(For a Reuters live blog on U.S., UK and European stock

markets, click LIVE/ or type LIVE/ in a news window)

* Banks, miners and industrials lead gains on FTSE 100

* Ashmore drops as assets under management falls by $3.1

billion

* FTSE 100 up 0.5%, FTSE 250 adds 0.2%

(Updates to close)

By Devik Jain and Shashank Nayar

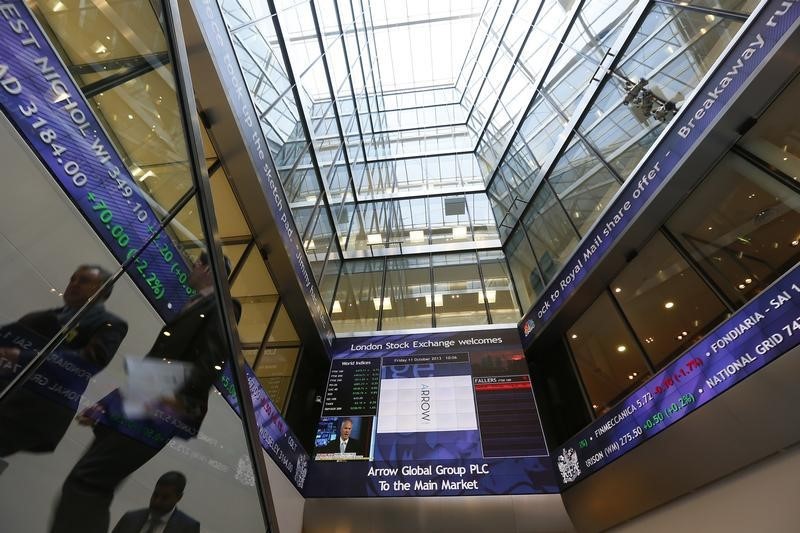

April 16 (Reuters) - London's FTSE 100 ended above the 7,000

mark on Friday for the first time since the pandemic pummelled

risk assets last year and gained for the second consecutive week

as falling coronavirus infections lifted optimism about a

stronger economic recovery.

The blue-chip index .FTSE climbed 0.5%, led by gains in

precious metal and base metal miners .FTNMX551030

.FTNMX551020 , which rose 1.7% and 0.7% respectively and

heavyweight banking stocks .FTNMX301010 that stand to benefit

from an economic re-opening gained 1.7%.

“Value-style stocks offering jam today rather than jam

tomorrow have been in demand, as well as lots of companies well

placed to benefit from the reopening of the economy thanks to

the rollout of the COVID vaccines," said Russ Mould, investment

director at AJ Bell.

The prevalence of COVID-19 infections in England dropped

sharply to its lowest level since September, the Office for

National Statistics (ONS) said on Friday, further bolstering

sentiment towards a quicker revival. The domestically focussed mid-cap FTSE 250 index .FTMC

gained 0.2% for the third consecutive session to hit a fresh

record high.

Globally, sentiment was bolstered after a batch of Chinese

and U.S. economic data helped investors price in a solid

recovery from a coronavirus-led slump. MKTS/GLOB

The FTSE 100 has bounced back nearly 40% from its pandemic

closing low in March and is nearly 8% away from its January 2020

high as investor confidence in a faster economic revival

strengthened on speedy vaccines and fiscal support.

Among other stocks, Man Group EMG.L rose 0.5% after the

hedge fund manager said it expected customers to put in more

money in the coming quarters as client engagement was positive

this year.

Ashmore Group ASHM.L dropped 3.4% to the bottom of the

FTSE 250 index after its assets under management fell by $3.1

billion during the first three months of 2021, as market

volatility hurt performance.

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

UPDATE 2-FTSE 100 ends second week higher on higher commodity prices, rebound bets

Published 04/16/2021, 04:38 PM

Updated 04/17/2021, 12:30 AM

UPDATE 2-FTSE 100 ends second week higher on higher commodity prices, rebound bets

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.