* Graphic: World FX rates http://tmsnrt.rs/2egbfVh

* Graphic: Foreign flows into Asian stocks https://tmsnrt.rs/3lKhL5I

* Philippine shares surge 3% to lead gains in the region

* Indonesian economy in first recession in two decades

* Singapore shares boosted by banks

By Anushka Trivedi

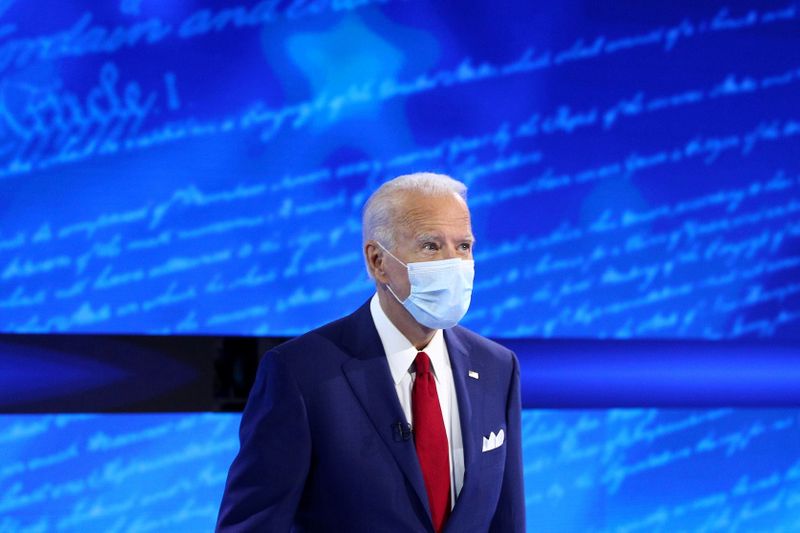

Nov 5 (Reuters) - Stocks and currencies in Asia's emerging

markets rose on Thursday as Democrat Joe Biden pulled ahead of

Republican rival Donald Trump and was within striking distance

of clinching a nail-biting U.S. presidential election.

The Democratic candidate is widely seen as likely to be less

combative on trade policy and in relations with the region's

growth engine China, and investors hope that it may clear the

way for Asia's stronger recovery from the coronavirus crisis.

"Biden is a seasoned politician and will revert the United

States to a trajectory of more conventional foreign policies and

geopolitical manoeuvring, which is somewhat good for China and

emerging economies at large," said Mahesh Sethuraman, country

head of global sales trading at Saxo Capital Markets, Singapore.

In the short term, however, analysts said a retreat for the

dollar was also a major driver for the region's currencies, with

the Taiwan's dollar TWD=TP and Indian rupee INR=IN rising

1.5% and 0.6%, respectively. FRX/

The Chinese yuan CNY=CFXS was marginally higher, while the

trade-sensitive South Korean won KRW=KFTC gained around 0.8%.

Philippine stocks .PSI rallied as much as 3.7%, far

outperforming their peers, to hit a more than eight-month high.

Jennifer Lomboy, a fixed income fund manager at

FirstMetroAsset in Manila, said local investors were encouraged

by the upbeat third-quarter corporate results and after

inflation in October ticked up. Biden late on Wednesday predicted victory over Trump after

pivotal wins in Michigan and Wisconsin, while the Republican

incumbent sought to offset a narrowing path to re-election with

lawsuits and demands for a recount. Betting sites now lean heavily towards Biden, although

investors continue to worry about a long, drawn-out battle which

could delay a much-needed fiscal support for the U.S.

economy. Most Asian stock markets rose about 1% to 2%, with the

Singapore's benchmark .STI gaining 2% after strong quarterly

results by the city-state's biggest lenders. Indonesian stocks .JSKE hit a near two-month high and the

rupiah IDR= surged 1% despite data showing that Southeast

Asia's largest economy fell into a recession in more than two

decades. Chances of Bank Indonesia cutting rates by the end of the

year are higher as the recent rupiah appreciation allows the

central bank to refocus on weak domestic fundamentals, Goldman

Sachs analysts wrote.

HIGHLIGHTS:

** Indonesian 10-year benchmark yields fall 2.7 basis points

to 6.602%.

** Thailand's 10-year government bond yields slide 3 basis

points to 1.35%.

** Singapore shares hit a more than two-month high; DBS

Group DBSM.SI and Oversea-Chinese Banking Corp OCBC.SI post

better-than-expected results.

Asia stock indexes and currencies at 0659 GMT

COUNTRY FX RIC FX FX INDEX STOCKS STOCKS

DAILY % YTD % DAILY % YTD %

Japan JPY= +0.11 +4.06 .N225 1.73 1.90

China CNY=CFXS +0.14 +4.78 .SSEC 1.20 8.75

India INR=IN +0.57 -3.96 .NSEI 1.39 -0.77

Indonesia IDR= +1.11 -3.48 .JKSE 2.59 -16.86

Malaysia MYR= +0.34 -1.49 .KLSE 1.21 -6.70

Philippines PHP= +0.05 +4.83 .PSI 2.80 -14.98

S.Korea KRW=KFTC +0.84 +2.50 .KS11 2.40 9.83

Singapore SGD= -0.03 -0.99 .STI 2.17 -20.24

Taiwan TWD=TP +1.73 +5.59 .TWII 0.40 7.68

Thailand THB=TH +0.32 -3.61 .SETI 1.57 -21.41