(For a Reuters live blog on U.S., UK and European stock

markets, click LIVE/ or type LIVE/ in a news window)

* Brexit deal announcement awaited, fishing still under

discussion

* London mid-caps hit highest in 10 months

* Banks lead gains, material stocks dip

* Stock markets in Germany, Italy and Switzerland closed

* No European markets report on Dec 25 due to Christmas

holiday

(Updates to close)

By Susan Mathew and Supriya R

Dec 24 (Reuters) - European shares rose for a third straight

session on Thursday with a Brexit trade deal finally in sight

just a week before Britain cuts its ties with the European

Union.

London mid-caps .FTMC jumped 1.2% to end a holiday

shortened session at their highest since February, while the

FTSE 100's .FTSE gains were limited by a stronger pound

weighing on the exporter-heavy index. .L

Brexit-sensitive banks .SX7P led the pan-European STOXX

600 index .STOXX 0.2% higher to make up losses from earlier in

the week when a new fast-spreading variant of the coronavirus

spooked markets. GBP/

After months of wrangling, and amid warnings of no deal,

Britain and the European Union were on the cusp of striking a

narrow trade agreement, sources in London and Brussels said,

swerving away from an acrimonious split five years after the

Brexit referendum. Talks could still have "some hours to run", a UK source said

on Thursday, adding that the two sides were still haggling over

the EU's right to fish in British waters. "Everyone's very curious to see what ultimately will be

decided on," said Bert Colijn, senior economist, eurozone at

ING, adding that the big theme was if tariffs were off the table

- seen as crucial to limiting the impact on European exporters.

"If you look at it in the very long run... finding a deal at

the 11th hour is going to be positive from a growth potential

side for the UK economy, and therefore, ultimately... to

stocks."

Banks .SX7P jumped 0.7% with Britain's Lloyds LLOY.L and

Barclays BARC.L up 4.0% and 1.8%, respectively.

Irish stocks .ISEQ closed down 0.3% with Flutter

Entertainment FLTRF.I falling 2.2%, making the travel and

leisure sector .SXTP the biggest decliner in Europe.

France's CAC 40 .FCHI closed down 0.1%, while Spain's

lender-heavy index .IBEX climbed half a percent.

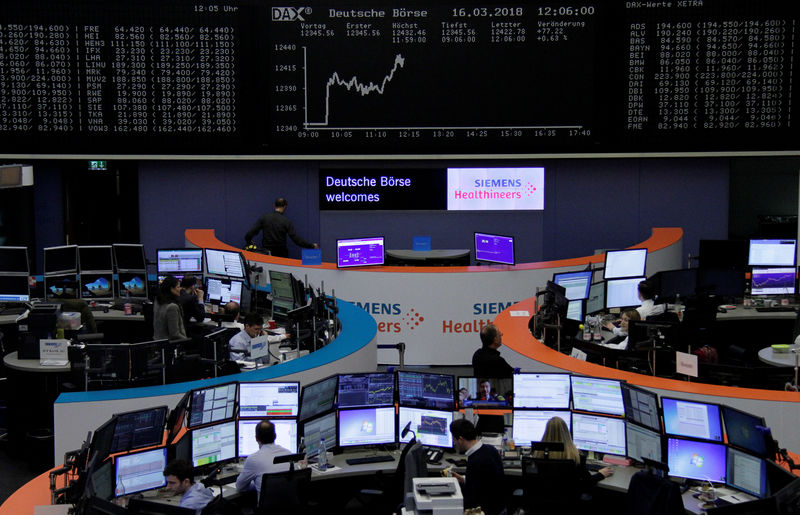

Stock markets in Germany, Italy and Switzerland were closed

for the Christmas holidays.

Unprecedented amounts of stimulus, and lately vaccine

optimism, have seen the STOXX 600 rise close to 50% from its

March lows, though it still remains about 9% below this year's

pre-pandemic high and is on course to end the year about 5%

lower.

Banks and oil .SXEP stocks have weighed the most on

worries about the economic toll of the pandemic, while

technology stocks .SX7P have led the recovery among major

sectors as they emerged winners amid the work-from-home trend.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UPDATE 3-European stocks end on high note with Brexit deal in sight

Published 12/24/2020, 04:12 PM

Updated 12/24/2020, 09:40 PM

UPDATE 3-European stocks end on high note with Brexit deal in sight

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.