Wall Street had another down session overnight although the NASDAQ was able to bounce back on Microsoft earnings as risk sentiment turns sour despite a big lift in durable goods orders. This sent the USD lower particularly against Euro which pushed European stocks down as the Australian dollar continued to dice with the 66 cent level following yesterday’s softer than expected inflation print. 10 year US Treasury yields rose slightly but remained depressed just above the 3.4% level, meanwhile oil prices fell out of bed with Brent crude tumbling to a new monthly low at the $77USD per barrel level as gold struggled to find direction, still unable to get back above the $2000USD per ounce level but staving off a larger selloff compared to other undollars.

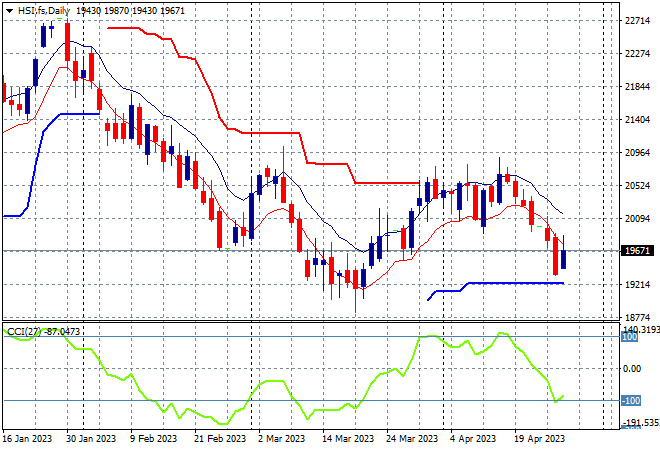

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets where lifted going into the close but the Shanghai Composite eventually closed slightly lower and still below the 3300 point barrier at 32646 points while the Hang Seng is bouncing back much stronger after tech stocks were down, closing 0.7% higher to almost get above the 20000 level, closing at 19757 points. The daily chart was showing resistance building at the 20500 point level before this rollover with daily momentum unable to get into a clear overbought mode, as price action returns to the start of year correction phase. Watch for any break below the 19000 point level as an ominous sign:

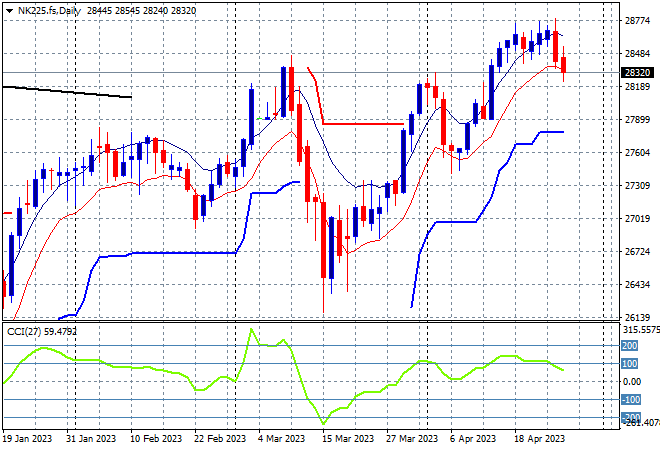

Japanese stock markets were the worst performers in the region for a change, with the Nikkei 225 down over 0.7% at 28416 points. Futures are indicating another pullback on the open in line with Wall Street woes as daily momentum reverts out of its overbought conditions as price action will now test support at the low moving average area with resistance firm just below the 29000 point level:

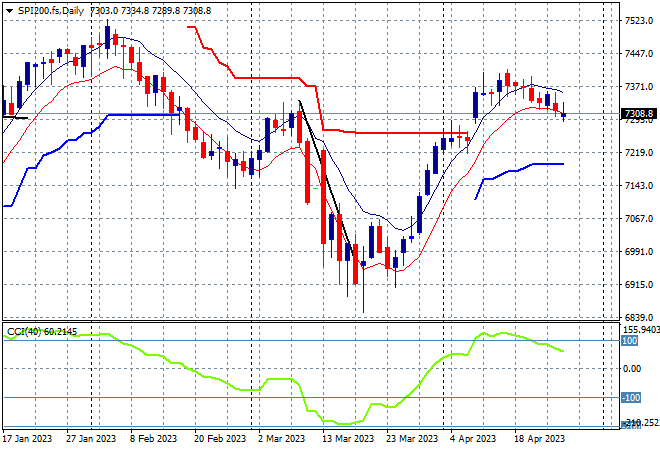

Australian stocks returned with a bad start before the ASX200 managed to close only 0.1% lower on the back of the weaker than expected inflation print, closing at 7316 points. SPI futures are indicating at least another 0.2% drop on the open and while this market looks a little more robust than others, helped by the lower Australian dollar, the attempt to get back to the January levels is looking dicey at best. I’m watching further deceleration that could turn into broader selling here as a rounding top pattern is formed. Daily momentum has retraced from overbought and while this trend is well supported watch the low moving average for signs of a breakdown:

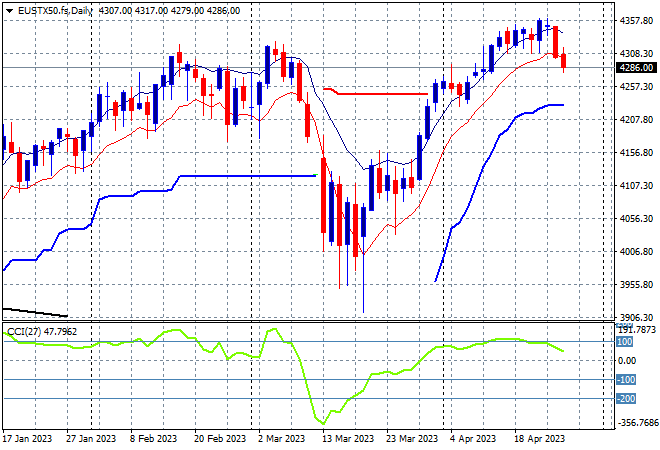

European markets were doing much better but remain stung with the Wall Street bug with falls across the continent as the Eurostoxx 50 Index closed 0.7% lower to close at 4347 points. Another market that wants to extend above its previous March highs but daily momentum never really got into the overbought zone. This was looking like setting up for further gains but the volatility from Wall Street is now dragging down spirits as the low moving average on the daily chart is under threat so watch for another breakdown tonight:

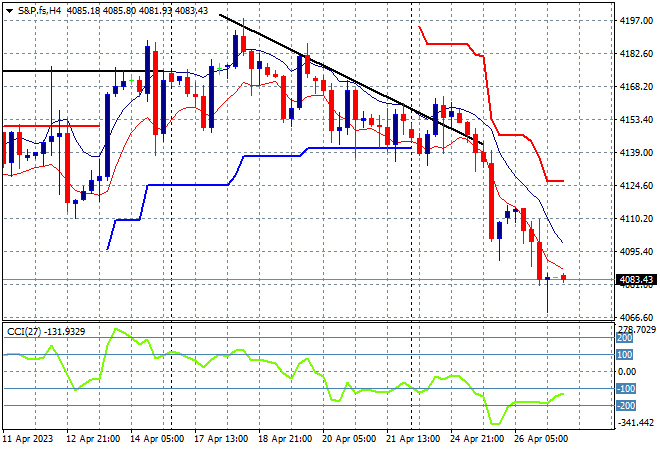

Wall Street remains listless here among volatile earnings with NASDAQ only saved by Microsoft (NASDAQ:MSFT) and Meta (NASDAQ:META), finishing some 0.5% higher while the S&P500 continued to tumble, down more than 0.3% to finish at 4055 points. The four hourly chart shows price action falling sharply below the early April lows now after recently breaking through short term support at the 4140 point level. There was a modicum of support here at the 4100 point level but it looks like 4000 points is the downside target:

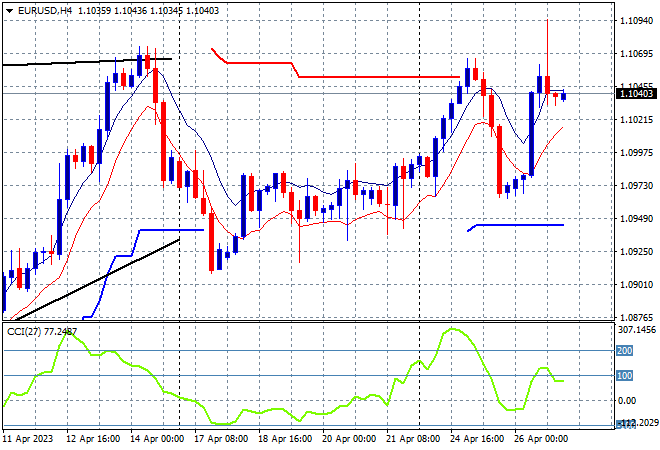

Currency markets at first saw the USD firm against almost everything in the wake of the durable goods order but Euro ran away to breach the 1.10 handle again before pulled back into line. The Union Currency has now exceeded last week’s point of control above the mid 1.09 level with strong buying support at the low 1.09’s showing there’s more potential upside here but watch for volatility ahead on further economic prints:

