US consumer confidence surprised to the upside overnight, with new house sales and durable goods orders also lifting unexpectedly, staving off rumors of an imminent US recession. This was enough to give Wall Street the shot in the arm it needed with broad gains across equity markets expected on the open here in Asia.

US bond markets saw a small lift in yields with 10 year Treasuries up to the 3.77% level while oil prices surprisingly slumped with Brent crude folding below the $73USD per barrel level. Gold also rolled over back to its recent weekly low at the $1910USD per ounce level.

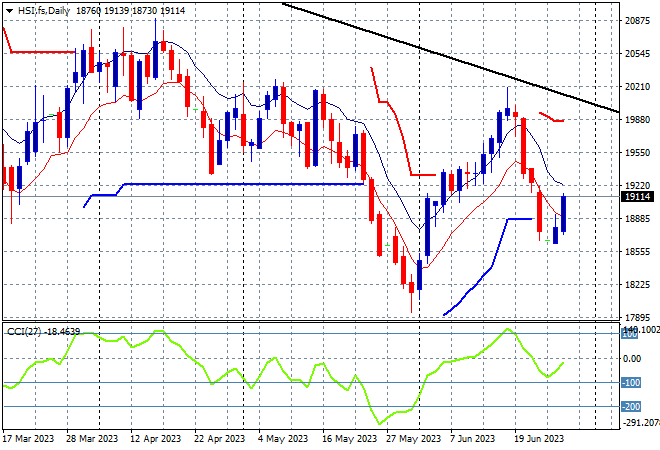

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets are bouncing back after a shaky start to the trading week with the Shanghai Composite up more than 1.2% to 3189 points while the Hang Seng Index had a similar bounce, finishing 1.8% higher to the 19148 point level as the selling reverses.

The daily chart was showing a series of strong sessions that took it back above the previous resistance zone as daily momentum became positive and overbought, retracing most of the May losses. However this sharp reversal trend needs a lot of fill shortly or will follow through below the 19000 point level as part of the overall downtrend:

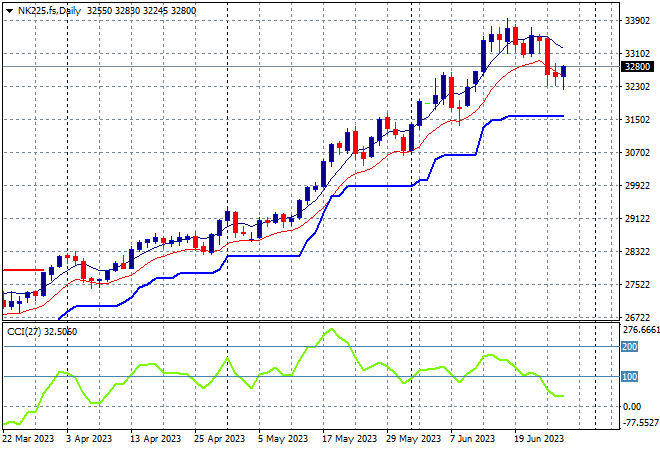

Japanese stock markets were unable to hold on with the Nikkei 225 falling back nearly 0.5% lower to 32538 points. Futures are indicating a clawback of some of these losses on the open given Wall Street’s bounce.

Trailing ATR daily support had been ratcheting higher but with the 33000 point level now broken and daily momentum retracing from overbought settings we could see a further retracement back down to that support zone. A consolidation back to 31000 points is sorely needed to take some heat out:

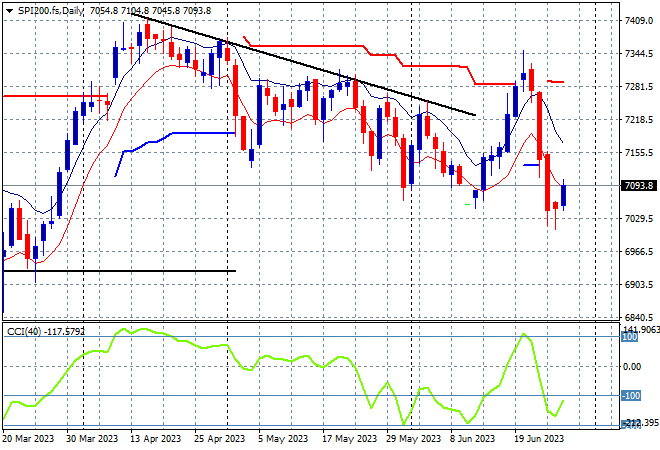

Australian stocks had a good but modest reversal with the ASX200 closing nearly 0.5% higher at 7118 points.

