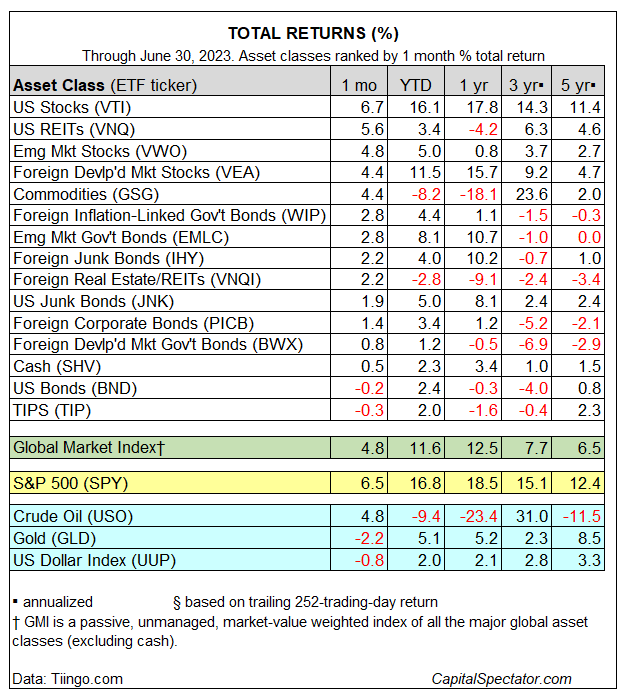

Global markets rebounded in June after widespread losses in May, based on a set of proxy ETFs. The downside outlier to last month’s rally for the major asset classes: US bonds, which continued to lose ground.

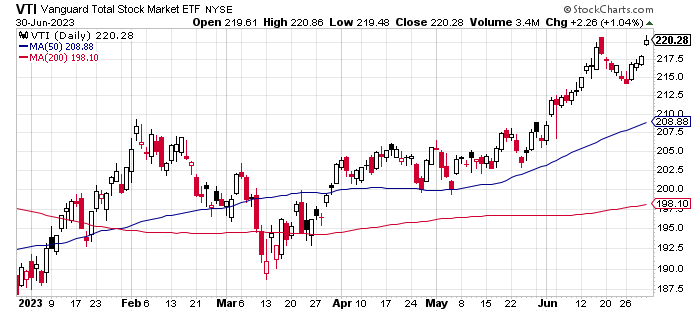

US stocks topped the winner’s list in June. Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI) rose 6.7%, marking a fourth consecutive monthly advance. Although VTI remains well below its record close, set in January 2022, the fund ended last week at a 14-month high.

Note that US shares (VTI) are also the top performer so far in 2023, posting a strong 16.1% return. On the flip side, a broad brush definition of commodities (GSG) is suffering the biggest loss in 2023 for the major asset classes, slumping more than 8%.

The only losers in June were US investment-grade bonds (BND) and inflation-indexed Treasuries (TIP). Both ETFs slipped fractionally, each marking a second month of modest loss.

The Global Market Index (GMI) rebounded last month with a sizzling 4.8% gain. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios. After June’s rally, GMI is up a red-hot 11.6% for the year.

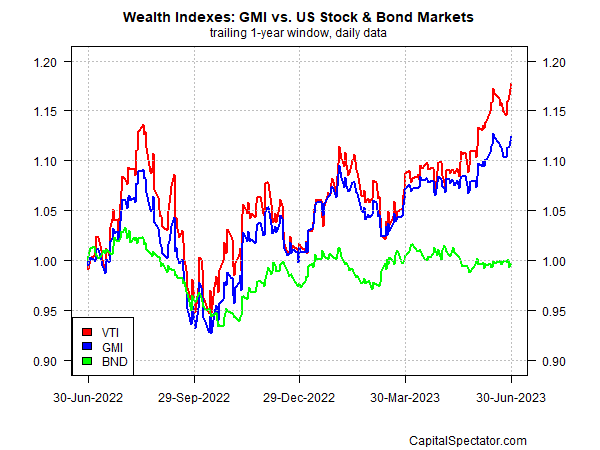

Reviewing GMI’s performance in context with US stocks (VTI) and US bonds (BND) over the past year reflects a strong but middling performance. GMI is up nearly 13% over the past 12 months, well behind VTI’s nearly 18% increase but far ahead of the bond market’s fractional loss, based on BND.