U.S. stock futures steady as Fed meeting looms large

Last week we wrote about how M&A activity has been light so far for 2024, well the same holds for IPO activity. However, next week brings two highly anticipated public debuts that could reignite hopes for an upswing in IPOs.

Astera Labs and Reddit Going Public

Astera Labs (NASDAQ:ASTB), a semiconductor company that builds connectivity solutions to help with AI and Machine Learning workloads, is set to IPO on Wednesday, March 20. The Intel-backed company will make their public debut by offering 17.8M shares in a share price range of $27 - 30, putting its IPO raise at as much as $534M, with a valuation of $5B.

This will mark the first big semiconductor debut since ARM Holdings back in September. Speaking of ARM, their IPO lockup period ended on Tuesday, March 13 and was met with increased trading activity, but ultimately share prices have remained flat since then.

Reddit (NYSE:RDDT) will make its long-awaited public debut on Thursday, March 21. The debut offering will feature 22M shares, in a price range of $31 - 34, making for a total raise amount of $715M on the high end, and a valuation of close to $6.5B.

IPO Activity Light Year-to-Date

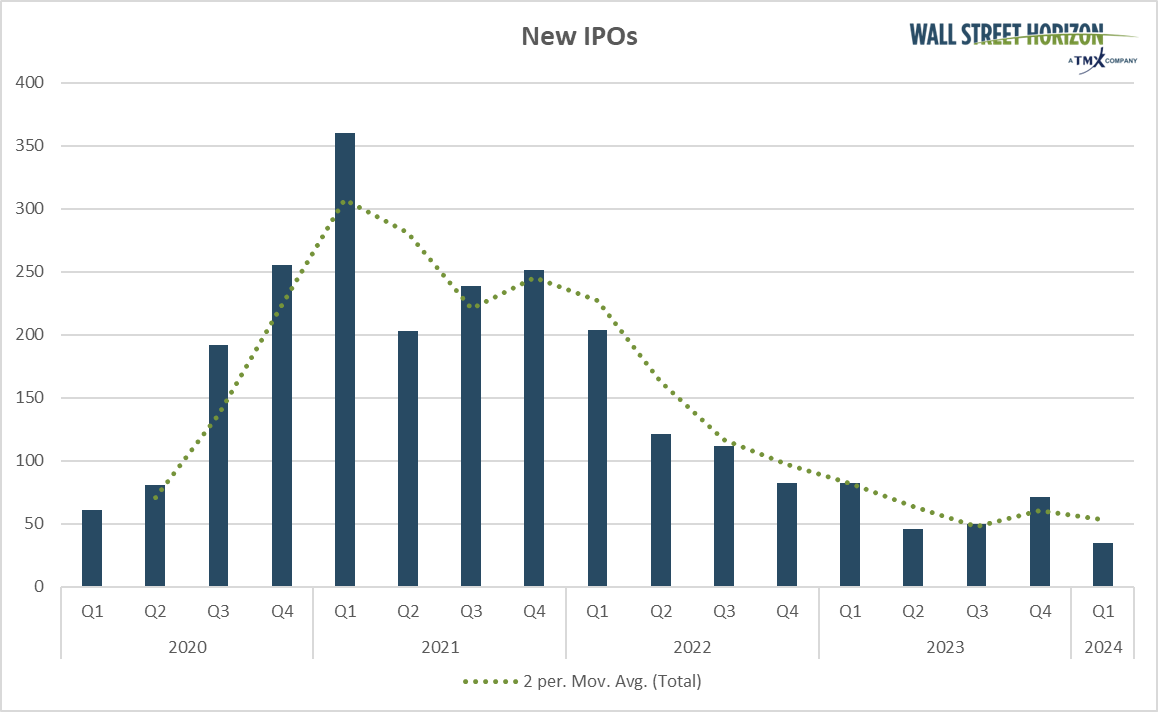

Despite these two high-profile debuts, YTD has otherwise been light for IPOs which are still facing headwinds from higher interest rates making private companies hesitant to come to market. In January and February, there were only 34 IPOs, vs. a 5-year average of 93. So far in March only Neonc Technologies Holdings (NASDAQ:NTHI) has filed for an IPO.

Source: Wall Street Horizon

Looking Ahead

How Astera Labs and Reddit perform next week and in the weeks following their public entrance will likely impact how confident other private companies are in IPOing in 2024. Last year’s IPO glut was in-part due to the worse-than-expected performance of many newly public companies. Poor business conditions caused companies such as Reddit to delay their plans to go public. With interest rates expected to fall later this year and the continued path to a soft landing, this could be just the recipe needed for a resurgence in IPO activity.