Stocks finished flat, with the S&P 500 falling just six bps. Most of the weaknesses yesterday came in the equal-weighted S&P 500, with the RSP ETF falling by almost 85 bps.

Meanwhile, we saw the dollar index rise by around 30 basis points, while the 10-year rate fell by seven bps to 4.2%, with the CDX High Yield index moving higher as well. This felt like a risk-off day.

The chart for the DXY looks interesting, as the dollar has bounced off the 61.8% retracement level, and it appears to be forming an inverse head and shoulders. And if it should move above the 104.50 level, it could trigger a break out back to 106.

What was odd about yesterday’s rally in the dollar was that it came despite rates across the curve falling. But that is because rates globally fell sharply yesterday, which allowed the spread between the United States and Germany 2-Year rates to rise.

So, if rates globally continue to fall, the dollar can continue to benefit as long as the interest rate differential grows wider in favor of the dollar.

What is interesting about the spread on the 2-year is that it is getting to the upper end of its recent range, and pushing above 2.05% on the spread could lead to further dollar strength.

The CDX High Yield Index also crept higher yesterday and, for now, has survived the 400 region, which it continues to hold.

The move down in rates, the rise in the dollar, and the high yield spreads suggest more of a risk-off tone to the market. This is the first time I can think of this dynamic happening for some time, and it will be essential to watch to see how this plays out.

It could be a sign of some nervousness coming into the market. For the past two years, we have grown accustomed to rates, the dollar, and spreads moving higher and stocks moving down.

But we are seeing a great many changes starting to take place in the market, with the recent rotation from growth to value, and now rates moving down, with the dollar and spreads moving higher, along with gold.

These are old-school, classic risk-off trades and flights to safety.

The odd thing is that there is nothing in the clear and present in the US to see this type of trade manifest, which suggests the market may be starting to think about the possibility of a hard landing.

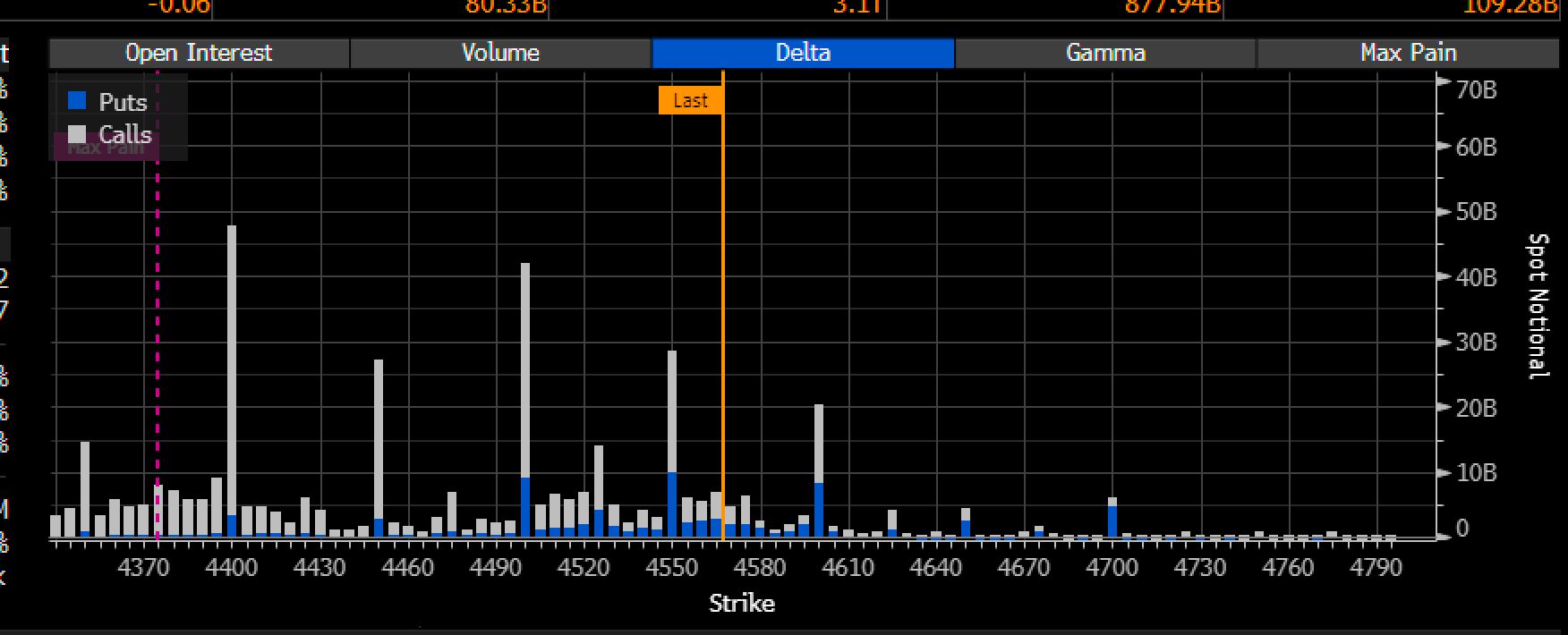

Finally, the S&P 500 continues to consolidate around the 4,600 level, which is the call wall and preventing the index from moving up.

If the call wall doesn’t roll higher, the index will struggle to move higher from current levels.

Meanwhile, I think there is a good chance that the recent high will mark wave “C,” and the next leg of the decline is on the way, with the index moving back to 4,100.

As noted previously, the dynamics of CTA flows are over, and the index is pretty heavy in positive gamma. But the flip level is somewhere around 4,530.

Any pullback that takes the index below 4,530 will flip the index from positive to negative gamma, and that will mean instead of market makers propping the market up, market makers will be going with the trend of the market.

Considering the amount of positive call delta and gamma on the boards, there could be a lot of hedges market makers will need to unwind.

The dynamics that took the market higher are the same ones that could very quickly take it lower, and I continue to think we will head back to 4,100 before most people think.