* LVMH, Airbus rise on upbeat outlook from research firms

* Fresenius tumbles on issuing profit warning

* Basic materials dip as copper, iron ore price decline

* BP slides on first loss in a decade

(Updates to close)

By Shreyashi Sanyal and Susan Mathew

Feb 2 (Reuters) - European shares rose on Tuesday on hopes

of a faster economic recovery, with some upbeat economic growth

data and encouraging outlook on big names such as Airbus and

LVMH putting a pan-regional index on course to erase last week's

hefty losses.

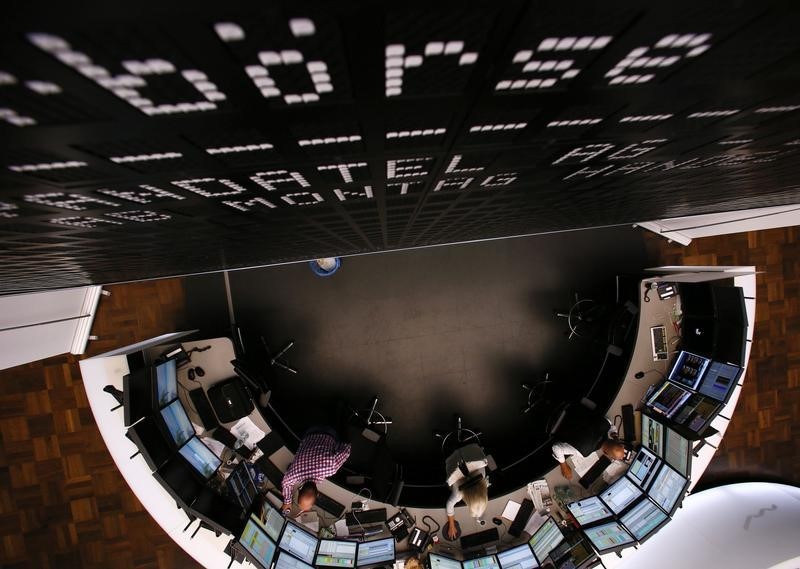

Europe's STOXX 600 index .STOXX closed higher for a second

straight session, up 1.3% on broad-based gains after losing over

3% last week on concerns around the slow rollout of COVID-19

vaccines in the euro zone.

Preliminary data on Tuesday showed the euro zone economy

contracted by less than expected in the fourth quarter of 2020

as large economies Germany and Spain still managed slight

expansions. "But with lockdowns extended well into the first quarter,

another technical recession is in the making," said Bert Colijn,

senior euro zone economist at ING.

Luxury brand owners LVMH LVMH.PA and Kering PRTP.PA

jumped 3.4% and 1% respectively after brokerage Berenberg

recommended the stocks, noting long-term structural drivers of

demand for luxury products remain intact. Planemaker Airbus AIR.PA rose after a Morgan Stanley

upgrade on overlooked production increases.

Anticipation of strong results from Amazon AMZN.O and

Google-parent Alphabet GOOGL.O and hopes of a $1.9 trillion

U.S. COVID-19 relief package in the United States also kept

sentiment buoyed. Medical device maker Coloplast COLOb.CO and Sweden's

Indutrade INDT.ST were the top gainers on STOXX 600 on topping

quarterly earnings.

Basic materials .SXPP was the only in the red as copper

and iron ore prices tanked, while gains in the oil sector were

limited by a 4.5% slide in BP BP.L after it reported its first

loss in a decade. IRONORE/ MET/L

London's blue-chip FTSE 100 .FTSE gained the least among

regional peers, weighed upon by reports that the UK variant of

the coronavirus has developed a new, concerning mutation that

could reduce the efficacy of vaccines. .L

Fresenius Medical Care FMEG.DE tumbled 10.3% after the

world's No.1 kidney dialysis firm warned its adjusted net profit

was likely to drop this year. FRENZY PAUSES

Silver prices dropped on Tuesday, halting a rally to near

eight-year highs in the previous session that was the latest

move in two weeks of turmoil on financial markets fuelled by a

pack of Reddit-centered individual investors. A pause in a social media driven rally that drove up prices

of the commodity as well as certain stocks including GameStop

Corp GME.N has helped calm worries about potential losses

incurred by certain hedge funds causing disruption to markets as

a whole.

Finnish shares of Nokia NOKIA.HE , also caught up in the

frenzy, slid 5.3%.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UPDATE 2-European shares rise on recovery hopes, LVMH leads

Published 02/02/2021, 05:22 PM

Updated 02/03/2021, 01:10 AM

UPDATE 2-European shares rise on recovery hopes, LVMH leads

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.