Last night saw US stocks breakdown at the end of the session as the debt ceiling shenanigans in Congress ended in deadlock again. This came after the USD lifted again with all the major currencies under heel, including the Australian dollar as it was pushed to the mid 66 cent level. European stocks fell back slightly with futures again indicating that Asian markets may bring the hesitation as well.

Meanwhile 10 year US Treasury yields rose appreciably, up through the 3.5% level to a start of month high while oil prices were steady as Brent crude hovered around the $75USD per barrel level. Gold fell back sharply however, breaking down below the $2000USD per ounce level in an ominous move.

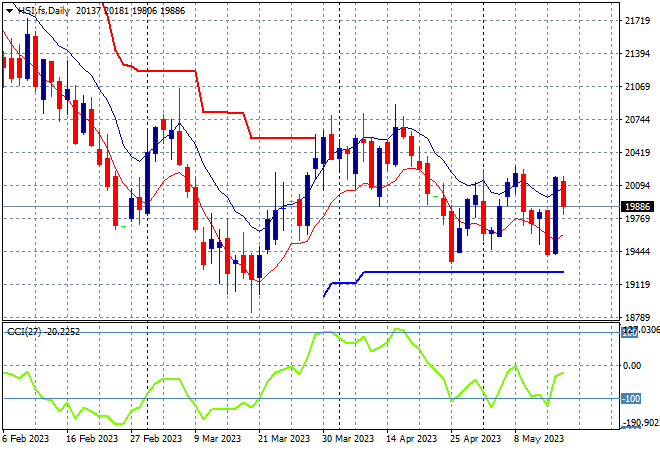

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets sold off slightly going into the close, with the Shanghai Composite down nearly 0.7% at 3290 points while the Hang Seng floated along with a scratch session to still stay shy of the 20000 point level.

The daily chart is still showing resistance building above at the 20500 point level as price action wants to return to the start of year correction phase below 19000 points with a failure to make any new weekly highs since early April. This maybe changing however as support builds:

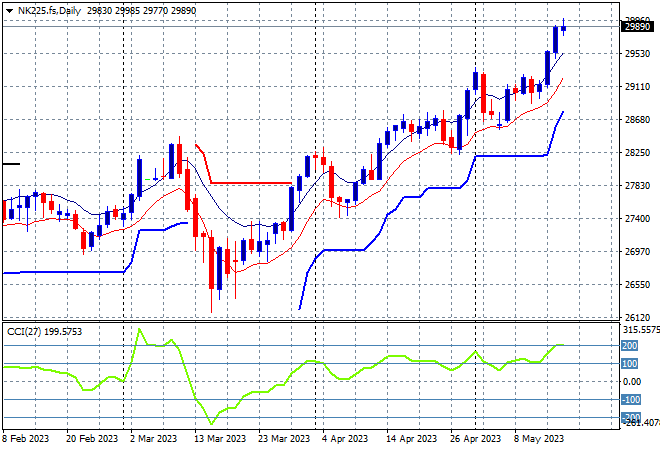

Japanese stock markets were the best performers, finally closing in on the 1990 levels with the Nikkei 225 lifting nearly 1% higher at 29842 points. Futures are indicating a further strong start on the open that could threaten the 30,000 point level.

Overall the trend remains up following some steam taken out before the holidays as price action hasn’t yet tested the low moving average area, indicating that overall risk sentiment will not threaten trailing ATR support at 28000 points either as daily momentum remains firmly on the upside:

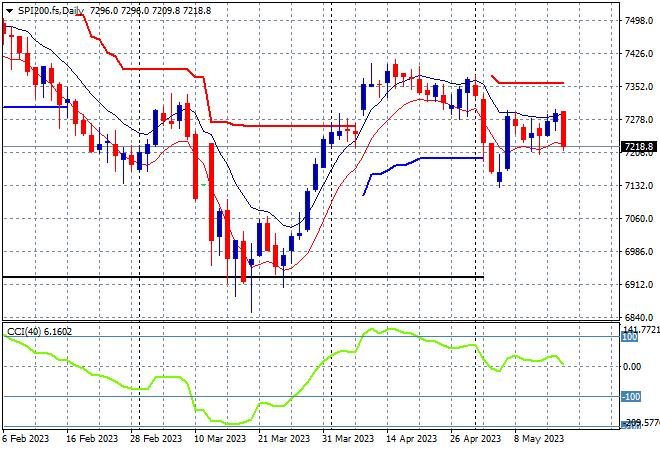

Australian stocks were hesitant once again as local traders decided to start selling instead, with the ASX200 managing to closed nearly 0.5% lower at 7234 points.

SPI futures are down at least 0.5% following the late falls on Wall Street overnight as daily momentum remains positive but not exactly exciting as we move into yet another staid trading week.

The upside target in the medium term remains the April highs at 7400 points as daily momentum will try to bounce out of the negative zone with price action needing to break the high moving average band first, but support at 7200 points may come under threat first:

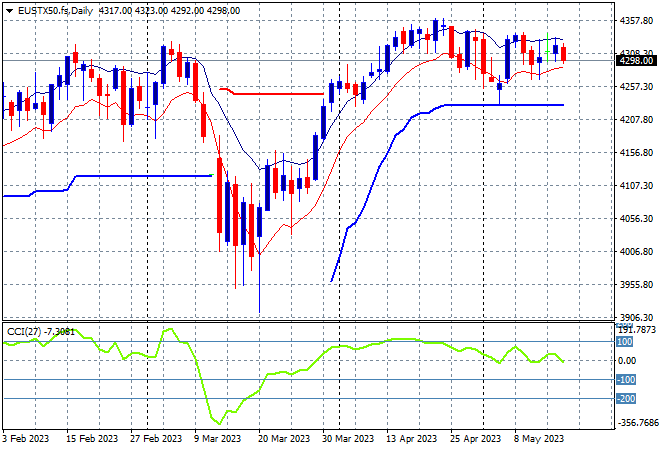

European markets were unable to gain traction amid the GDP print and ZEW survey with marginally lower returns across the continent and in Brexit-land with the Eurostoxx 50 Index closing dead flat again to remain slightly above the 4300 point level at 4315 points.

This is another relief rally that may have legs as its much closer to the previous highs than in other risk markets, but also could be pushed over on reassessment of risk and inflation concerns.

The daily chart clearly shows price action caught between strong trailing ATR support at the 4200 point level and weekly resistance at the 4350 points level:

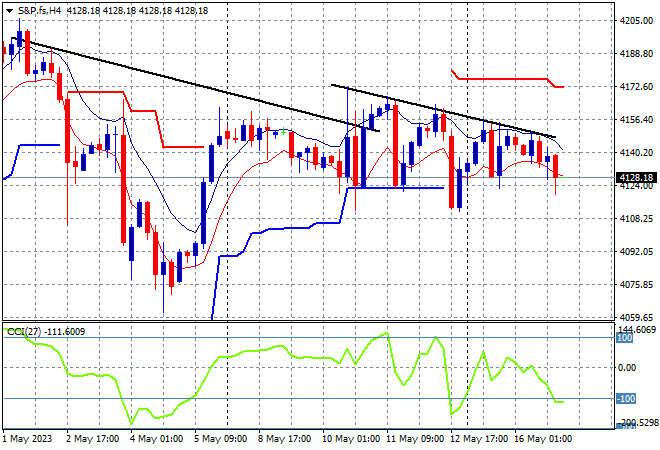

Wall Street was looking grand until the final few hours that saw a reversal of all the night’s gains with the headline Dow losing more than 1% while the NASDAQ treaded water as the S&P500 lost nearly 0.7%, taking back its previous gains and then some to finish at 4109 points.

The four hourly chart however shows that price action has not been ready to engage higher with a lack of a new daily high since mid last week at the 4150 point level or thereabouts. There is still a likelihood that this bounce might stall before it gets back to the end of April 4200 level. While short term support at the 4120 point level remains quite firm its really coming under pressure now:

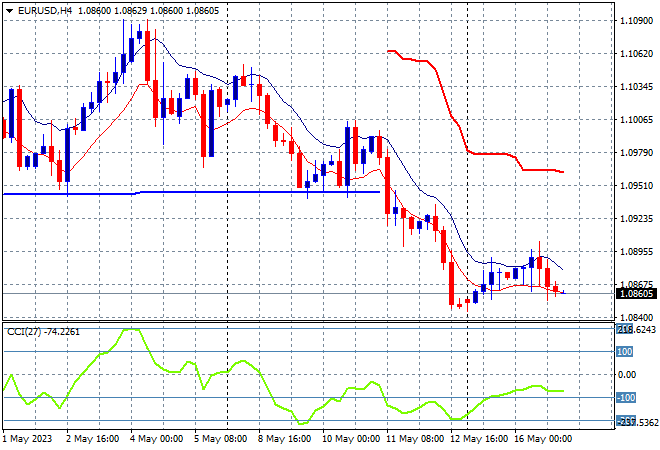

Currency markets are continuing their dominant USD trend following a series of economic prints overnight and speeches from Fed officials that are keeping US inflation rate expectations higher. The German ZEW survey tanked while US retail sales were quite soft so this lead to a further run on King Dollar, pushing Euro back below the 1.09 handle again.

Short term momentum on the four hourly chart shows nearly oversold settings with resistance now shifting to former support at that mid 1.09 level proper:

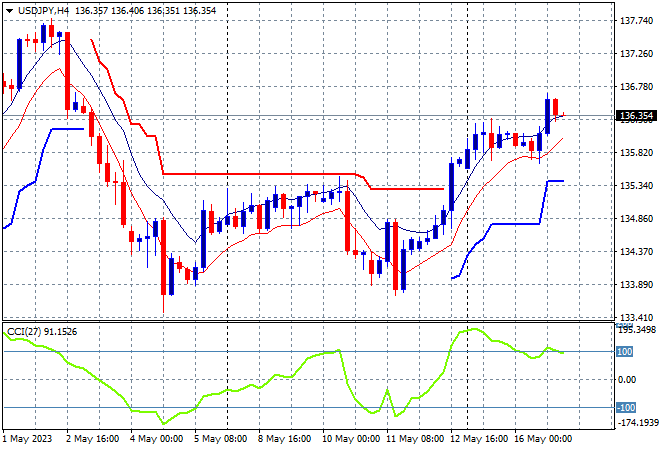

The USDJPY pair stalled slightly above its new weekly high to keep its big selloff in Yen from Friday night intact, maintaining a position just above the 136 handle.

This breakout may have more legs as short term momentum readings are only slightly overbought although immediate price action trajectory is a little steep. But having cleared trailing ATR resistance at the mid 135 level the scope for further upside is increasing:

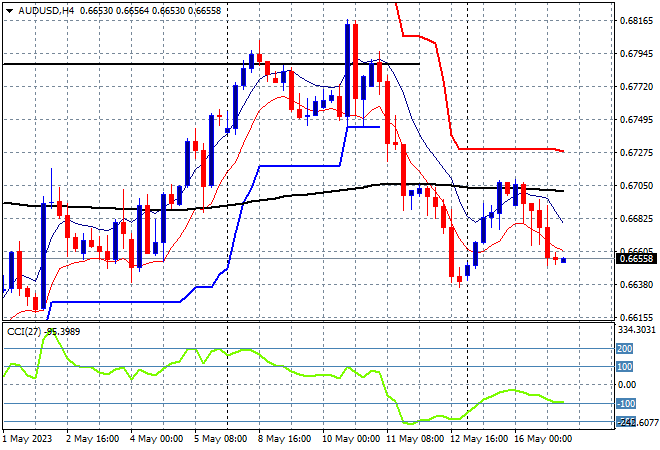

The Australian dollar tried to hold on to its post weekend gap bounce but failed to get back above the 67 handle and rolled over again in the wake of a stronger USD.

Price action has now definitively rejected the previous weekly previous highs (upper black horizontal line) so while the Pacific Peso has done well hold above previous overhead resistance at 67 cents, this move could see that return to the weekly lows below the 66 cent level:

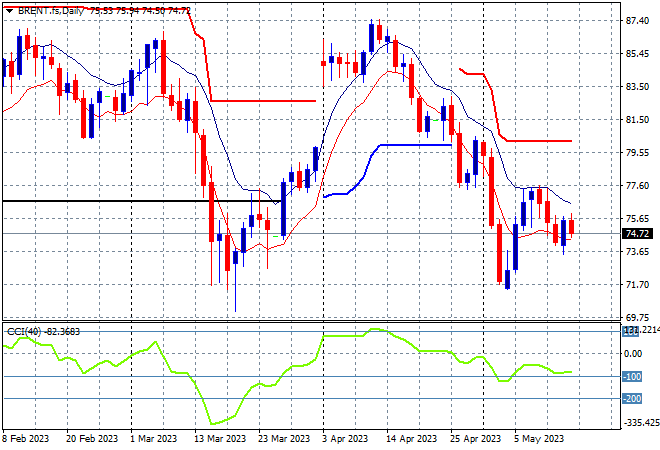

Oil markets are trying to bounce back after a series of breakdowns that culminated in a bounceback that is likely to be a dead cat bounce, with Brent crude basically unchanged overnight as part of this move to finish just below the $75USD per barrel level.

This still keeps price well below the December levels (lower black horizontal line) after breaching trailing ATR support previously with daily momentum almost back into oversold mode. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

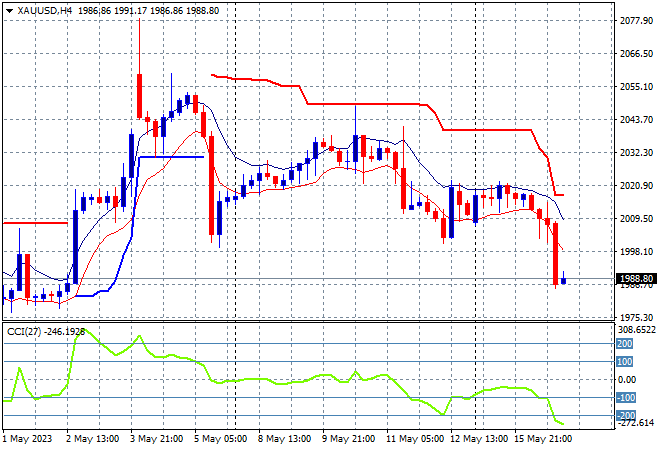

Gold was still recovering from its pullback following the NFP print before a run to USD safety last night saw it breakdown below the psychological $2000USD per ounce level, making a new monthly low in a sharp one-off move.

While there is continued buying support above previous weekly support levels just above the $1980 level, short term momentum had been in the negative zone with the potential to breakdown here as I’ve been explaining for a while, with price action unable to move above the high moving average. Support at the April lows must hold: