats win both chambers of Congress.

While Democratic plans to raise taxes on corporate profits

and capital gains could hit share prices, their pledge on large

stimulus is seen as offsetting those blows.

Clean energy is seen as a potential winner at the expense of

conventional energy under a Biden presidency. The Dow Jones oil

and gas index .DJUSEN is down nearly 49% this year. Biden

reiterated his campaign pledge of net-zero-emissions by 2050.

The Nasdaq index .IXIC , which had led the market's rally,

has underperformed lately, losing 1.4% so far this week, on

concern Democrats will take a harder stance on big tech firms.

"A blue wave may lead to concerns about the impact on the

tech sector, while a Biden win and a split Congress may imply

another four years of limited policy changes and politicking,"

said Mary Nicola, senior economist at Pinebridge Investments in

Singapore.

Expectations of bigger government stimulus have also boosted

U.S. borrowing costs. The 10-year U.S. Treasuries yield

US10YT=RR rose to a four-and-a-half-month high of 0.870% on

Thursday and last stood at 0.853%.

U.S. House of Representatives Speaker Nancy Pelosi reported

progress in talks with the Trump administration for another

round of financial aid, saying legislation could be hammered out

"pretty soon". In the euro zone, bond yields inched lower after the latest

monthly purchasing managers' index (PMI) data showed the impact

of the second wave of COVID-19 infections in Germany and France.

France saw business activity contract in October. German

manufacturing rebounded, but its services dipped.

German 10-year bond yields DE10YT=RR , the benchmark for

the bloc, inched lower to -0.57%. French 10-year borrowing costs

FR10YT=RR dropped a similar amount to -0.29%.

In currency markets, the dollar was 0.03% lower against a

basket of currencies =USD early in Europe, shy of a seven-week

low hit on Wednesday.

The euro EUR= was unchanged against the dollar at $1.1818,

So was sterling at $1.3084. The Chinese yuan stood at 6.6767 per dollar in offshore

trade CNH= , off a 27-month high of 6.6278 on Wednesday.

Oil prices eased. O/R Brent futures LCOc1 dropped 0.1%

to $42.41 per barrel. U.S. crude futures CLc1 shed 0.2% to

$40.57 per barrel.

Gold was steady, with spot gold XAU= little changed at

$1,903.36 per ounce. GOL/

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Global assets http://tmsnrt.rs/2jvdmXl

Global currencies vs. dollar http://tmsnrt.rs/2egbfVh

Emerging markets http://tmsnrt.rs/2ihRugV

MSCI All Country Wolrd Index Market Cap http://tmsnrt.rs/2EmTD6j

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

REFILE-GLOBAL MARKETS-Stocks bide time as U.S. election caution sets in

Published 10/23/2020, 04:59 PM

Updated 10/23/2020, 05:00 PM

REFILE-GLOBAL MARKETS-Stocks bide time as U.S. election caution sets in

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.