By Ambar Warrick

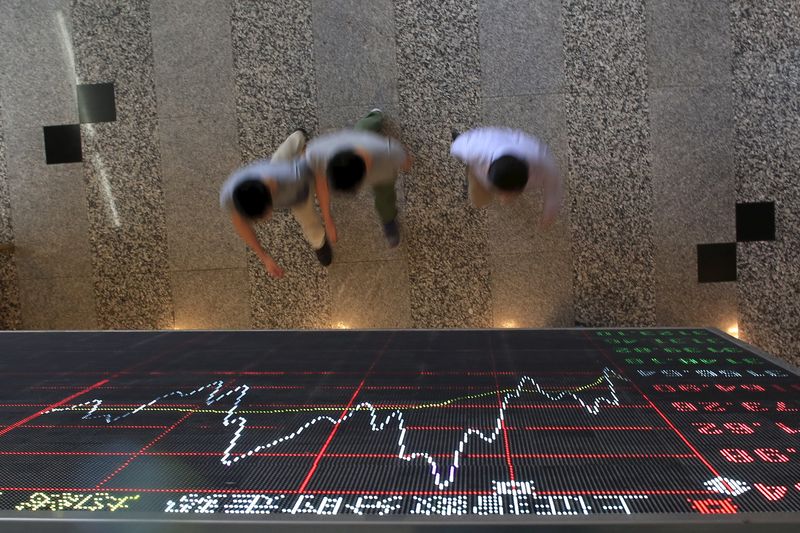

Investing.com -- Chinese stock indexes sank amid broad-based losses on Friday as mixed economic data raised some concerns over the timing of an economic recovery this year, while broader Asian markets rose cautiously in anticipation of key U.S. nonfarm payrolls data.

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes sank 1.7% and 1.4%, respectively. Both indexes saw steady profit taking this week after recently hitting multi-month highs. Chinese indexes were also the worst performers in Asia this week.

Mixed economic data released drummed up concerns over a speedy recovery in China, after the lifting of its zero-COVID policy. While the country’s services sector rebounded sharply in January after four months of declines, a private survey showed that smaller-scale manufacturing businesses were still struggling in the face of rising COVID-19 cases and lingering supply chain issues.

Hong Kong’s Hang Seng index was the worst performer for the day, falling 1.8% on losses in technology stocks. Sentiment towards the tech sector was dented by mixed quarterly earnings from major U.S. firms released overnight.

Other Asian tech-heavy indexes also lagged, with the Taiwan Weighted index up 0.1%, while South Korea’s KOSPI added 0.5%.

Broader Asian stocks crept higher as sentiment remained cautious in anticipation of the U.S. nonfarm payrolls reading. Data released overnight indicated some strength in the jobs market, raising concerns that robust employment could keep U.S. inflation higher for longer.

Markets were also digesting a mixed outlook on monetary policy from the Federal Reserve. While the bank noted that inflation had retreated significantly in the past few months, it still flagged more interest rate hikes, given that price pressures are still relatively high in the country.

This, coupled with fears of a strong nonfarm payrolls reading, saw markets reassessing their outlook on U.S. monetary policy. Markets also feared that rising U.S. interest rates could spur a potential recession this year - a scenario that bodes poorly for risk-heavy Asian stocks.

Most regional bourses were set to end the week marginally higher, following an initial rally on bets that the Fed could pause its rate hike cycle sooner than expected.

Indian stocks rose on Friday, with the Nifty 50 and BSE Sensex 30 indexes adding 0.2% and 0.6%, respectively. But a severe rout in the shares of Adani Enterprises Ltd (NS:ADEL) and its related firms continued.

The stock plummeted 30% on Friday to a near two-year low, and was set to lose over 60% of its value this week.