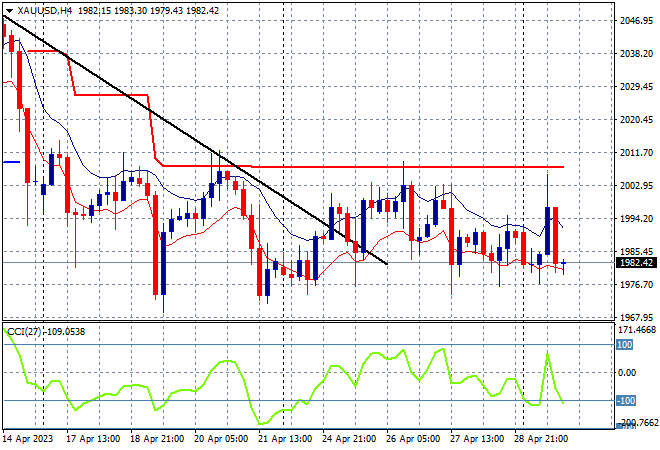

Wall Street failed to recover its gains at the end of the session overnight with scratch sessions abiding as European stocks were closed due to the May Day holiday. Asian bourses are looking to open flat despite a solid start to the new trading week and month with local traders ready to act on the RBA’s meeting later this afternoon. The Australian dollar was slammed back to support at the 66 cent level overnight as other major currencies feel the weight of a stronger USD. 10 year US Treasury yields rose through to the 3.5% level again in anticipation of the next Fed meeting while oil prices are still depressed with Brent crude hovering below its new monthly low at the $80USD per barrel level as gold continues its failure to get back above the $2000USD per ounce level, closing at $1982 per ounce.

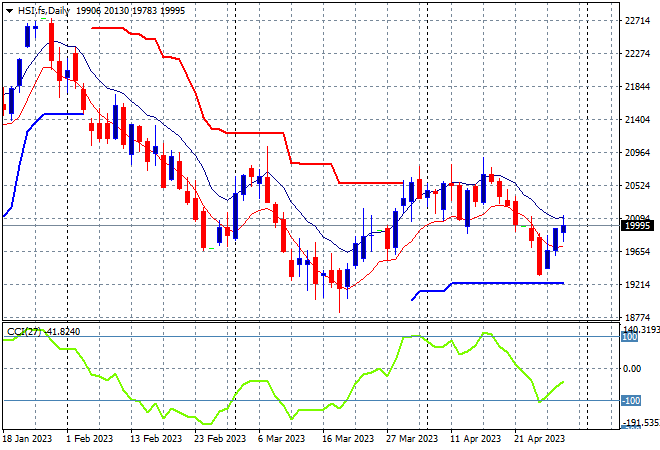

Looking at share markets in Asia from yesterday’s session where Chinese share markets were closed and will remain so through Wednesday, with the Hong Kong based Hang Seng Index will return to trading today. After closing shy of the 20000 level on Friday the daily chart is still showing resistance building at the 20500 point level before this recent rollover as price action returns to the start of year correction phase. While this small bounce may have legs, watch for any break below the 19000 point level as an ominous rollover sign:

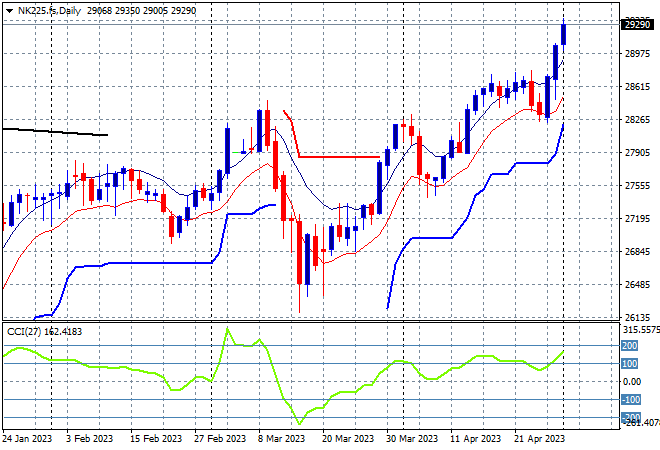

Japanese stock markets had very solid sessions on the back of better consumer confidence data with the Nikkei 225 finishing nearly 1% higher at 29123 points. Futures are indicating a strong lift on the open in line despite the pullback on Wall Street overnight as Yen sold off appreciably as well, suggesting a new monthly higher to be made again. Daily momentum is quite overbought as price action previously tested support at the low moving average area with resistance now pushed aside at the 29000 point level:

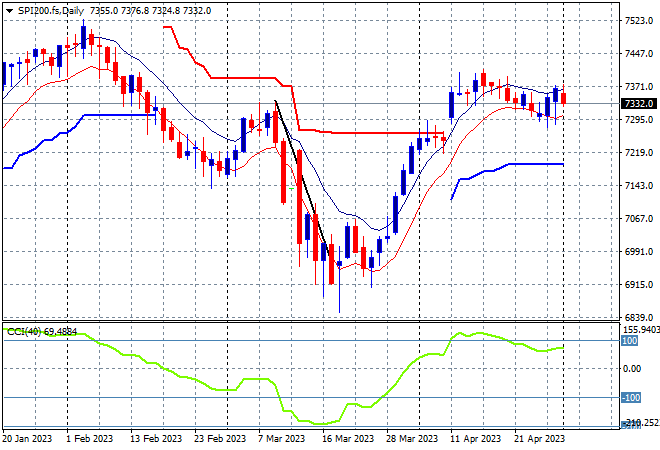

Australian stocks were able to put in a small uplift on light trading yesterday, with the ASX200 closing 0.3% higher at 7334 points. SPI futures are dead flat in line with the end result on Wall Street overnight. The market is being helped somewhat by the lower Australian dollar, but the attempt to get back to the January levels is still looking dicey as everyone looks to the next move by the RBA today. Daily momentum has retraced from overbought and while this trend is well supported watch the low moving average for signs of a breakdown:

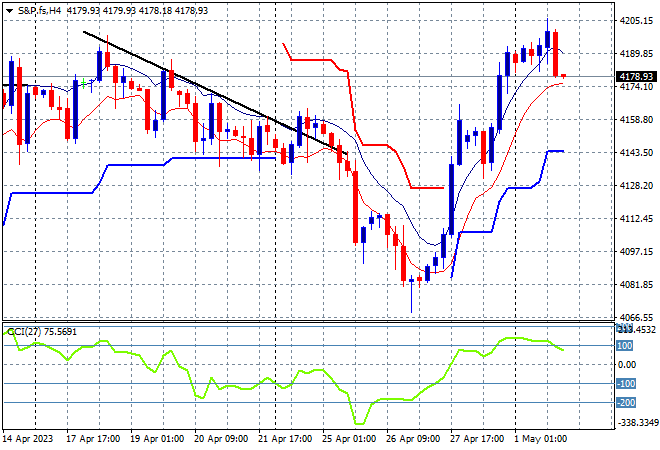

Wall Street was looking to build on its Friday night gains but failed to follow through despite some good earnings reports with the NASDAQ down just over 0.1% while the S&P500 tread water to finish at 4167 points after breaking through the 4200 point level earlier in the session. The four hourly chart shows price action almost stalling its sharp rebound off the early April lows with the potential to break down as we head into the next round of earnings and economic data:

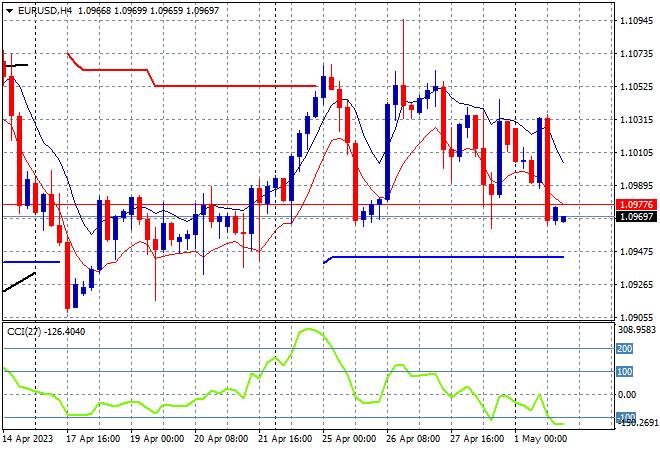

Currency markets remain somewhat volatile and uncorrelated amid more economic data with the USD firm initially strong against almost everything before the GDP print soured King Dollar’s chances. Euro was pushed below the 1.10 handle briefly before rebounding slightly late in the session. This keeps it above last week’s point of control at the mid 1.09 level with strong buying support at the low 1.09’s showing there’s more potential upside here but watch for volatility ahead on further economic prints:

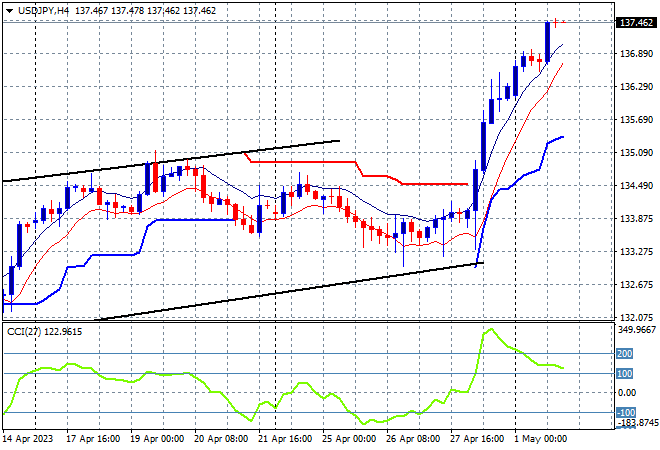

The USDJPY pair came back from Yen safe haven buying to stabilise right on the 134 handle overnight after briefly touching the lower bound of its trend channel. The four hourly chart is still potentially forming a bearish head and shoulders pattern here but short term momentum readings have bounced back in neutral settings. Support at the recent lows is the areas to watch here with further falls below previous trailing ATR support possible:

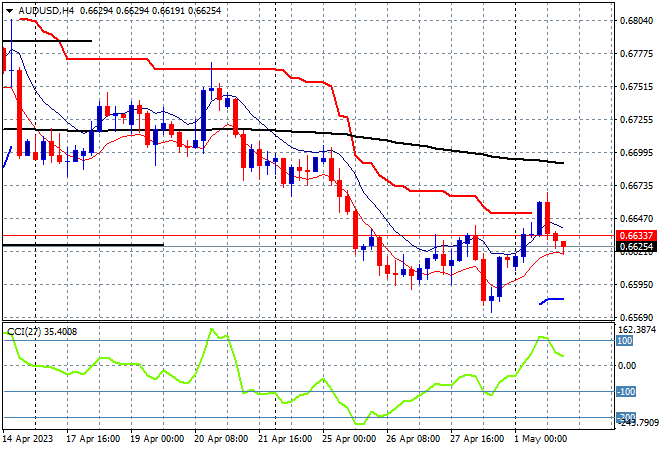

The Australian dollar is holding the line here at recent support at the 66 handle with a small blip above that level overnight as risk markets bounced back. With another pause by the RBA at the next meeting likely, the Pacific Peso will remain under pressure well below the 67 handle with overall price action remaining quite weak in the face of domestic economic data, with the firming USD now taking it back to the early April lows with the potential to undershoot:

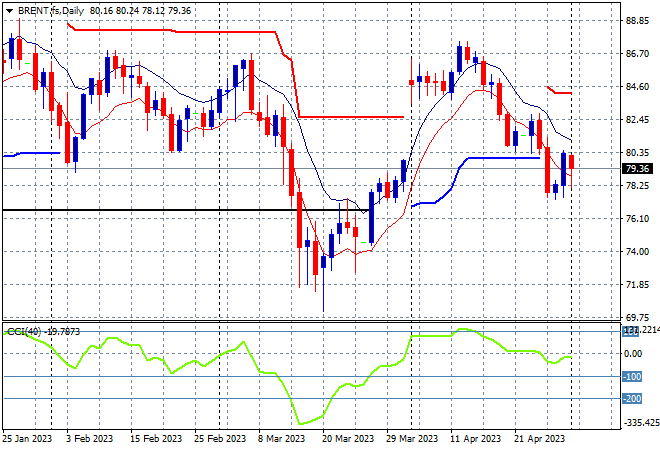

Oil markets are still not enjoying the USD volatility with Brent crude remaining at its recent lows around the $78USD per barrel level. This takes it back to the December levels (lower black horizontal line) but has not yet overshot to the $70 level after breaching trailing ATR support, with daily momentum negative but not yet oversold: