Wall Street finished dead flat overnight as earnings concerns mounted while European shares rebounded on a poorer than expected ZEW sentiment survey. The Australian dollar lifted on the release of the RBA minutes yesterday, maintaining a somewhat strong position just above the 67 handle. 10 year US Treasury yields were basically unchanged and remain just above the 3.5% level while the commodity complex still doesn’t like the stronger USD with oil prices pulling back from their recent highs as Brent crude finished just below the $85USD per barrel level. Gold was able to rebound slightly above the $2000USD per ounce level after a brief blip below.

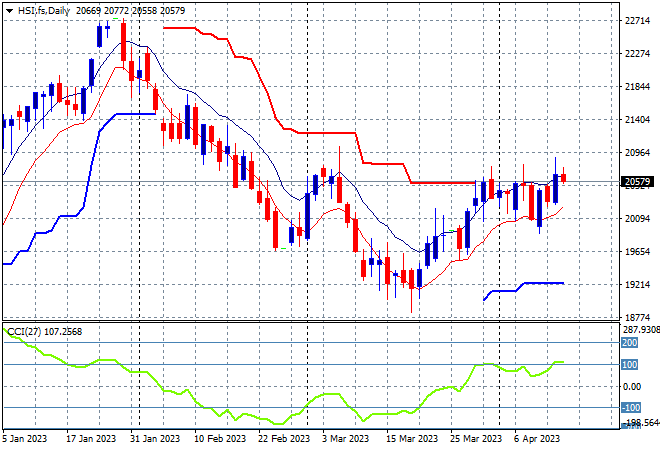

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets are trying to lift from a mixed session into the close, with the Shanghai Composite up just 0.2% to almost get through the 3400 point barrier at 3393 points while the Hang Seng pulled back somewhat, down 0.6% to finish at 20650 points. The daily chart is showing resistance building again at the 20500 point level with daily momentum trying to get into a clear overbought mode, as price action wants to breakfree of the start of March position. The start of year correction may be over but still requires a substantial lift above the current level before calling it a new rally:

Japanese stock markets have found some lost confidence with the Nikkei 225 closing more than 0.5% higher on a weaker Yen at 28662 points. The previous bounceback looked like a bull trap, but this may have more traction, taking out the March highs with futures indicating another strong lift on the open. Daily momentum is now getting back into overbought conditions with support building at the 27000 point area:

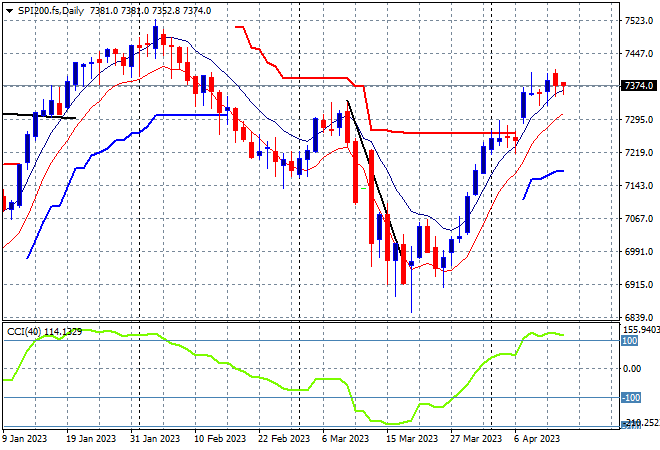

Australian stocks slipped with the ASX200 finishing nearly 0.3% lower to remain below the 7400 point level at 7360 points. SPI futures are almost dead flat in line with the uncertainty on Wall Street overnight so expect another staid session today. The daily chart shows price action wanting to continue the break through the March highs in an attempt to get back to the January levels but deceleration is building here into a rounding top pattern. Daily momentum remains nicely overbought and this trend is well supported so it this could be a temporary blip:

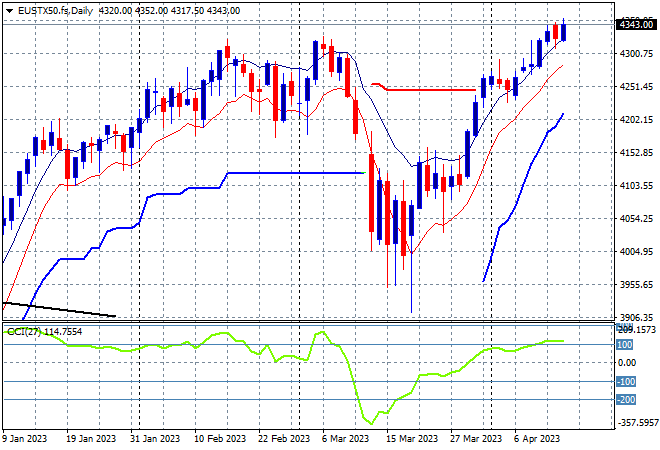

European markets were able to recalibrate overnight with some minor gains across the continent with the Eurostoxx 50 Index closing 0.6% higher to 4393 points in the wake of the ZEW survey results. Another market that wants to extend above its previous March highs with daily momentum getting into overbought zone but possibly a little too hot in the short term. This looks like setting up for further gains but the drop in Euro and talk around inflation at the ECB may dampen spirits in the sessions ahead:

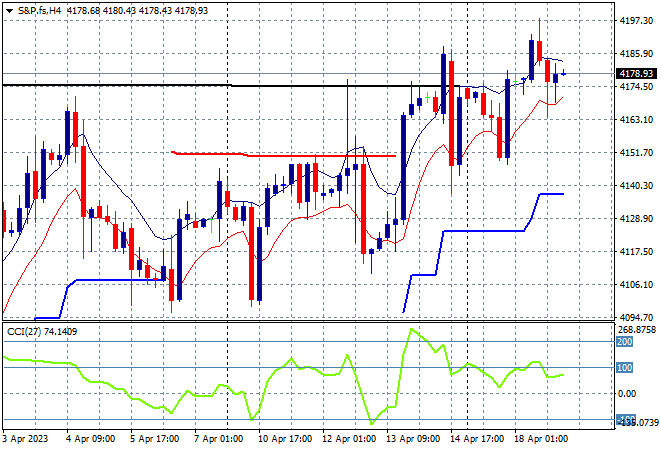

Wall Street however was unable to convert any meaningful gains with both the NASDAQ and S&P500 putting in scratch sessions, the latter closing at 4154 points. The four hourly chart shows how hesitation is building at this point of control, albeit with a series of higher lows supporting more upside potential. Watch for a potential pullback to the low moving average area that has so far held in this melt up rally:

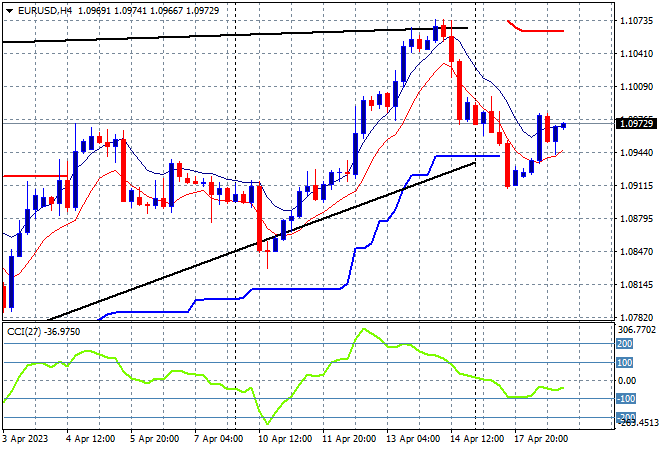

Currency markets saw a slightly weaker USD overnight in the wake of the ZEW survey result with ECB inflation expectations still meddling the true direction of Euro particularly, while Pound Sterling moderated on an unexpected lift in unemployment. The union currency was able to bounce off the 1.09 level overnight but stalled out before hitting the 1.10 handle as short term momentum remains clearly negative. Watch for some consolidation here before another potential breakdown into the 1.09 handle proper:

The USDJPY pair ran out of steam at the top edge of its trend channel to retrace slightly back to the 134 level after making some new daily highs. The four hourly chart shows some hesitation building with short term momentum readings now moderating back to positive neutral settings after being overbought. I still contend we could be looking at a short lived move higher so watch for any drop below the high moving average:

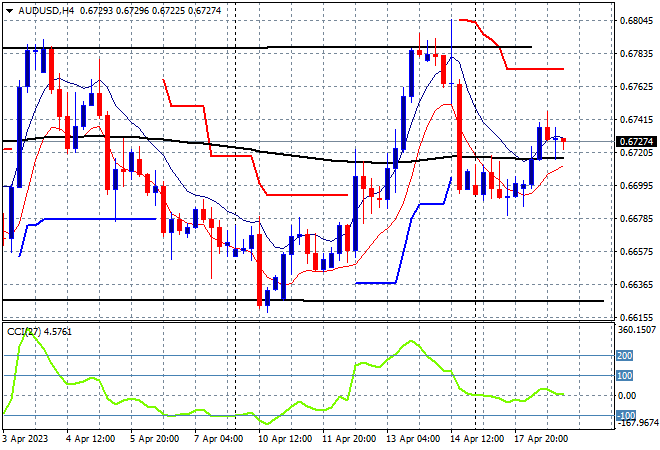

The Australian dollar lifted on the release of the RBA Minutes with speculation another rate rise is around the corner, with a somewhat solid attempt to breakout of its funk. USD strength is not really the catalyst here as the RBA pauses with overall price action remaining quite weak as domestic economic data falters. Pressure has yet to come off the Pacific Peso as the 67-68 cent zone is confirmed as a key level of resistance:

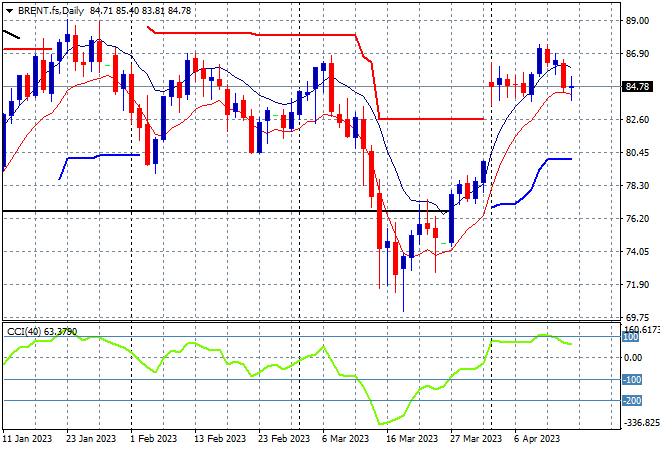

Oil markets are still in highly bought mode with supply disruptions keeping both markers elevated but Brent crude continued to pull back slightly to that start of its recent breakout position at just below the $85USD per barrel level. This is still a big turnaround since the March nadir, getting back to the start of year holding position below the key $90 level. The overall trend from a longer term perspective could still see a rangebound condition that falls back to the December lows around the $78 level so watch for any break below the low moving average on the daily chart as signs of buying pressure exhausting:

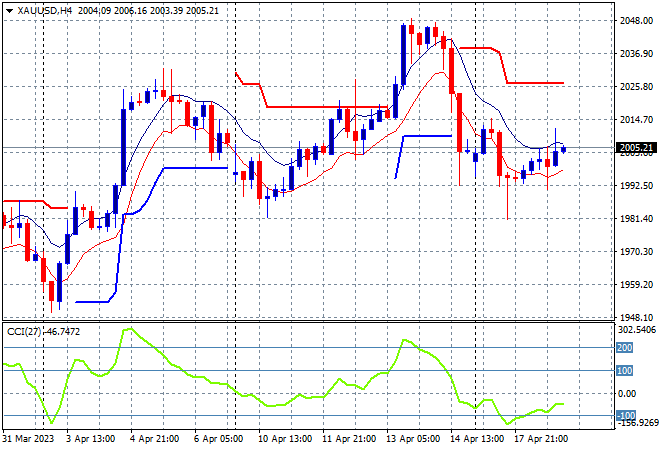

Gold is definitely following the undollar trend with a similar move to Euro and Aussie dollar overnight, getting back above the $2000USD per ounce level but only just in a fairly weak move. While the four hourly chart shows strong intrasession buying support that;s keeping the previous weekly low position intact, short term momentum remains clearly negative so watch for a break below the tentative daily trendline from the mid March breakout: