Technical strategist explains how S&P 500 could hit 7,300 in early 2026

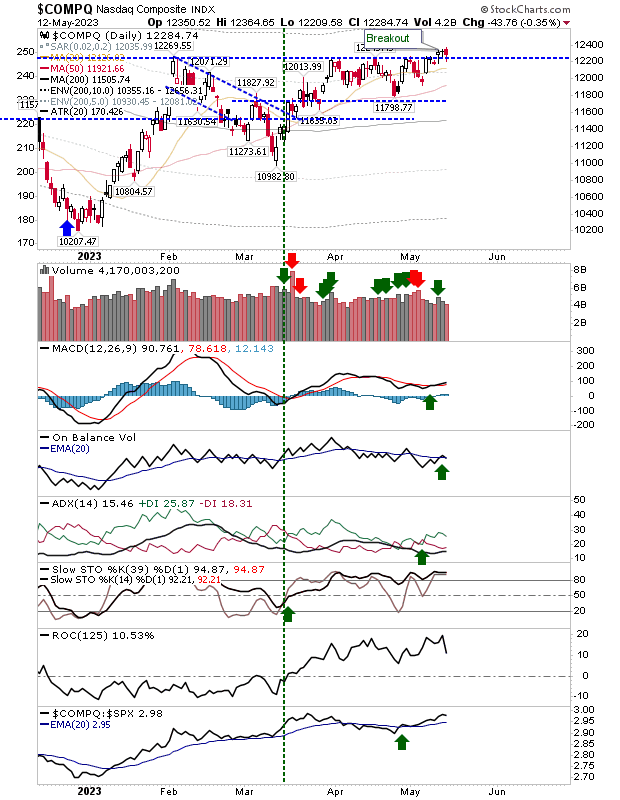

The Nasdaq went into the weekend with a breakout, and despite Friday's losses, it managed to cling to breakout support. There was good buying volume on the breakout, and Friday's selling volume was well down on the previous buying - confirming the move.

The letdown was the lack of price follow-through. Technicals are in good shape, particularly stochastics and relative index performance. The only disappointment was the relatively lackluster MACD, which has flatlined slightly.

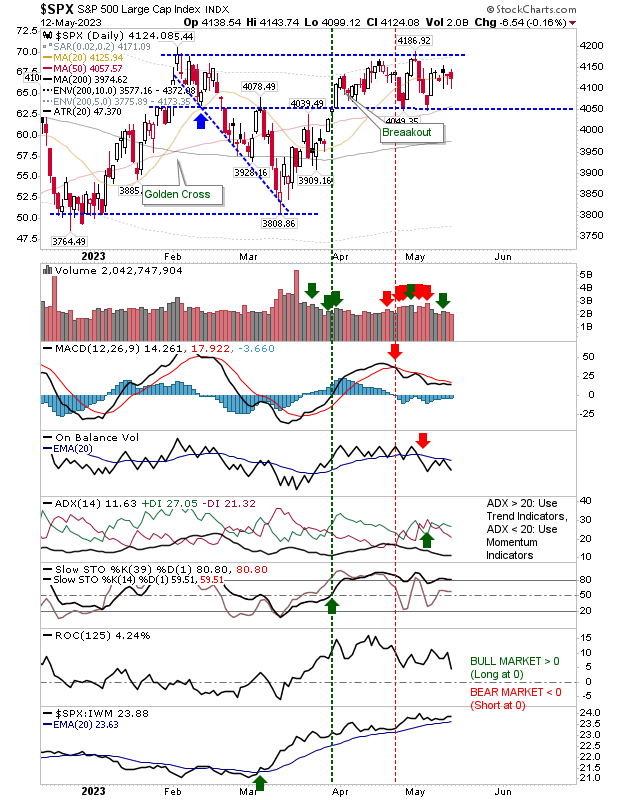

The S&P 500 remains range bound and below breakout resistance. It's enjoying a period of anonymous action that likely wouldn't pique the interest of traders or AI trading systems.

