- USD/JPY could face volatility as Trump’s policy moves and the BOJ meeting loom large.

- Speculation grows over a potential rate hike by the BOJ, with inflation and Treasury yields hitting decade highs.

- The pair could see sharp moves, depending on the interplay of Japanese monetary policy and U.S. tariff strategies.

- Kick off the new year with a portfolio built for volatility - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

Donald Trump’s inauguration dominated yesterday’s session, with the new president wasting no time in signing several executive orders addressing key socio-economic issues.

While stock markets responded with moderate gains, the U.S. dollar softened slightly, signaling a cautious tone among investors.

However, the initial calm of the new year appears to be fading. As Trump’s administration begins to implement its policies, markets may face increased volatility, with potential ripple effects across stock indices and currency pairs.

In the forex market, all eyes are on the USD/JPY pair ahead of the Bank of Japan's (BOJ) highly anticipated meeting on Friday.

Traders are speculating that Governor Kazuo Ueda may signal a hawkish shift, including a possible interest rate hike.

Currently, the yen is experiencing a local correction, which could develop into a more pronounced decline if the BOJ moves to tighten policy further.

BOJ Decision: Will Ueda Deliver a Hawkish Surprise?

The BOJ's last rate hike in July—a modest 15 basis points—marked a cautious step toward normalization after years of ultra-loose monetary policy.

Since then, Japan’s central bank has emphasized the need for more data, maintaining a conservative approach in light of its long battle with deflation and fears of tightening too aggressively.

This week, markets are pricing in a 74% probability of a 20-basis-point hike, reflecting growing expectations of a policy shift.

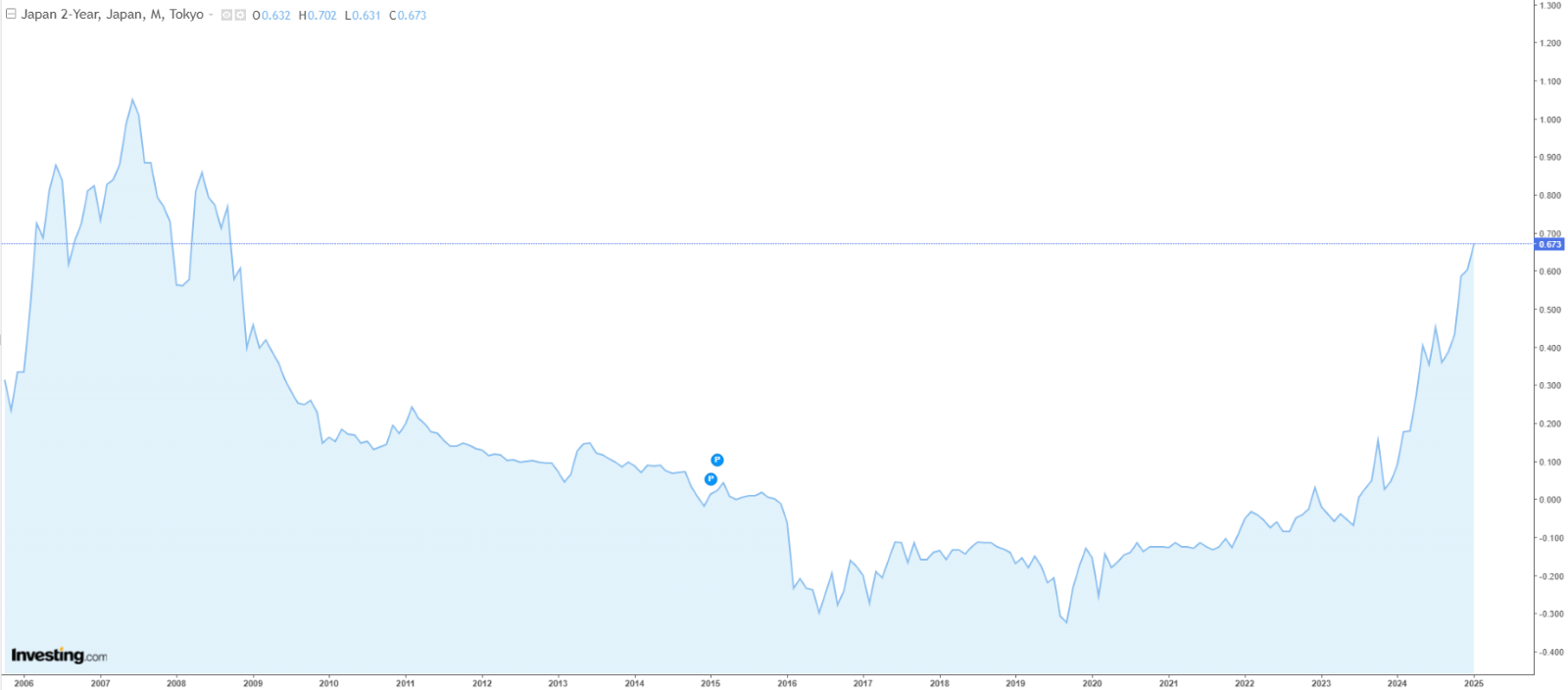

Governor Ueda’s recent hawkish remarks have fueled these bets, pushing the Japan 2-Year Treasury yields to their highest levels since 2008.

Similarly, Japan 30-Year Treasury yields reached levels not seen since 2009, underscoring the market’s anticipation of a pivotal decision.

Despite the hawkish momentum, mixed signals from broader economic indicators suggest uncertainty remains.

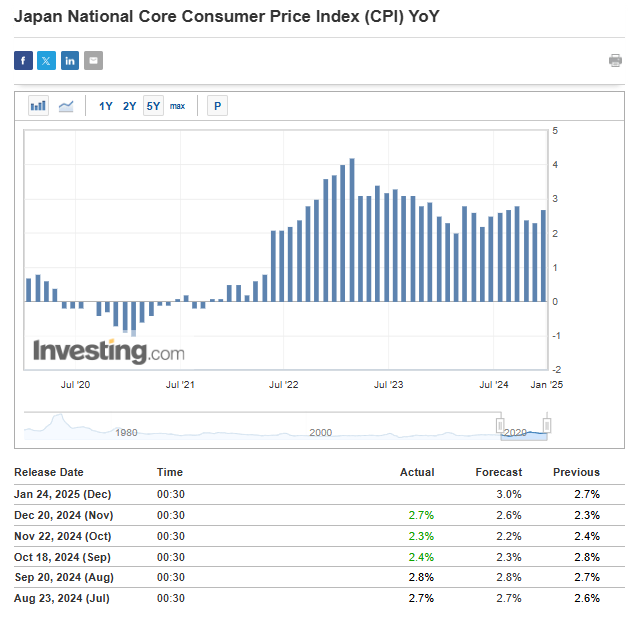

Inflation data due just before the BOJ meeting is expected to show a year-over-year rise to 3%. If confirmed, this could bolster the case for a rate hike, though inflation appears to be stabilizing above the BOJ’s target rather than rebounding significantly.

Tariff Policy and Its Impact on the Dollar

Markets are also closely watching Trump’s tariff policy, which could inject further volatility into financial markets.

A strong implementation of Republican tariff promises may trigger a new wave of U.S. dollar appreciation. For the USD/JPY pair, this could create an intriguing technical setup.

If Japan delivers a rate hike while Trump adopts a softer tariff stance, the USD/JPY pair may extend its current correction. Key support levels include the confluence of the upward trendline and the demand zone near ¥154 per dollar.

The recent dip in USD/JPY has brought the pair closer to a critical support zone, encompassing minor horizontal support at 155.00, the 50-day moving average, an uptrend line from September 2024, and the 200-day moving average.

These levels have historically played a key role, with the 200-day moving average standing out as a formidable barrier for bears.

A break below this area could open the door for a deeper decline toward the ¥149 level. On the flip side, buyers remain poised for a retest of long-term highs around ¥162 if bullish momentum returns.

***

Curious how the world’s top investors are positioning their portfolios for the year ahead?

You can find that out using InvestingPro.

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.