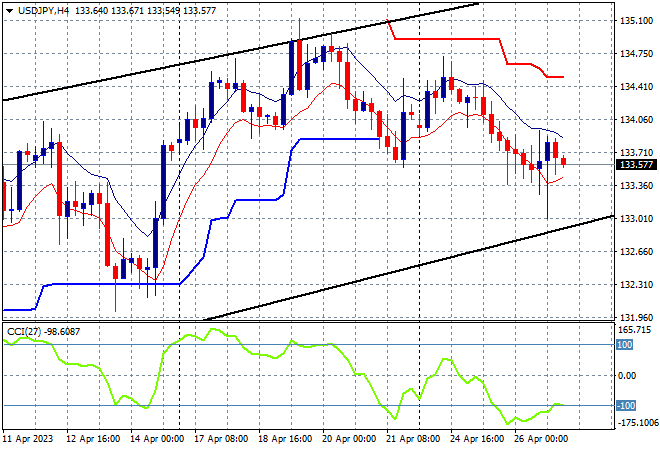

The USDJPY pair is seeing further Yen safe haven buying as risk correlations build with a return almost below the 133 handle overnight. The four hourly chart is looking like forming a bearish head and shoulders pattern here with short term momentum readings remaining quite oversold. Support at the recent lows is the areas to watch here with further falls below previous trailing ATR support possible:

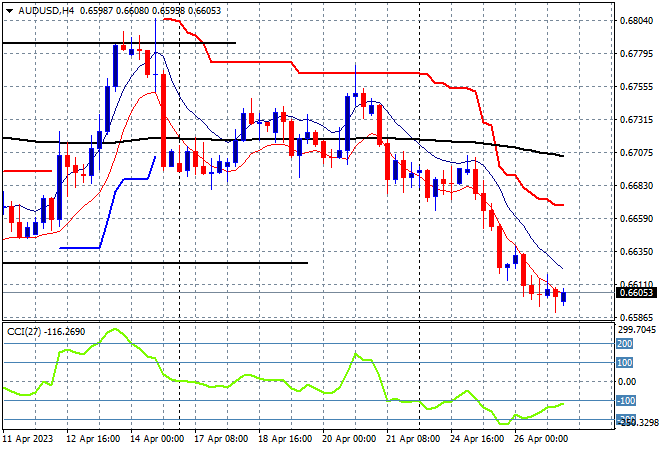

The Australian dollar is following risk markets but is slowly decelerating into key support at the 66 handle following yesterday’s inflation print that looks to all but confirm another pause by the RBA at the next meeting. The Pacific Peso had been under pressure here at or around the 67 handle with overall price action remaining quite weak in the face of domestic economic data, with the firming USD now taking it back to the early April lows with the potential to undershoot:

Oil markets are not enjoying the USD volatility or latest economic data with both WTI and Brent crude selling off to below the pre-breakout positions with the latter now below the $78USD per barrel level. As I mentioned last week, the overall trend from a longer term perspective could still see a rangebound condition that falls back to the December lows around the $78 level so this rejection of the recent weekly highs is a definite sign of buying pressure exhausting and potential abandonment. Watch for further falls all the way down to the $70 level after breaching trailing ATR support:

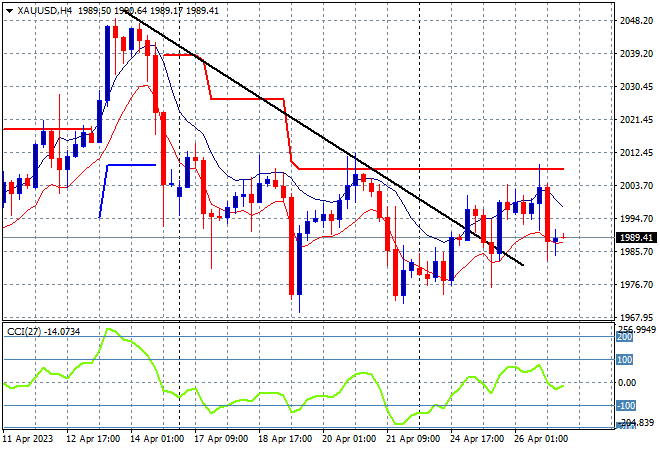

Gold is still moving around independently but is failing to find direction and strength with another move overnight that failed to get back above the $2000USD per ounce level yet maintaining buying support just below. The four hourly chart shows the previous short term downtrend now broken as momentum moves to the positive side, yet trailing ATR resistance and the psychologically important $2000 level need to be breached soon to have any hope of turning this into a recovery: