By Ambar Warrick

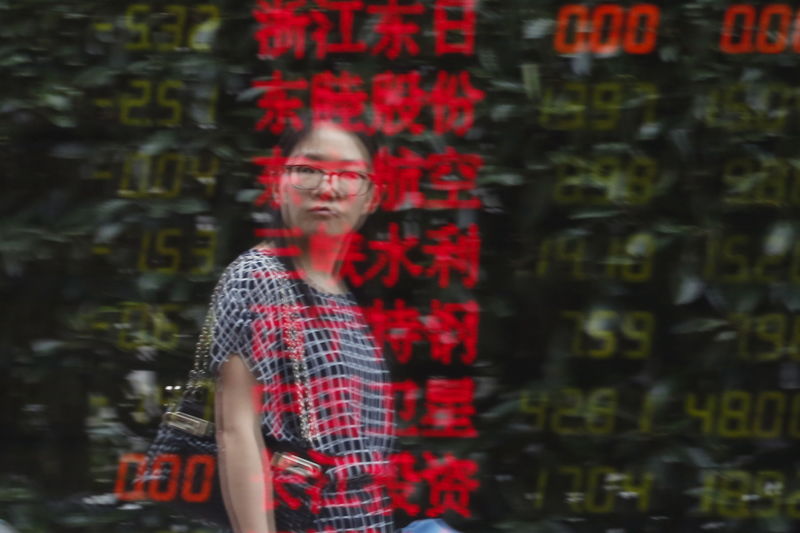

Investing.com-- Most Asian stock markets retreated on Monday as investors pivoted out of risk-heavy assets ahead of more signals on U.S. monetary policy this week, while rising COVID-19 cases in China dampened optimism over an economic reopening in the country.

Chinese and Hong Kong stocks were the biggest decliners on the day as markets feared that the relaxing of anti-COVID measures in China will result in much higher infection rates. China is already struggling with a record-high increase in daily infections.

This largely offset optimism over a potential economic recovery in the country, with the withdrawal of COVID curbs.

The Shanghai Shenzhen CSI 300 and Shanghai Composite indexes fell 0.8% and 0.6%, respectively, while Hong Kong’s Hang Seng index slumped nearly 2%. Analysts also forecast high volatility in Chinese markets as the country relaxes anti-COVID measures.

The Taiwan Weighted index, which is also heavily exposed to China, fell 0.7%.

Japan’s Nikkei 225 index fell 0.2% after data showed producer price inflation in the country remained pinned near 40-year highs in November. The reading shows that price pressures are likely to remain more stubborn and pressure the Japanese economy in the near-term.

India’s Nifty 50 and BSE Sensex 30 indexes were flat on Monday ahead of key consumer inflation data due later in the day, which is expected to show that price pressures eased further in the country.

Focus this week is squarely on key U.S. consumer price index (CPI) inflation data due on Tuesday. While the data is expected to show that inflation eased further in November, stronger-than-expected producer price index inflation for the month may herald a similar trend in consumer prices.

The data is expected to largely factor into the Fed’s stance on monetary policy. The central bank is set to hike interest rates by 50 basis points at the conclusion of a two-day meeting on Wednesday.

But a stronger-than-expected inflation reading could elicit more hawkish signals from the central bank. Several Fed officials have warned that stubborn inflation will see U.S. interest rates peak at much higher levels than anticipated.

Still, Treasury Secretary Janet Yellen said on Sunday that inflation is expected to fall substantially in 2023, indicating some positive trends for markets.

Rising U.S. interest rates weighed heavily on Asian stock markets this year, as liquidity conditions tightened and as investors pivoted into higher-yielding debt markets.