By Swati Pandey

SYDNEY, July 15 (Reuters) - Asian shares jumped on Wednesday

as optimism about a coronavirus vaccine bolstered risk appetite

while the euro rose to a four-month top on the prospect of

stimulus ahead of a crucial EU summit.

MSCI's broadest index of Asia-Pacific shares outside Japan

.MIAPJ0000PUS rose 1.2%, edging closer to a recent five-month

peak.

Japan's Nikkei .N225 added 1.5% to the highest since June

10 while Australia's benchmark index was up 1%. Chinese shares

gained modestly with the blue-chip CSI300 index .CSI300

ticking up 0.3%.

E-mini futures for the S&P 500 EScv1 rose 0.8%.

Risk appetite was boosted by Moderna Inc's MRNA.O

experimental vaccine for COVID-19 which showed it was safe and

provoked immune responses in all 45 healthy volunteers in an

ongoing early-stage study. On Tuesday, the Dow Jones Industrial Average .DJI rose

over 2%, while the S&P 500 .SPX gained 1.34% and the Nasdaq

Composite .IXIC climbed 0.94%. .N

"... the vaccine is more than a show stopper. It's the

ultimate recession stopper," said Stephen Innes, markets

strategist at AxiCorp.

The stock surge came despite lingering bad news about the

coronavirus and after three U.S. states reported new record

daily deaths from the pandemic, while tensions continued to grow

between the United States and China.

"Although a mismatch between financial markets and the real

economy remains in full effect, the removal of a single

recessionary input (the virus) via a vaccine can pave the way

for fast economic recovery," Innes added.

"So, the positive news on the vaccine can go a long way to

explain the dissonance between the shift in the stock market

sentiment relative to the angst on Main Street."

Simmering tensions between the United States and China also

loom large, after U.S. President Donald Trump signed legislation

and an executive order to hold China "accountable" for the

national security law it imposed on Hong Kong.

The dollar was on the defensive, particularly against

risk-sensitive currencies, following news of progress in vaccine

development.

The euro EUR=EBS rose to as high as $1.1423, its strongest

since March 10 and not far off its peak so far this year of

$1.1495.

The single currency has been helped by hopes the European

Union could agree at its summit later this week on a rescue

financing package that will limit the economic damage to the

bloc from the coronavirus pandemic.

The euro's strength helped to push the dollar index =USD

to 96.056, a one-month low.

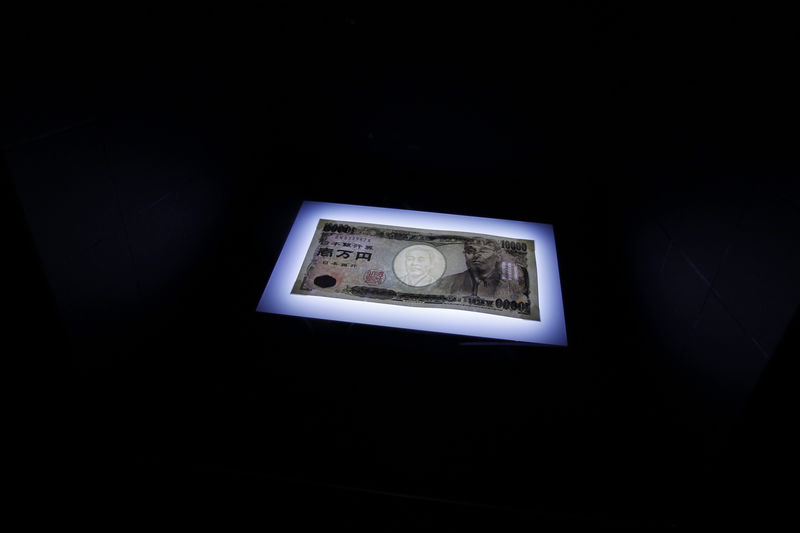

The yen was little moved at 107.27 per dollar JPY= , off a

two-week high of 106.635 ahead of the Bank of Japan's policy

announcement later in the day where it is expected to keep

monetary policy steady.

The risk-sensitive Australian dollar rose 0.5% to $0.7009

AUD=D4 .

There were still signs of wariness among investors, as

yields on leading U.S. and euro zone government debt fell and

safe-haven gold prices solidified gains above $1,800 an ounce.

Spot gold XAU= rose to $1,809 an ounce.

Oil prices rose on Wednesday after a sharp drop in U.S.

crude inventories. Brent crude LCOc1 futures were up 10 cents

at $43 a barrel, and U.S. crude CLc1 futures rose 14 cents to

$40.43 a barrel. O/R

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Global assets http://tmsnrt.rs/2jvdmXl

Global currencies vs. dollar http://tmsnrt.rs/2egbfVh

Emerging markets http://tmsnrt.rs/2ihRugV

MSCI All Country Wolrd Index Market Cap http://tmsnrt.rs/2EmTD6j

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GLOBAL MARKETS-Asian markets, risk assets ride up on vaccine hopes

Published 07/15/2020, 10:26 AM

Updated 07/15/2020, 10:30 AM

GLOBAL MARKETS-Asian markets, risk assets ride up on vaccine hopes

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.