In the long run, this should be viewed as bullish as there is no double top, and only a lack of interest from buyers has prevented this from pushing higher.

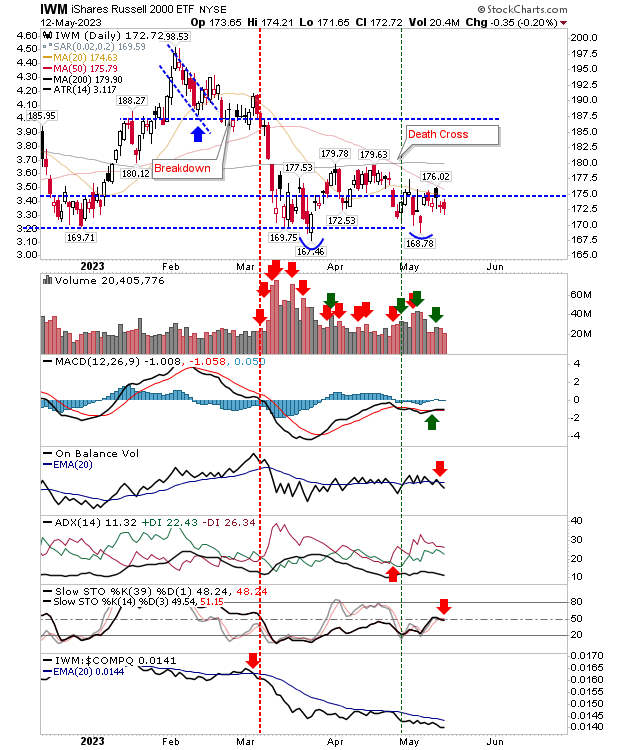

On the flip side, the Russell 2000 ($IWM) is on the other side of the trading range interest, unlike the S&P 500, which is knocking on the door of a breakdown than a breakout.

Since the "Death Cross" in late April, the 50-day MA has become resistant and has contained any attempt to rally. Friday's selling doesn't help the bulls' cause.

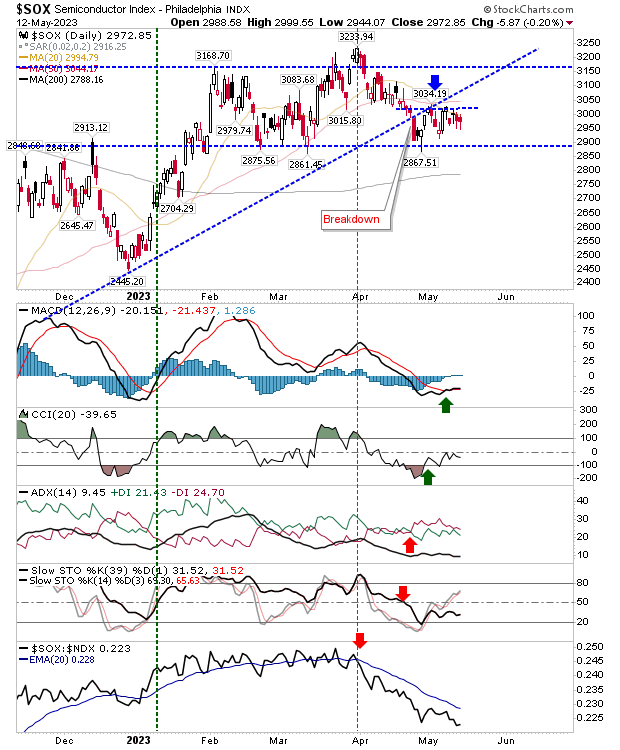

The Semiconductor Index is also struggling to recover from its breakdown, in addition to a secondary resistance defined by the three-week trading range.

Technicals are still mixed with a weak MACD trigger 'buy' and bearish ADX and Stochastics. The sharp underperformance against the Nasdaq 100 is the biggest concern, and it's no closer to reversing this trend.

For next week, we are again looking for something more from bulls; to build on last week's breakout in the Nasdaq and to help drive a similar breakout in the S&P 500.