SPI futures are up nearly 0.3% as Wall Street bounced back overnight with a steep recovery required to get back to the previous weekly highs near ATR resistance at 7300 points. This level may just be too far out of reach as medium term price action from the March highs remains somewhat intact:

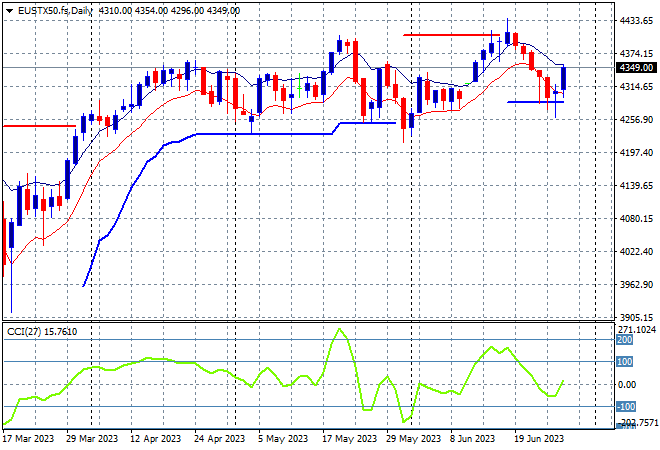

European markets were able to find some stability with modest gains across the continent as the Eurostoxx 50 Index finished some 0.5% higher at 4305 points.

The daily chart was previously showing a clear breakout that turned into a bull trap but weekly support at 4200 points has so far been well defended. Weekly resistance at the 4350 points level is the true area to beat next with support below remaining quite firm but not enough to let prices accelerate away:

Wall Street finally got its stuff together with broad gains on all three bourses as tech stocks led the way on the consumer confidence front as the NASDAQ lifted more than 1.6% while the S&P500 finished over 1% higher to 4378 points, just shy of the key 4400 point level.

The four hourly chart showed a decline from the start of last week maybe over with this breakout but the 4400 point level is not broken in the physical market. Short term momentum has switched to broadly positive and almost overbought but overhead resistance is not yet under threat:

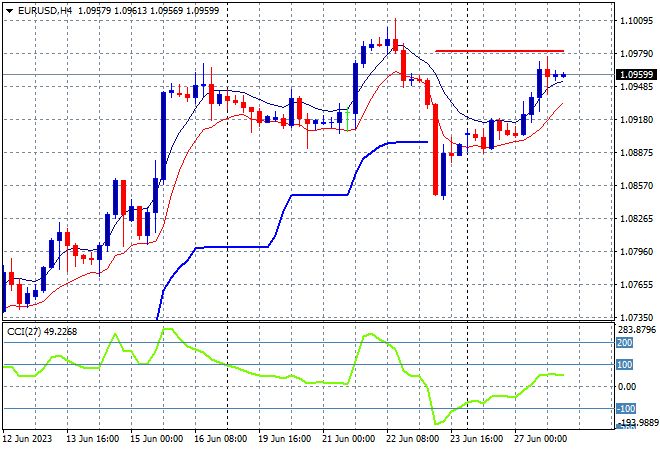

Currency markets saw some divergence on the US economic figures with Euro lifting against King Dollar while Yen and Aussie remained in the doldrums. Euro was able to get out of its current containment at the 1.09 handle with another attempt to get back to the previous weekly high.

