(For a Reuters live blog on U.S., UK and European stock

markets, click LIVE/ or type LIVE/ in a news window.)

* Payment cos jump as bitcoin hits all-time highs

* Cannabis shares reverse premarket gains

* Weekly jobless claims edge down

* Indexes: Dow flat, S&P up 0.20%, Nasdaq rises 0.53%

(Adds comment, details; updates prices)

By Medha Singh and Devik Jain

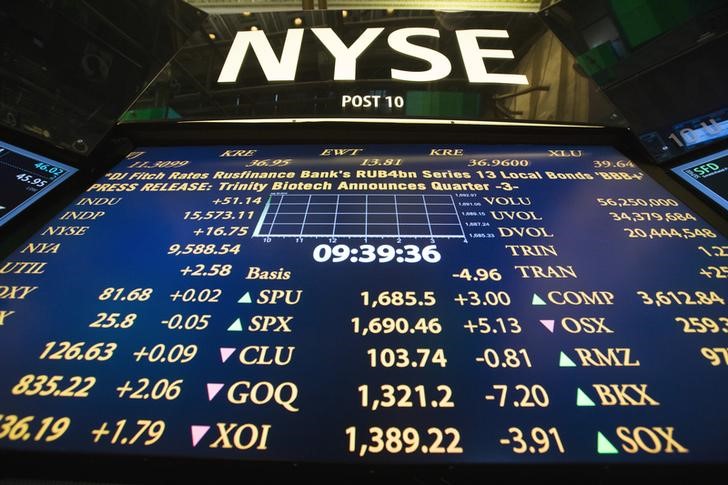

Feb 11 (Reuters) - The S&P 500 and the Nasdaq rose on

Thursday, just shy of record highs with investors betting on

more fiscal stimulus to ride out a coronavirus-driven recession

as data showed a stalling recovery in the labor market.

Mastercard Inc MA.N rose about 3% after the credit-card

giant said it was planning to offer support for some

cryptocurrencies on its network this year, joining a string of

big-ticket firms that have pledged similar support. Other payments companies PayPal Holdings Inc PYPL.O and

Visa Inc V.N gained 7% and 2%, respectively.

Bank of New York Mellon BK.N rose about 2% after saying it

had formed a new unit to help clients hold, transfer and issue

digital assets, sending Bitcoin BTC=BTSP up over 8% to an

all-time high of $48,481. The number of Americans filing new applications for

unemployment benefits were 793,000 last week, compared to

812,000 in the prior week, but they are well below the record

6.867 million reported last March when the pandemic hit the

United States. "As long as the economic news is difficult the Fed is going

to continue to act, which will prop up the stock market," said

Sandy Villere, portfolio manager at Villere & Co in New Orleans,

Louisiana.

Wall Street's main indexes had hit record highs recently on

prospects of a $1.9 trillion coronavirus relief package to

jumpstart the economy with a largely better-than-expected

earnings season also helping the sentiment.

Analysts now expect fourth-quarter earnings for S&P 500

firms to grow 3%, versus forecast of a 10.3% drop at the

beginning of January, per Refinitiv data.

"There is room for the market to take a breather but usually

there is some sort of catalyst that gets that going," said Tom

Martin, senior portfolio manager at Globalt Investments in

Atlanta.

"And right now the news isn't providing you that - fiscal

stimulus, monetary stimulus, coronavirus information and

earnings are all pretty positive."

Federal Reserve Chairman Jerome Powell reassured investors

on Wednesday that interest rates will remain low for some time

to spur the economy and jobs growth, but provided no new

insights on monetary policy. The tech sector .SPLRCT and semiconductors .SOX hit

record highs, while economy-linked energy .SPNY and

industrials .SPLRCI took a back seat after being in the

spotlight this year.

At 11:50 a.m. ET, the Dow Jones Industrial Average .DJI

rose 4.43 points, or 0.01%, to 31,442.23, the S&P 500 .SPX

gained 7.70 points, or 0.20%, to 3,917.58 and the Nasdaq

Composite .IXIC gained 74.71 points, or 0.53%, to 14,047.56.

U.S.-listed shares of cannabis companies including Tilray

TLRY.O and Aphria APHA.O reversed premarket gains to drop

42% and 20% after the sector caught the attention of

Reddit-inspired retail investors this week. Walt Disney Co DIS.N was nearly flat ahead of its results

after market close. Pinterest Inc PINS.N rose 7.1% after a report said

Microsoft Corp MSFT.O approached the image-sharing company in

recent months about a potential buyout. The negotiations were,

however, currently not active, according to the report.

Advancing issues outnumbered decliners by a 1.3-to-1 ratio

on the NYSE and on the Nasdaq.

The S&P 500 posted 33 new 52-week highs and no new lows,

while the Nasdaq recorded 377 new highs and 11 new lows.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US STOCKS-S&P 500, Nasdaq drift towards record highs as data fuels stimulus bets

Published 02/12/2021, 01:19 AM

Updated 02/12/2021, 01:20 AM

US STOCKS-S&P 500, Nasdaq drift towards record highs as data fuels stimulus bets

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.