Wall Street again finished dead flat overnight as earnings concerns mounted while European shares suffered a similar fate as the USD firmed somewhat against the majors. The Australian dollar remains stuck as punters worry about the next RBA rate rise, holding just above the 67 handle. 10 year US Treasury yields lifted to breach the 3.6% level while the commodity complex still doesn’t like the stronger USD nor concerns about a slowing US economy with oil prices pulling back again, with Brent crude off nearly $2 to the $83USD per barrel level. Gold was unable to rebound and get back above the $2000USD per ounce level to return below in line with other undollars.

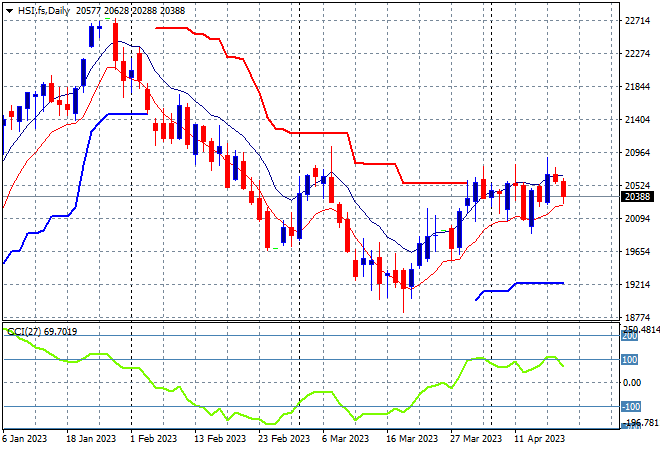

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets failed to gain traction as they head into the close, with the Shanghai Composite selling off sharply to be down over 0.6% to remain well below the 3400 point barrier at 3370 points. Meanwhile the Hang Seng pulled back even further, down more than 1.3% to close at 20367 points. The daily chart is showing resistance building again at the 20500 point level with daily momentum unable to get into a clear overbought mode, with price action now rolling over. The start of year correction may be returning here as the inability to get a substantial lift above that 20500 point level looks like failing:

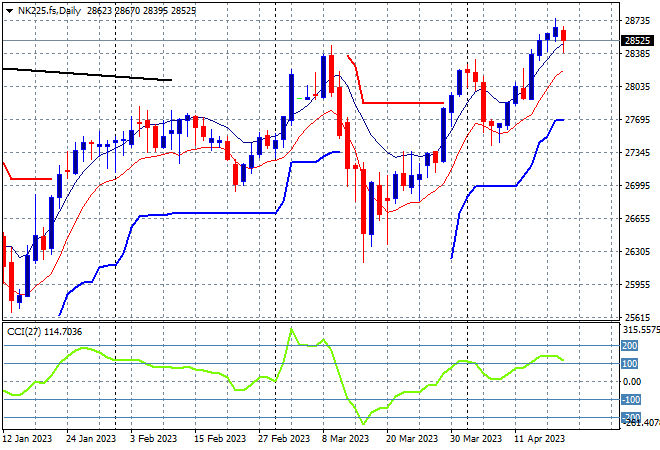

Japanese stock markets lost their new found confidence with the Nikkei 225 closing nearly 0.2% lower at 28606 points. The previous bounceback looked like a bull trap, but this still may have more traction, taking out the March highs although futures are indicating a slight pullback strong lift on the open. Daily momentum was getting back into overbought conditions with support building at the 27000 point area, but price action looks quite toppy here:

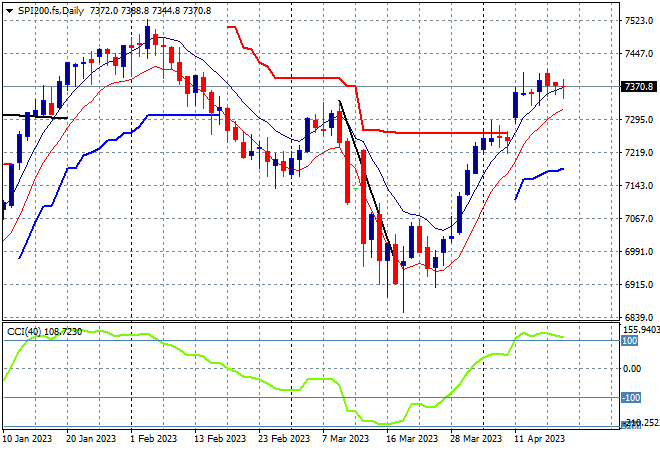

Australian stocks were treading water with the ASX200 finishing only slightly higher to remain below the 7400 point level at 7365 points. SPI futures are again dead flat in line with the uncertainty on Wall Street overnight so expect another wishy washy session today. The daily chart shows price action wanting to continue the break through the March highs in an attempt to get back to the January levels but deceleration is building here into a rounding top pattern. Daily momentum remains nicely overbought and this trend is well supported so it this could be a temporary blip:

