- Even the sharpest minds can stumble when emotions overrule discipline in investing.

- History shows that caution often outlasts the allure of market euphoria.

- In stretched markets, staying grounded and forward-thinking can be the ultimate edge.

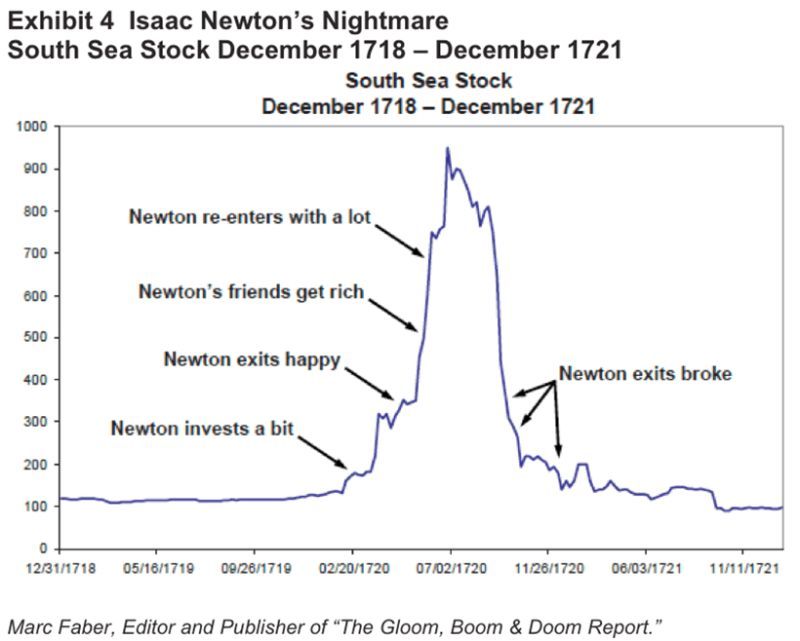

Isaac Newton, celebrated as one of the greatest minds in history, didn’t just theorize about gravity—he experienced it firsthand in the stock market. Despite his brilliance, Newton famously lost his fortune during the South Sea Bubble, proving that even genius can falter when greed takes the wheel.

Initially, Newton played the market like a master, cashing in on the rising stock prices and walking away with impressive gains. But, like many investors before and after him, he couldn’t resist the siren call of a skyrocketing market. Succumbing to FOMO and the herd mentality, he re-entered near the bubble’s peak, only to watch his investments crash to the ground.

The saying goes, “He who is ahead of his time is indistinguishable from he who is wrong.” It’s a sentiment Warren Buffett likely felt during the Dotcom Bubble when he sat out the mania, enduring criticism while others chased paper gains. History, of course, vindicated him—as it often does for those who choose caution over frenzy.

So, where does that leave us today?

While today’s markets may not yet scream "bubble," valuations are undeniably stretched. The U.S. market is expensive—and it could get even pricier before the music stops. The challenge lies in recognizing when caution, not aggression, becomes the winning strategy.

This doesn’t mean abandoning the market altogether. Instead, it calls for a defensive approach: finding pockets of value, steering clear of overhyped sectors, and keeping a level head when others lose theirs.

Looking ahead to 2025, the stakes grow even higher. Markets remain rich, yet no one wants to leave. The past two years have been remarkably positive, but this is precisely when a long-term perspective matters most. Zooming out—both backward and forward over five years—can help us make informed decisions rather than chasing short-term euphoria.

As we navigate these conditions, remember: the best investors don’t just watch the market—they prepare for its turns.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.