The S&P 500 finished lower by around 20 points yesterday. It was about rising rates and a stronger dollar. Surprisingly, the VIX moved lower by 1%, which is odd, given Federal Reserve Chair, Powell’s appearance today.

Volatility

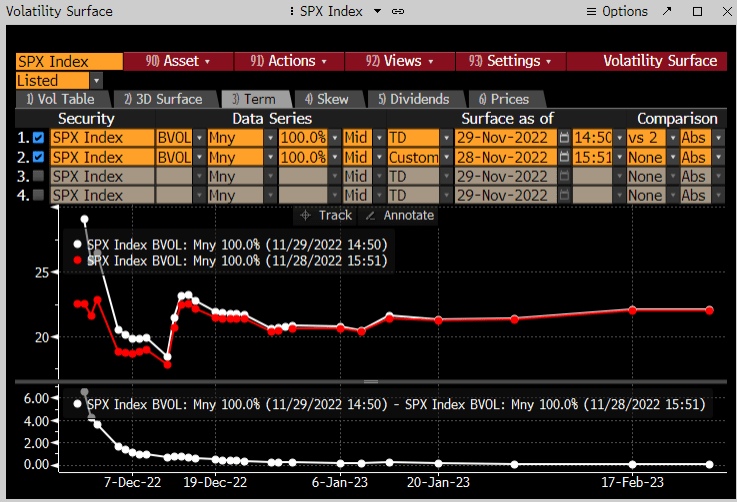

But looks can be deceiving because we live in a world where the S&P 500 has an expiration date every day of the week. So why buy puts 30 days from now when you can purchase hedges for today and worry about what comes next later? So with that type of mentality, you can understand why implied volatility for today’s S&P 500 expiration date is rising sharply and why the VIX is down. If Powell has a Jackson Hole tone, which I think he will, then that entire volatility curve should rise sharply today and the VIX with it.

US Dollar

The dollar seems to influence the S&P 500 more than anything else these days. The dollar has snapped back the past two days, which has me again saying I think the dollar has bottomed. Maybe I am stubbornly bullish on the dollar, but I know Powell needs financial conditions to tighten, and the dollar plays a significant role in financial conditions tightening. So if Powell delivers that hawkish message today, the dollar should rise. I’d like to see the DXY get back to 110 or so.

S&P 500

If the dollar makes it back to 110, it will inflict much pain on the equity market and probably result in that gap filling at 3,750. Nothing new from me, as I have been looking for a gap fill to 3,750 since the November options expiration date.

TIP ETF

We also saw a good move higher in rates yesterday, which helped push the (NYSE:TIP EPS lower. The TIP ETF has not been a factor now for some time and has been trading sideways. The TIP traded sideways, heading into Jackson Hole for about two months. The TIP ETF has traded sideways for about two months, heading into the Powell Q&A session tomorrow. Maybe the TIP ETF will wake up today. Again, real rates need to rise to tighten financial conditions.

Growth To Value (SPYG to SPYV)

The SPYG to SPYV ratio has already started to fill the gap from the Nov. 10 CPI reading.

Apple

Apple (NASDAQ:AAPL) is on the cusp of breaking down and filling the gap from Nov. 10.

ARKK ETF

The {959230|ARKK}} ETF also looks like it has started to fill the gap.

If Powell does his job of tightening financial conditions today, volatility should rise, rates should increase, the dollar should strengthen, and the S&P 500 should fall and move lower towards 3,750.