The union currency may oscillate further on a lot of ECB and other central bank talkfests happening in tonight’s session so watch for a further breakout to test the April highs above the 1.10 handle but also a wild oscillation lower on bad European news:

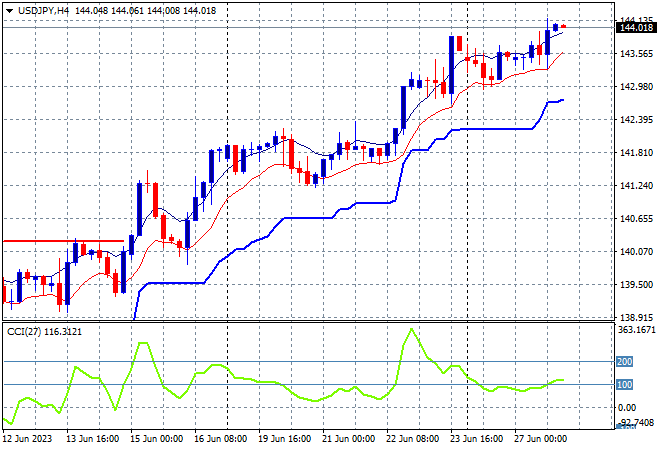

The USDJPY pair was able to keep advancing overnight despite stronger moves in Euro with a push above the 144 level for yet another record high as Yen deflates.

The previous consolidation back down to trailing ATR support was looking like repeating itself here mid week, turning into a medium term consolidation but the BOJ pause and Fed Chair Powell’s comment is giving the pair new life. Four hourly momentum is back into overbought mode as short term price action never touches ATR trailing support in this very steady uptrend:

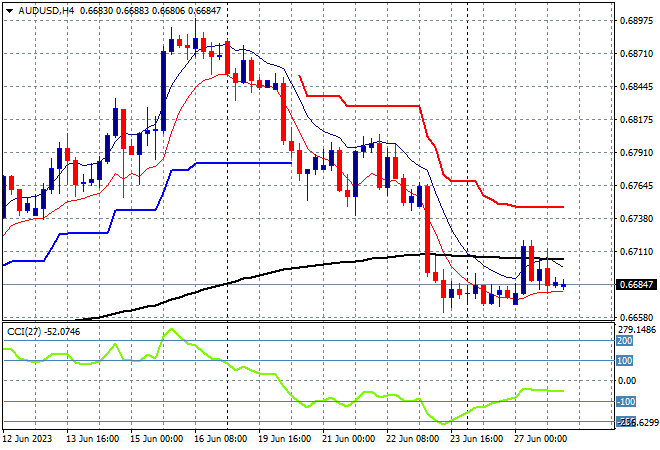

The Australian dollar is still going nowhere as it licks its wounds from the Friday night selloff, still sitting at the high 66 cent level and anchored at a new weekly low in the process.

ATR support is a long way away after the Pacific Peso failed to put previous overhead resistance at 67 cents aside with domestic recession concerns and an aggressive Fed overshadowing any attempt at the RBA in managing inflation, so we’re likely to see more downside ahead:

Oil markets are unable to gain any ground despite a weaker USD with macro concerns outweighing again overnight as Brent crude flopped back down to the $72USD per barrel level.

Price remains anchored around the December levels and the March lows with daily momentum still negative with no new weekly highs. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

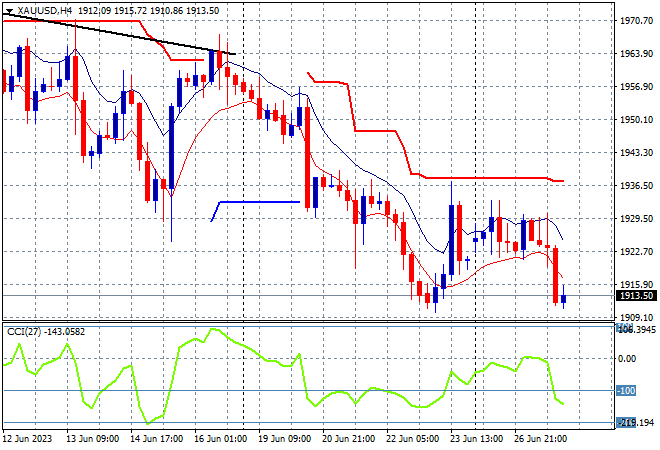

Gold is failing to stabilise with a return overnight to its low from the Friday night session as it head straight down to the $1910USD per ounce level, sitting there this morning.

The daily chart had been showing a continued failure to get back above the psychological $2000USD per ounce level , with short term ATR resistance just too far away on any bounceback. All the signs were building here for a complete capitulation below $1930 so watch for another rollover down to the $1900 level next as momentum returns to oversold settings: