- December in election years sees an 83.3% positive return, boosting investor confidence.

- With many stocks overpriced in the current bull market, focusing on undervalued stocks with strong market support is crucial.

- Let’s explore some stocks to consider this holiday season.

- Looking for more actionable trade ideas? Subscribe here for up 55% off as part of our Bird Black Friday sale!

December often brings holiday cheer to Wall Street, especially in election years. The S&P 500 has climbed in 83.3% of Decembers during such years, a striking trend that gives investors plenty of reason to stay bullish.

Even more compelling, in the last 10 instances where the S&P 500 gained 20% or more by December, the index closed the month higher 9 times, with an average gain of 2.4%.

While the market’s lofty valuations—evident in metrics like the Shiller P/E ratio—may cause concern, savvy investors can still find opportunities. The key is to apply disciplined stock selection filters to pinpoint undervalued names with strong potential.

Here are the criteria I used to identify today's picks:

- Undervalued stocks: Trading below their fair or fundamental value.

- Broad market support: A majority of analysts rate them as buys.

- Upside potential: Market consensus suggests a notable average target price above current levels.

- Dividend yield: They reward shareholders with consistent payouts.

After applying these filters, a shortlist of promising stocks emerges. Let’s dive into the names that made the cut.

1. Crocs (CROX)

Since reporting its third-quarter results, Crocs (NASDAQ:CROX) has been falling on weakness in its HEYDUDE brand.

But in early November an executive, Replogle, bought shares worth a total of $252,222.

It was Replogle's third purchase this year, following previous purchases of 2,000 shares each in March and August. The November purchase was the largest so far, suggesting it was taking advantage of the stock's slump.

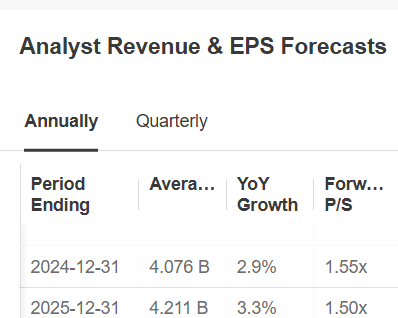

It will publish its quarterly accounts on February 13. For the 2024 computation the forecast is for earnings growth of 2.9% and for 2025 it would be 3.3%.

Source: InvestingPro

The company's focus on product innovation and strategic marketing initiatives that are beginning to bear fruit are positively valued.

Targeting younger audiences with the launch of a TikTok store demonstrates the company's ability to adapt and reach consumers with a lower age range. Also contributing to this is the launch of new collaborations with popular franchises such as Beetlejuice and SpongeBob SquarePants.

International expansion continues to be a pillar of growth, with solid performance in markets such as Australia, France, Germany and China.

It has 12 ratings, of which nine are buy, three are hold and none are sell.

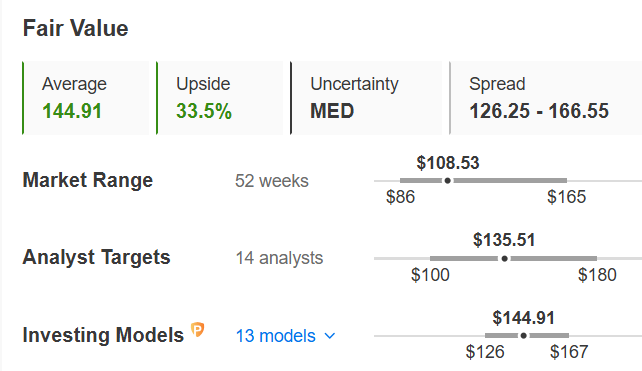

Its shares are trading 33.5% below their fundamental value, which would be at $144.91.

The market gives it an average target price of $135.51.

Source: InvestingPro

2. Nucor (NUE)

Nucor Corp (NYSE:NUE) is a U.S. company based in Charlotte, North Carolina, founded in 1965 and one of the leading producers of steel in the country.

Shares in the steel sector rallied on Donald Trump's victory on the issue of tariffs and the Federal Reserve's interest rate cuts.

The company has increased its dividend since 1973, currently yielding 1.41%. That's not too high, but it is expected to keep increasing it as it has for more than half a century.

Source: InvestingPro

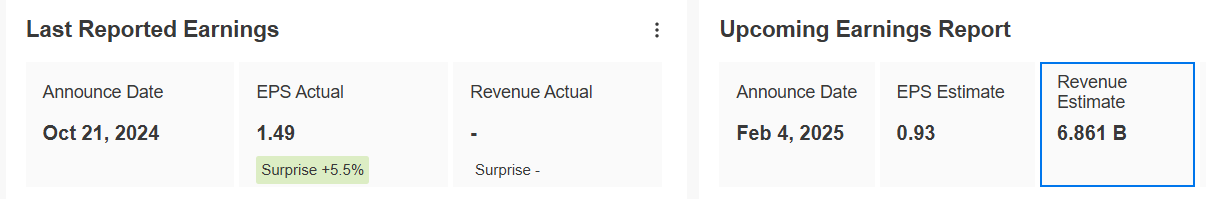

It will release its quarterly accounts on February 4. The 2024 numbers are not good, but for 2025 they are expected to be much better, with EPS, or earnings per share, up 9.4%.

Source: InvestingPro

The company remains optimistic about its growth strategy, with significant capital expenditures aimed at expanding capacity and improving product offerings.

The company's P/E ratio of 10.61 suggests that it may be undervalued relative to its earnings, which aligns with the company's optimistic outlook on future growth opportunities.

The market gives it an average price at $172.51.

Source: InvestingPro

It was unable to break through its resistance when it touched it in early November, hence the recent cuts.

3. L3Harris Technologies (NYSE:LHX)

It is a provider of defense technology products in the maritime, land, air, space, and cyber areas. It provides services to various commercial and government agencies, such as the U.S. Navy, Department of Defense, and Army, and has a market capitalization of $47.06 million.

It will pay a dividend of $1.16 per share on December 6, and shares must be held prior to November 18 to be eligible to receive the dividend. The company's dividend yield is 1.88%. The payments are backed by more than 20 years of steady dividend growth.

Source: InvestingPro

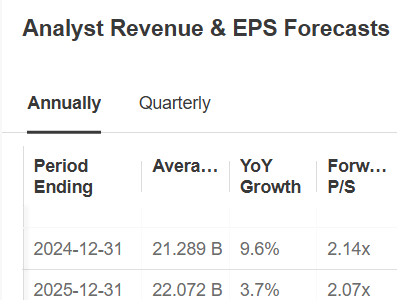

It will publish its accounts for the quarter on January 23. For the full 2024 computation, revenue growth is forecast at 9.6% and for 2025 at 3.7%.

Source: InvestingPro

The stock trades 7.7% below its faire value or fair price by fundamentals, which is at $259.17.

The market gives it an average price target at $279.14.

Source: InvestingPro

4. Perrigo Company (PRGO)

Perrigo Company (NYSE:PRGO) is an American manufacturer of pharmaceuticals. It is based in Ireland for tax purposes. It was founded in 1887.

It has a market capitalization of $3.82 billion and a forward price/earnings (P/E) ratio of 10.85 (lower than the industry average), being undervalued compared to its peers, as well as its own five-year average multiple of 14.12.

The company offers an attractive dividend yield of 3.89% and has raised dividends for 22 consecutive years. It will pay out $0.2760 per share on Dec. 17, and you must own shares by Nov. 29 to be eligible to receive it.

Source: InvestingPro

On March 3 we will know its next quarterly results, expecting an increase in EPS (earnings per share) of 14.03%.

Source: InvestingPro

Perrigo recently completed the sale of its rare disease business HRA Pharma for up to $275 million, which will help reduce debt and allow it to focus more on its core business.

Of the 4 ratings it has, 3 are buy, 1 is hold and none are sell.

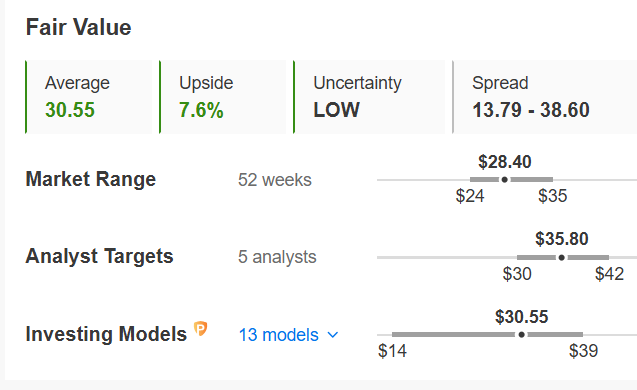

It is trading 7.6% below its fair value or price for fundamentals, which would be at 30.55 dollars.

The average target price assigned by the market is $35.80.

Source: InvestingPro

Ever wondered how top investors consistently outperform the market? With InvestingPro, you’ll unlock access to their strategies and portfolio insights, giving you the tools to elevate your own investing game.

But that’s not all—our AI-powered analysis delivers 100+ stock recommendations every month, tailored to help you make smarter, faster decisions.

Ready to take your portfolio to the next level? Click here to start today!