Oil prices surge over 1% after Trump orders Venezuela blockade

Stocks finished mostly lower as Nvidia (NASDAQ:NVDA) reported earnings results. The S&P 500 fell by 0.6%, while the Nasdaq 100 declined by approximately 1.2%.

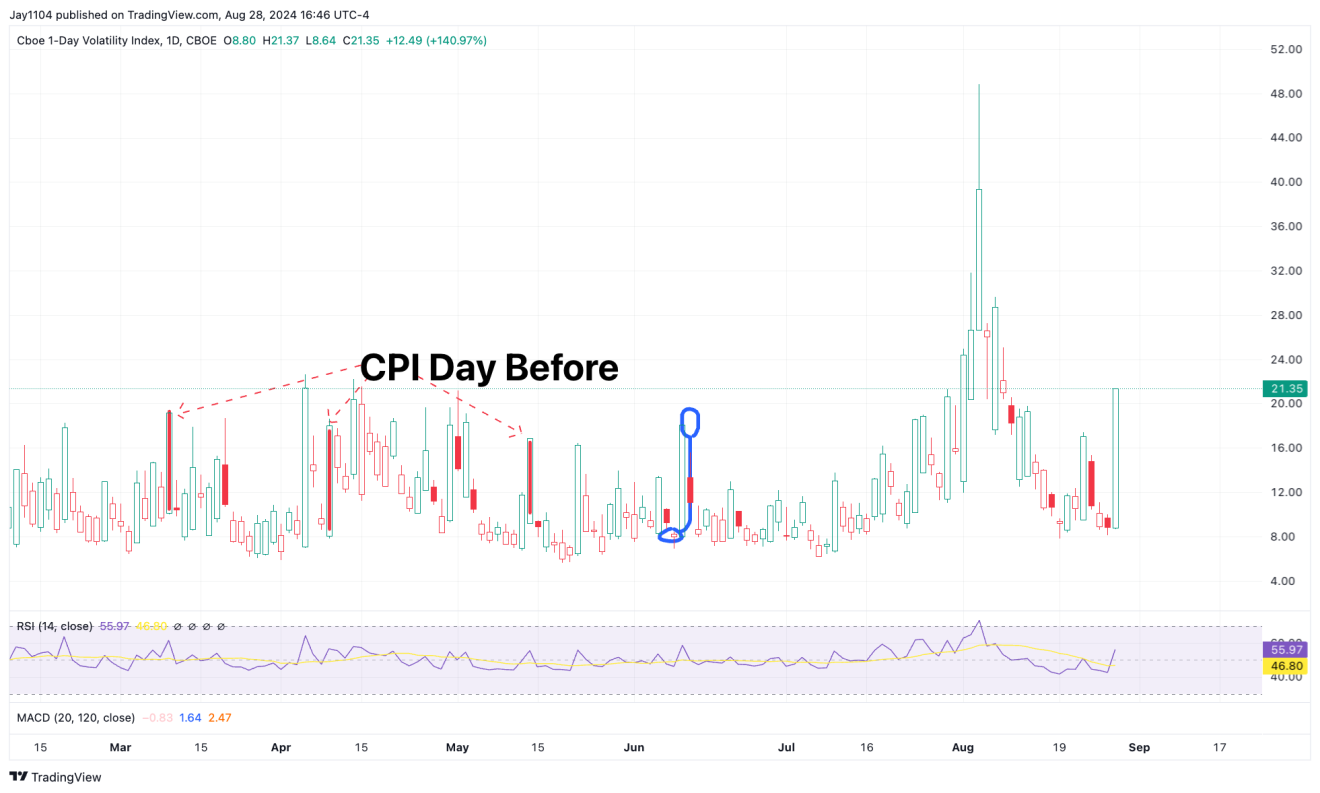

The market’s movements were primarily driven by nervous anticipation surrounding Nvidia’s results, as evidenced by the VIX 1-Day climbing above 21.

It appears that Nvidia’s earnings have taken on the significance of a Fed meeting, jobs report, or CPI release.

Nvidia Tops Expectations, Stock Drops

Speaking of Nvidia, the company reported—no surprise—$30 billion in revenue and guided the street to $32.5 billion for the next quarter. It seems they’re living on the edge with that extra $0.5 billion in the guidance.

That makes five quarters in a row where they’ve beaten guidance by $2 billion and raised the next quarter’s guidance by $4 billion. I can’t say I’ve seen that before.

So, I guess for next quarter, we should expect $34.5 billion in revenue and guidance of $36.5 billion—give or take 2%, of course.

(BLOOMBERG)

That has the stock trading down about 6% as of right now. Technically, there is some support around the $118 level. However, it also appears that the stock has completed a diamond reversal top, which could suggest a further decline beyond the $118 level, potentially back to the gap around $109.

The same pattern is evident in the S&P 500 futures contracts, presenting an opportunity to unwind much of the gains from the past few weeks.

The one factor that could potentially disrupt this is a reset in implied volatility (IV) today at the opening, as the VIX 1-Day returns to earth.

Finally, the yield curve continued to steepen yesterday and is now at -0.03%, with much further to climb.