* AstraZeneca vaccine news drives risk-on approach

* Vaccine could be released by mid-December

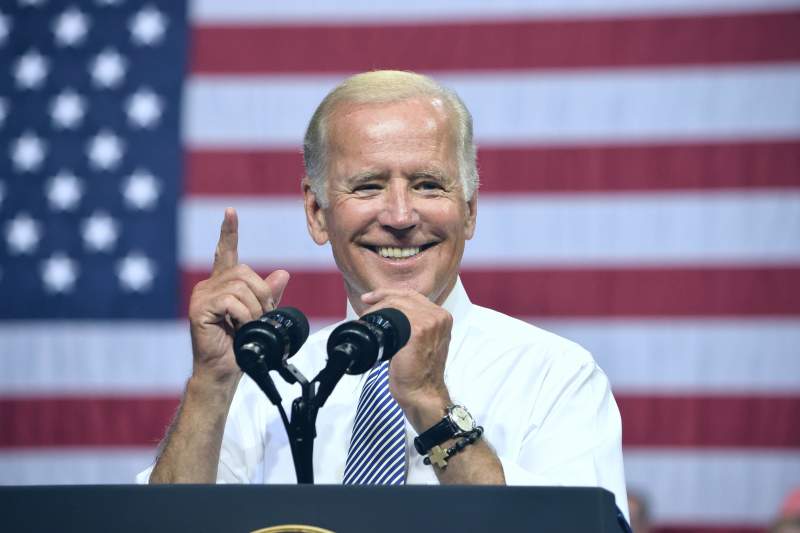

* Trump, government officials nod to formal Biden transition

* For a Reuters live blog on U.S., UK and European stock

markets,

click LIVE/ or type LIVE/ in a news window.

*

By Katanga Johnson and Julie Zhu

WASHINGTON/HONG KONG, Nov 24 (Reuters) - Asian shares

climbed on Tuesday as news U.S. President-elect Joe Biden was

given the go-ahead to begin his White House transition added to

an already brighter mood from progress made on COVID-19 vaccine

and the prospects for a speedy global economic revival

U.S. General Services Administration chief Emily Murphy

wrote in a letter to Biden on Monday that he can formally begin

the hand-over process.

President Donald Trump tweeted that he had told his team "do

what needs to be done with regard to initial protocols", an

indication he was moving toward a transition after weeks of

legal challenges to the election results. U.S. stocks also got an added boost after reports that Biden

plans to nominate former Federal Reserve Chair, Janet Yellen, to

become the next Treasury Secretary. Futures for the S&P 500

EScv1 rose 0.48% in early Asian trade. The upbeat backdrop helped MSCI's broadest index of

Asia-Pacific shares outside Japan .MIAPJ0000PUS advance 0.15%.

Australia's S&P/ASX 200 .AXJO was 1.1% stronger, touching its

highest level in almost nine months, with energy stocks leading

the pack. Japan's Nikkei .N225 jumped 2.48% while Seoul's Kospi

.KS11 was 0.74% higher.

Chinese blue-chips .CSI300 and Hong Kong's Hang Seng

.HSI were however outliers, edging down 0.75% and 0.08%.

The progress made on COVID-19 vaccines, which had

underpinned Wall Street overnight, helped keep risk appetite

elevated as it boosted optimism about a quicker revival for the

global economy.

AstraZeneca AZN.L said its COVID-19 vaccine, cheaper to

make, easier to distribute and faster to scale-up than its

rivals, could be as much as 90%

effective. "Traders are still buying into vaccine news clearance, as

the end of the pandemic becomes imaginable. Recent U.S. data

restored a bit of confidence that the economy is holding up,

despite surging COVID-19 infections and a painful lack of fresh

fiscal stimulus," said Kyle Rodda, a market analyst for IG

Australia.

"And the news of Yellen's possible nomination to the role of

U.S. Treasury Secretary potentially puts a very Fed-friendly

uber-dove at the reins of fiscal policy."

The U.S. dollar index touched its lowest since Sept. 1

before edging 0.214% higher with the euro EUR= unchanged at

$1.184.

On Wall Street, the Dow Jones Industrial Average .DJI rose

1.12% overnight, the S&P 500 .SPX gained 0.56% while the

Nasdaq Composite .IXIC added only 0.22%, underperforming as

traders rotated away from big tech names.

Some analysts expect big, short-term risks ahead of the U.S.

Thanksgiving holiday, although others say unexpected news events

at the start of the shorter trading week helped investors focus

on the growing positives for financial markets.

Oil prices added to last week's gains as traders anticipated

the vaccine news would spur a recovery in energy demand.

"Investors are ignoring near-term headwinds, chief among

which are surging global COVID infections, and instead looking

ahead to next summer," said PVM analyst Stephen Brennock.

The United States surpassed 255,000 deaths and 12 million

infections since the pandemic began, with daily infections at a

record near 170,000 and daily deaths around 1,500.

U.S. crude CLc1 advanced 0.14% to $43.12 per barrel and

Brent LCOc1 was at $46.10, up 0.09% on Tuesday, while an index

of commodity prices .TRCCRB touched its highest since early

March.

The yield on the benchmark 10-year notes US10YT=RR rose

slightly to 0.8684%.

Spot gold XAU= fell to $1,827.01 an ounce while U.S. gold

futures GCc1 dropped 0.46% to $1,829.30 an ounce.

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Global assets http://tmsnrt.rs/2jvdmXl

Global currencies vs. dollar http://tmsnrt.rs/2egbfVh

Emerging markets http://tmsnrt.rs/2ihRugV

MSCI All Country Wolrd Index Market Cap http://tmsnrt.rs/2EmTD6j

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GLOBAL MARKETS-Stocks rise as Biden transition, vaccine progress lift confidence

Published 11/24/2020, 10:42 AM

Updated 11/24/2020, 10:50 AM

GLOBAL MARKETS-Stocks rise as Biden transition, vaccine progress lift confidence

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.