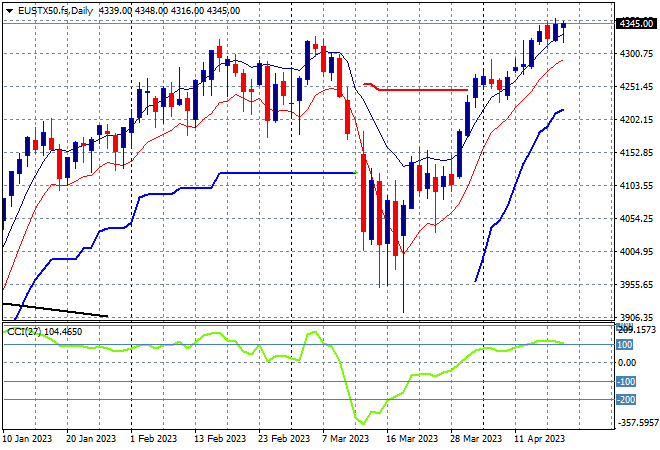

European markets were mixed again overnight with peripheral markets gaining while central bourses like the German DAX and FTSE 100 treading water as the Eurostoxx 50 Index closed flat at 4393 points, Another market that wants to extend above its previous March highs but daily momentum is struggling to really push into the overbought zone. This still looks like setting up for further gains but the drop in Euro and lack of direction from Wall Street may continue to dampen spirits in the sessions ahead:

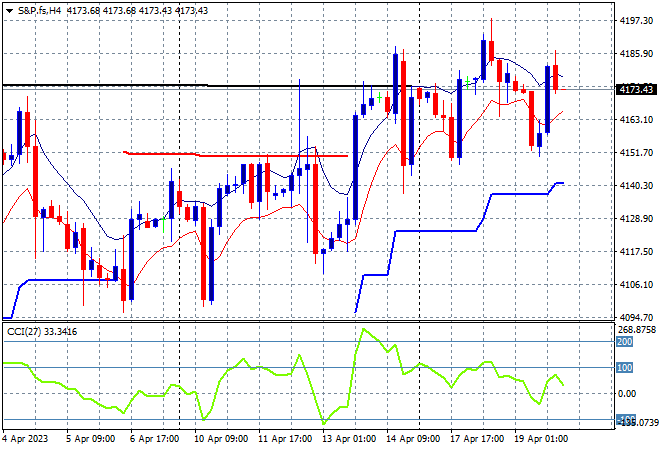

Wall Street was again unable to convert any meaningful gains as earnings season continued to dampen spirits with both the NASDAQ and S&P500 putting in scratch sessions, the latter closing at 4154 points. The four hourly chart shows how hesitation continues to build at this point of control, albeit with a series of higher lows supporting more upside potential. Watch for a potential pullback to the low moving average area that has so far held in this melt up rally:

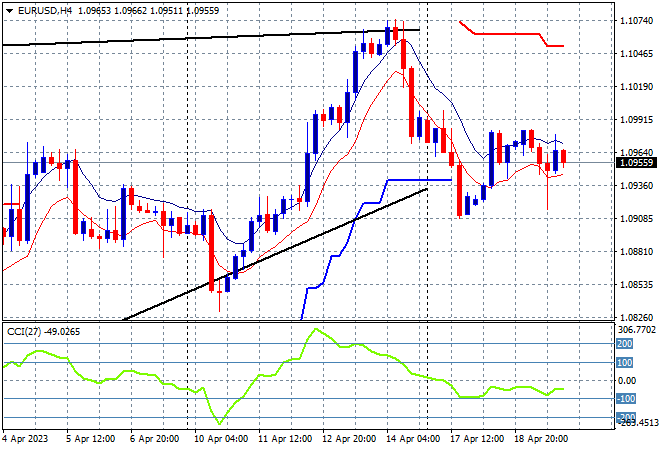

Currency markets saw a slightly stronger USD overnight in the wake of the latest Fed Beige Book read with most undollars pulling back although Euro remains somewhat bid here at the mid 1.09 level. The union currency was almost pushed below the 1.09 level overnight but was able to create a point of control at the mid level later in the session, but short term momentum remains clearly negative. Watch for some consolidation here before another potential breakdown into the 1.09 handle proper:

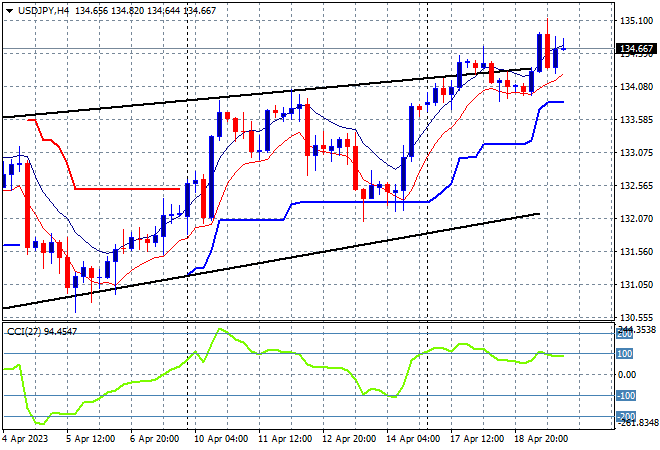

The {{#|USDJPY}} pair ran out of steam in the previous session but gained some extra heat last night to blast through the top edge of its trend channel to almost push into the 135 handle. This comes after making a series of new daily highs even as the four hourly chart showed some hesitation building with short term momentum readings still not quite overbought. Support at the 134 level is quite firm here so watch for another move higher:

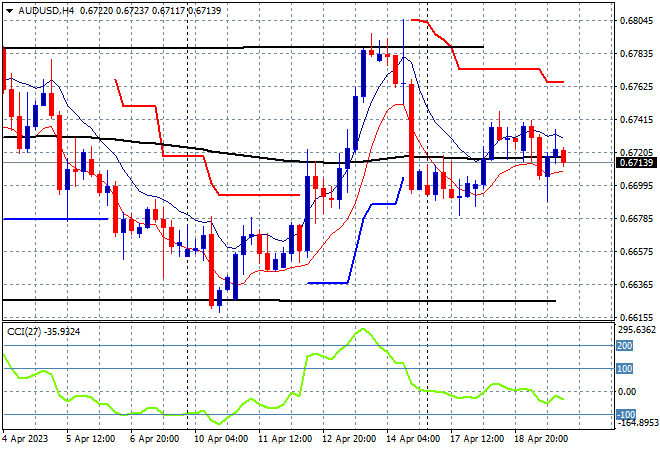

The Australian dollar remains stuck post the release of the RBA Minutes with another rate rise likely but still figuring out how that butts up against the Fed’s own inflation dilemmas is keeping the Pacific Peso under pressure here at or around the 67 handle. Overall price action remaining quite weak as domestic economic data falters with pressure yet to come off as the 67-68 cent zone is confirmed as a key level of resistance:

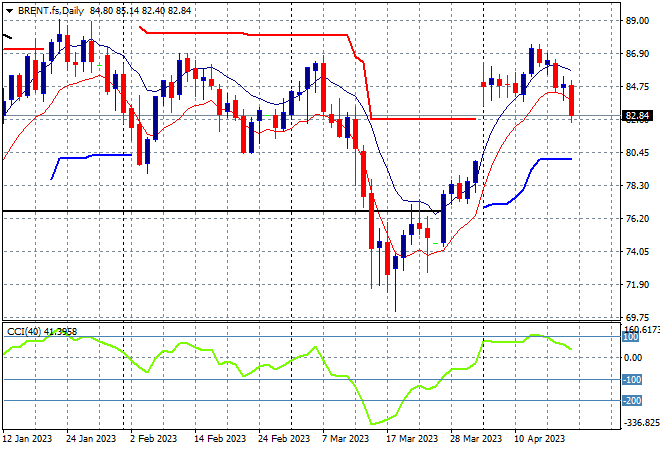

Oil markets were in a highly bought mode with supply disruptions keeping both markers elevated potential signs of weakness in the US economy is taking things off the boil with Brent crude pulling back further to below the $82USD per barrel level overnight. As I mentioned yesterday, the overall trend from a longer term perspective could still see a rangebound condition that falls back to the December lows around the $78 level so watch for any break below the low moving average on the daily chart as signs of buying pressure exhausting:

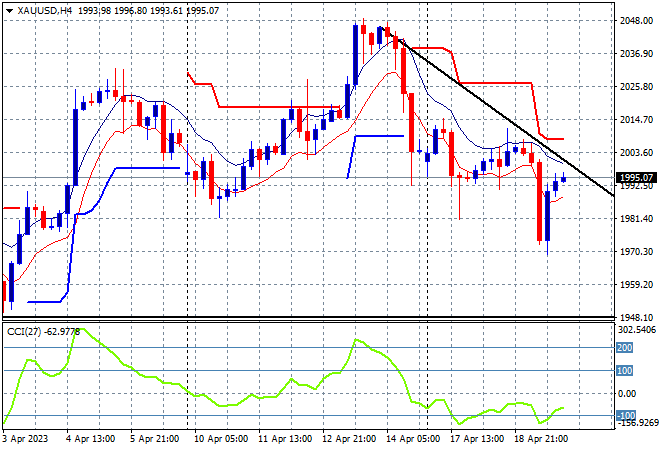

Gold is definitely following the undollar trend with a similar move to Euro and Aussie dollar overnight, retracing sharply below the $2000USD per ounce level before returning to the short term downtrend line to finish at the $1995 level this morning. While the four hourly chart shows strong intrasession buying support that’s keeping the previous weekly low position intact, short term momentum remains clearly negative so watch for a break below the tentative daily trendline from the mid March breakout: