Risk market volatility remains high in the wake of the Credit Suisse (SIX:CSGN) drama that saw European shares lose 3-4% across the board while Wall Street almost got out of it unscathed. The USD came back against Euro in particular with a strong reversal, but all the action remains in the bond market, with 10 year US Treasury yields having one of their biggest drops in years, down over 20 points to the 3.43% level. Is financial contagion spreading? The commodity complex isn’t liking the volatility with oil prices breaking down again with Brent crude finishing just above the $74USD per barrel level while gold is holding on with the shiny metal spiking again to be above the $1920USD per ounce level for a new monthly high.

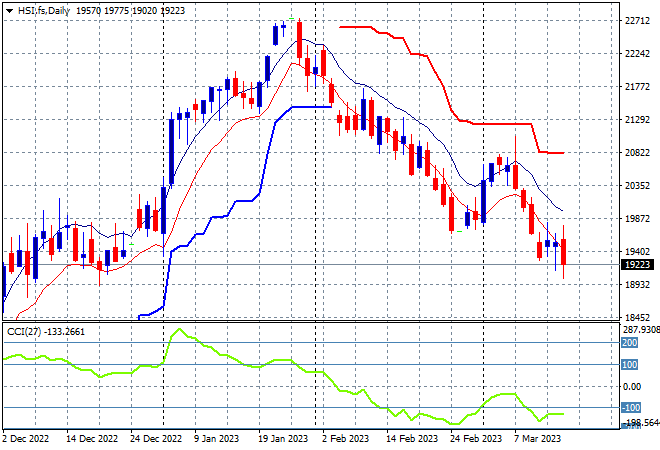

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets gained into the close, with the Shanghai Composite up by nearly 0.6% but still closing below the 3300 point barrier at 3263 points while the Hang Seng has lifted just over 1.3%, trying to take back the previous gains, closing at 19538 points. The daily chart was showing this rollover accelerating as price action retraced well below previous ATR support but could be reversing yet again today if futures are a guide as momentum is still well deep into oversold territory. This correction won’t finish until we see at least one close above the high moving average:

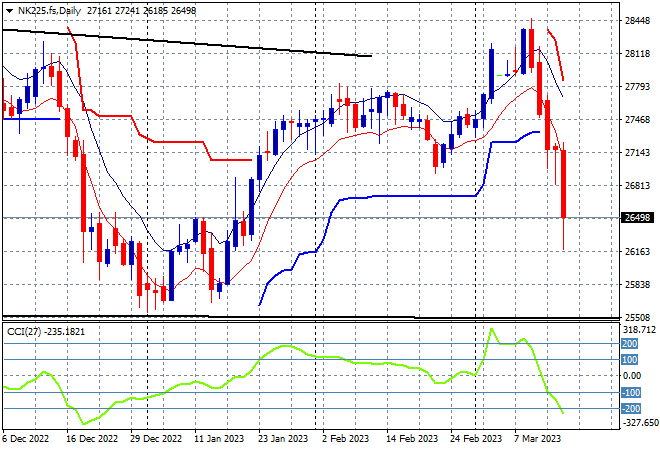

Japanese stock markets remain caught up in the volatility but the Nikkei 225 managed to close dead flat at 27229 points. The previous bounceback still looks like a bull trap, with futures indicating more downside on the open to the financial contagion spreading. Daily momentum has crossed into deep oversold readings with support under pressure at the 27000 point area which had been previously defended:

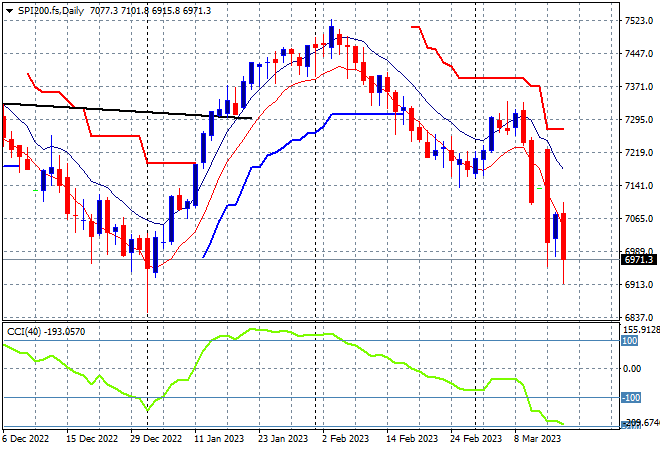

Australian stocks were again unable to escape the selling with the ASX200 closing nearly 0.9% higher to bounce strongly off the 7000 point level, finishing at 7068 points. SPI futures are off by at least 1.5% this morning despite Wall Street recovering somewhat later in the session as financial contagion worries continue. The daily chart was showing a clear downtrend after being unable to take out 7500 points, with the psychologically important 7000 point level the area that must be defended or the Xmas lows will be taken out:

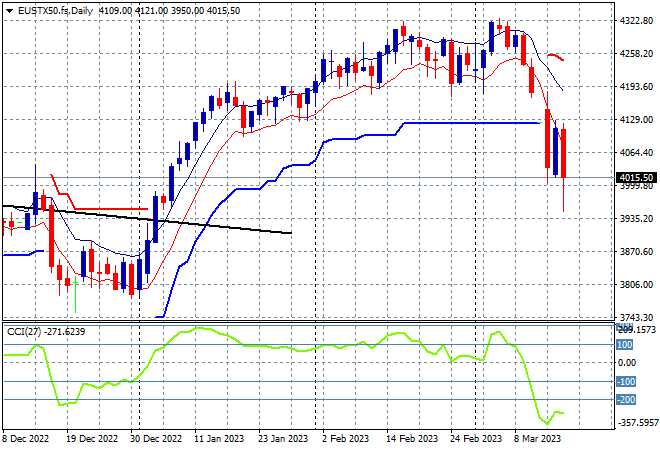

European markets sold off very sharply due to the near 20% drop in Credit Suisse with the Eurostoxx 50 Index closing nearly 3.5% lower at 4034 points. This is looking ugly to say the least with the post Xmas uptrend basically wiped out and the bearish engulfing candles and gaps down spelling more trouble ahead as daily momentum goes deep into oversold mode. A much lower Euro overnight is not helping either so watch out below:

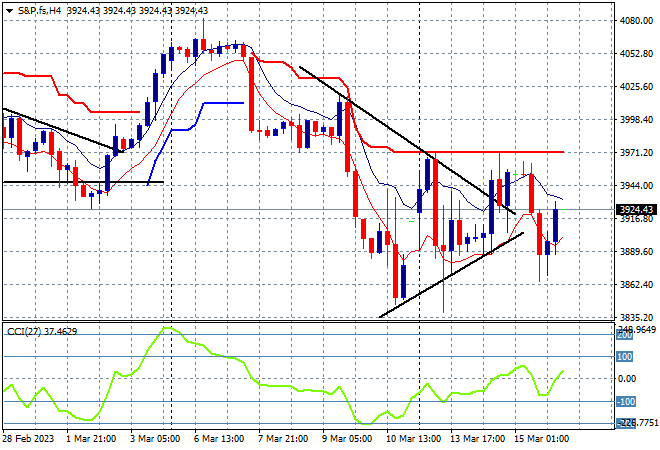

Volatility on Wall Street is still running high with steep losses at the open only covered by the NASDAQ which finished flat while the S&P500 lost some 0.8% to close at 3891 points, almost returning to the previous low. The daily chart is still looking like a classic bearish head and shoulders pattern with the right shoulder fully formed as you can see here on the four hourly chart as price action tried to push above the upper edge of the symmetrical triangle pattern but is now almost testing the pre-Xmas 3800 point support area. Short term momentum is out of extremely oversold settings and there is some support building here but resistance overhead could be too high to clear for now:

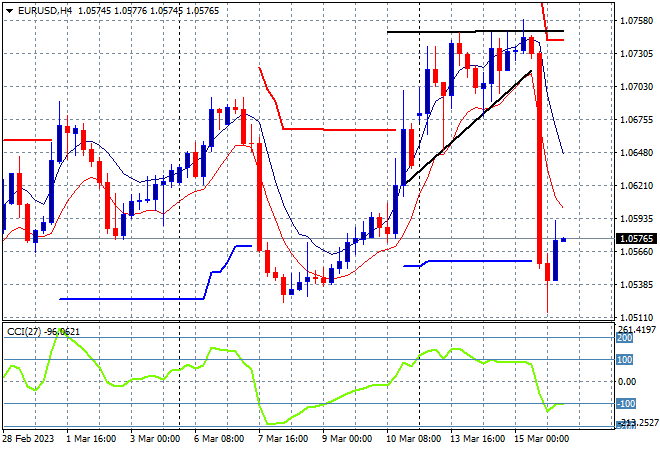

Currency markets were in a staunchly anti-USD direction lead by Euro but after forming resistance at the mid 1.07 level, the union currency slumped over 200 pips as the Credit Suisse liquidity problems came to light. This re-writes the weaker USD trend that is now readily apparent as interest rate expectations are pared back drastically, with the probability that price action will hover around the 1.05 handle for now:

