- China’s latest stimulus package is sparking optimism among investors.

- Key Chinese companies are already seeing gains, with more upside potential in focus.

- Below, we'll take a look at three stocks poised to see the biggest upside going forward.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

China has just launched its most ambitious economic stimulus since the pandemic, aiming to hit its 5% growth target for 2024.

The government’s intervention includes a three-pronged strategy: cutting rates, easing pressures on banks, and introducing support measures for the long-struggling real estate sector.

While it remains to be seen whether these steps will fully revive China’s growth engine, the stock markets have responded with optimism.

Over the last two sessions, the Shanghai Shenzhen CSI 300 and Hong Kong’s Hang Seng have surged, reflecting renewed confidence in the Chinese economy.

Several stocks we’ve previously highlighted are also benefiting.

Tencent (HK:0700) Music Entertainment Group (NYSE:TME), which showed upside potential in our earlier analysis using InvestingPro's tools, surged 16.40% in the September 24 session following the positive market news.

Despite the recent rally, more opportunities remain. Here are three stocks that still show strong potential based on their Fair Value and analysts’ Target Price:

1. NetEase

This online entertainment giant NetEase (NASDAQ:NTES) has already jumped 13.04% in the past week, but analysts continue to see more upside ahead.

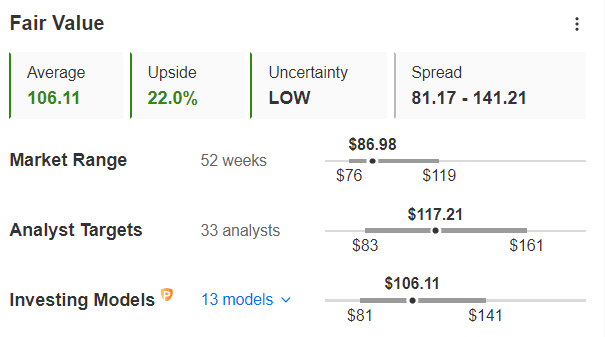

Source: InvestingPro

According to InvestingPro, its Fair Value is $106.11—22% higher than its September 24 close. Analysts set an even higher target price of $117.21.

2. ZTO Express

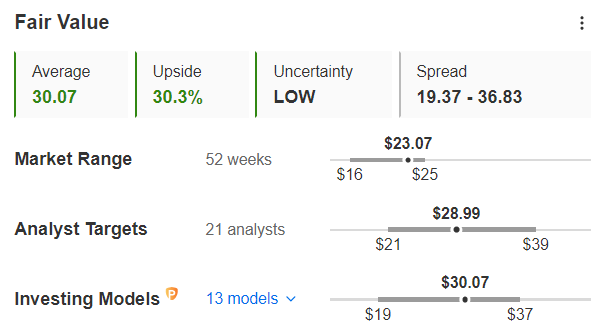

Specializing in logistics services, ZTO Express (NYSE:ZTO) saw a 6.56% gain on September 24, though it has retraced since.

With a Fair Value indicating a 30.3% upside from its current price, analysts have a target price of $28.99, signaling further growth potential.

3. Huazhu Group

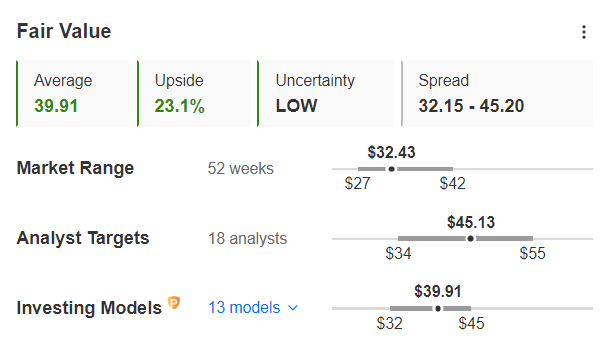

Operating over 10,000 hotels worldwide, Huazhu Group (NASDAQ:HTHT) is undervalued, with a possible 23.1% upside according to InvestingPro.

We've already highlighted this stock in one of our previous articles.

Analysts set the target price at $45.13, representing a 39% potential gain from its current price.

Source: InvestingPro

Bottom Line

Several major Chinese companies are already gaining momentum. After years of a bear market that drove down valuations, opportunities are now emerging for investors.

For instance, e-commerce giant Alibaba (NYSE:BABA) and tech company JD.com (NASDAQ:JD) have both shifted course, with Alibaba climbing 30% and JD.com up 22% over the past three months, and we covered these stocks in our previous analysis on Chinese stocks.

The question is whether these gains mark the start of a broader recovery or remain isolated events within a longer-term bearish trend.

The success of Beijing’s latest stimulus efforts could be key to unlocking more value across China's market, setting the stage for significant growth in the months ahead.

As you look to take advantage of the potential rally in Chinese stocks, InvestingPro's tools can prove invaluable in picking future winners.

Subscribe to InvestingPro now with an exclusive discount and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.