By Ambar Warrick

Investing.com-- Asian stock markets rose on Tuesday after a slew of strong corporate earnings spurred an overnight recovery on Wall Street, although mixed economic signals and concerns over a U.S. semiconductor blockade hurt Chinese stocks.

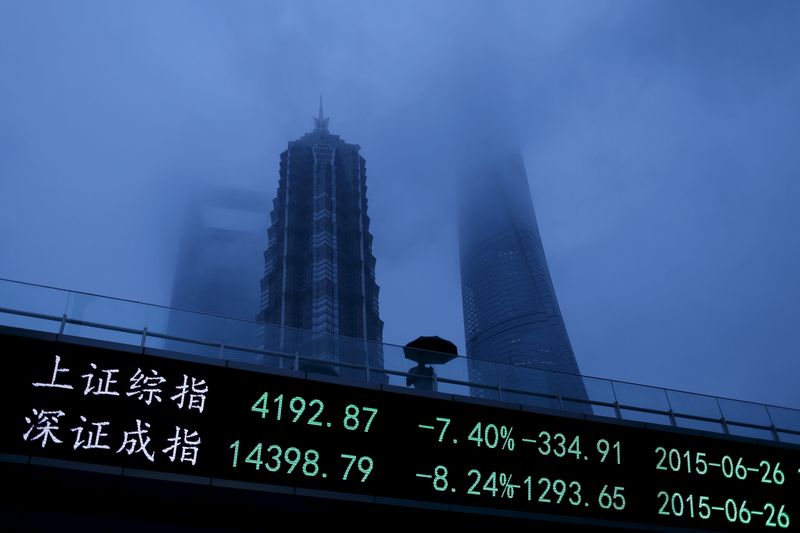

China’s bluechip Shanghai Shenzhen CSI 300 index fell 0.1%, while the Shanghai Composite index traded flat. Concerns over the Chinese economy continued to weigh on the stock market, after President Xi Jinping signaled the country has no intention of scaling back its strict zero-COVID policy.

But the government also unveiled plans for more stimulus spending, while the People’s Bank of China also kept monetary policy at accommodative levels on Monday in order to support economic growth. This helped Chinese stocks start the week on marginally positive terms.

Sentiment towards the country was battered by the U.S. moving to block Chinese firms from importing chips made using American technology. The move has the potential to severely hamper Beijing’s chipmaking ambitions, and could also result in retaliatory measures.

Still, there were some positive cues for Chinese stocks. BYD (SZ:002594), the world’s largest electric car maker, surged over 5% after it flagged an over 300% jump in its third-quarter profit.

Hong Kong-listed shares (HK:1211) of the firm jumped over 6%, and helped spur a 1% gain in the Hang Seng index.

Broader Asian markets rose tracking overnight gains on Wall Street. Japan’s Nikkei 225 index added 1.5%, while the Taiwan Weighted Index rose 1.2%, with both bourses recovering from steep losses in recent sessions. Taiwan stocks in particular were also hit hard by the U.S. curbs, given their exposure to Chinese chip demand.

Wall Street indexes rallied overnight after major bank stocks logged better-than-expected third-quarter earnings. Focus now turns to upcoming readings from major technology and consumer companies to gauge how corporate earnings performed amid rising inflation and interest rates.

Several major Asian companies are also set to release earnings this week, including Hong Kong exchange operator Hong Kong Exchange and Clearing (HK:0388), Singapore conglomerate Keppel Corp (SGX:KPLM) and telecom giants China Mobile Ltd (HK:0941) and China Telecom (HK:0728).

Among antipodean stocks, Australia’s S&P/ASX 200 index jumped nearly 2% on Tuesday. But global miner Rio Tinto Ltd (ASX:RIO), one of the largest stocks on the index, lagged its peers after it logged softer iron ore shipments in the third quarter, and flagged a weaker outlook for the year.