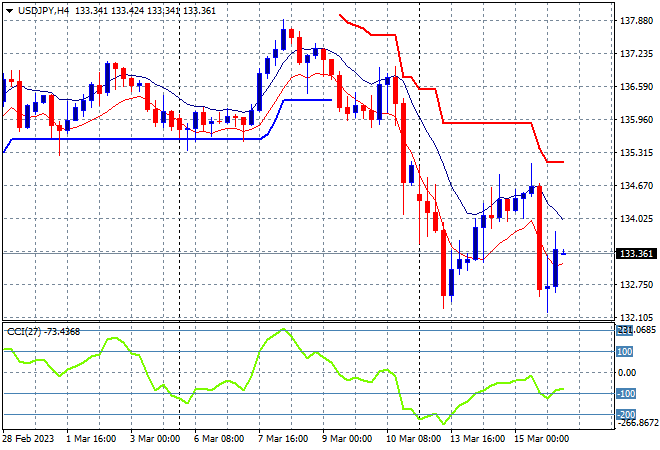

The USDJPY pair was trying to get out of the dumps as all things USD are sold off, with a sharp turnaround overnight due to Yen safe haven buying. A bounce off the start of week lows at the 132 handle is seeing sit above the 133 level late this morning. Price action looks like wanting to rollover here again as short term momentum remains negative but no longer oversold with not enough indication yet of upside potential:

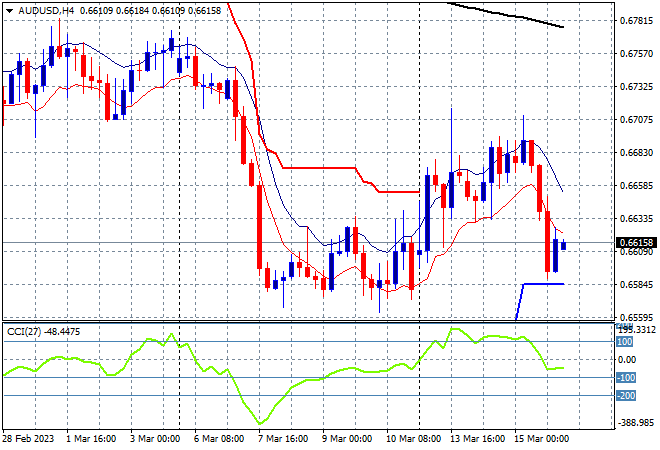

The Australian dollar was also trying hard to bounce back with a continued bounce through the mid 66 cent level and almost clearing the 67 handle before a sharp selloff overnight saw it return to the weekly lows. Overall price action had been quite weak following the previous local unemployment numbers that has not yet challenged interest rate expectations but with the Fed looking to ease off the throttle, pressure was looking to come off the Pacific Peso as the 67-68 cent zone is confirmed as a key level of resistance:

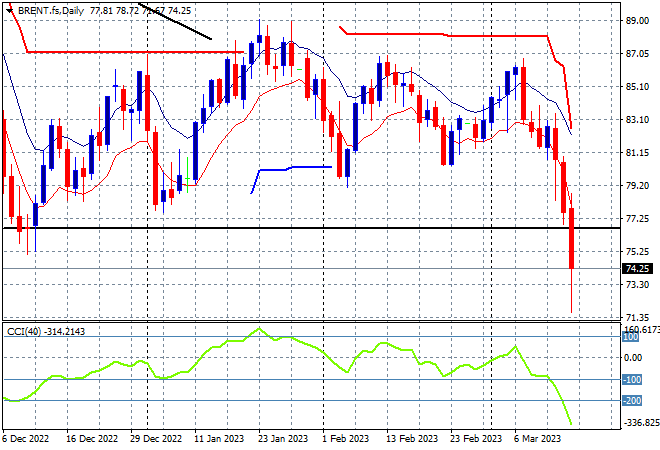

Oil markets were in retreat mode again overnight amid the volatility with Brent crude pushed down to the $70 level before settling at the $74 mark which now takes out the weekly lows. Daily momentum had only been nominally positive previously with no new weekly high as price action failed to beat the $88 highs from January. By taking out the December lows instead we are liking in a corrective phase as financial contagion spreads:

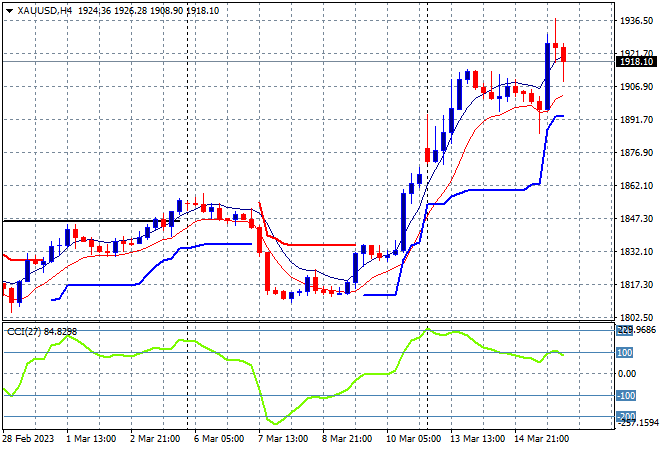

Gold has been on an absolute tear amid the financial chaos with a surge beyond expectations that cleared the $1900USD per ounce level which has so far not only been supported but spiked again to push through the $1920 level overnight. Former resistance on the daily chart at the $1850 level is a memory as interest rate expectations change drastically although this move could still prove too far, too fast with a possible retracement. Watch support to build at the former resistance level at $1850 then possibly move higher to $1900 even: