* European stocks open lower on profit taking, virus angst

* Japan's Nikkei hits 29-year high

* U.S. bond yields fall, dollar under pressure

* Oil suffers from COVID-19 worries

* Asian stock markets: https://tmsnrt.rs/2zpUAr4

By Tom Arnold and Hideyuki Sano

LONDON/TOKYO, Nov 6 (Reuters) - Global stocks were little

changed but near a record high while the dollar and U.S. bond

yields stayed sluggish on Friday on bets that a divided U.S.

Congress would hinder government borrowing, which could pave the

way for even more central bank stimulus.

Investors expect Democrat Joe Biden will beat President

Donald Trump but Republicans will keep control of the Senate,

allowing them to block Democrat policy such as corporate tax

hikes and debt-funded spending on infrastructure.

"From here, we believe the impact of the presidential result

should be relatively small," said Lars Kreckel, global equity

strategist at LGIM. "Whether Biden or Trump are in the White

House, governing with a Congress that is very likely to be

divided would be difficult and mean very little policy that

could significantly move equity markets would be passed."

A sense that a Biden presidency will be more predictable

than Trump's is also underpinning risk sentiment, even though

investors saw no quick rapprochement between the United States

and China on trade and other issues.

Biden had a 253 to 214 lead in the state-by-state Electoral

College vote that determines the winner, according to most major

television networks, putting him closer to the 270 Electoral

College votes needed to win.

In Pennsylvania, which has 20 electoral votes, Biden cut

Trump's lead to just over 18,000 by the early hours of Friday.

His deficit in Georgia, which has 16 electoral votes, shrunk to

about 450.

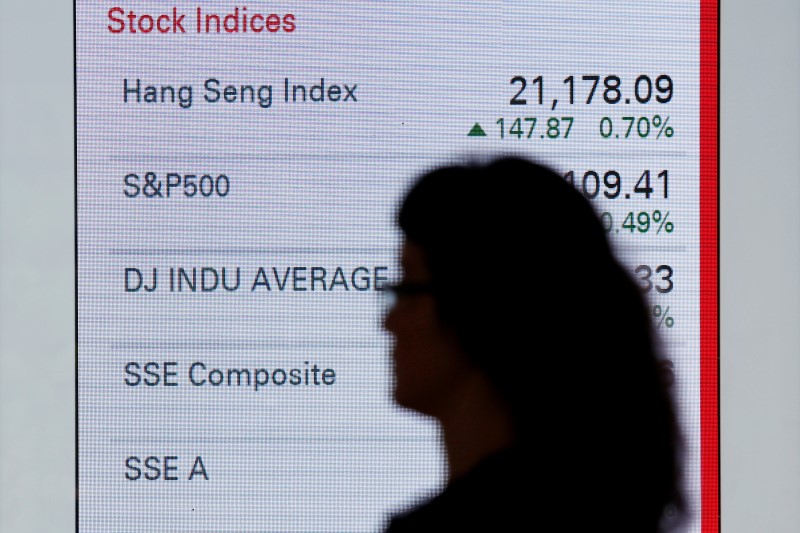

MSCI's all-country index of the world's 49 markets

.MIWD00000PUS was flat after gains earlier in the week, still

close to the record reached in September.

Europe's main stock index .STOXX opened 0.4% lower, with

investor sentiment dimmed by the economic toll of new lockdowns

in Europe to contain the coronavirus. Italy and France

registered record numbers of COVID-19 cases.

Japan's Nikkei average rose 0.9% .N225 to a 29-year high

while MSCI's broadest gauge of Asian Pacific shares outside

Japan rose 0.3%, near a three-year high. .MIAPJ0000PUS .

U.S. S&P futures ESc1 dropped 0.6%, a day after the

underlying stock index .SPX rose 1.95%.

Trump's attempts to pursue lawsuits challenging elections in

several states have so far done little to change expectations of

the outcome.

Still, some market players are wary of street protests

getting violent, after Trump claimed the election was being

"stolen" from him. U.S. bond yields drifted lower, with the 10-year Treasury

yield US10YT=RR falling to 0.773%, below the pre-U.S. election

level on Tuesday. It had struck a three-week low of 0.7180% on

Thursday. US/

The Federal Reserve kept its monetary policy loose and

pledged to do whatever it takes to sustain a U.S. economic

recovery. With COVID-19 raging in the United States and parts of

Europe, many investors assume more monetary stimulus is

inevitable.

The Bank of England expanded its asset purchase scheme on

Thursday and the European Central Bank is widely expected to

announce more stimulus next month.

Investors also focused on the prospects of stalled talks on

a U.S. coronavirus relief package restarting.

"We still anticipate that there will be a fiscal package in

excess of $1 trillion next year," said James Knightley, chief

international economist at ING Group in New York.

"This stimulus, when combined with a long-anticipated

COVID-19 vaccine, can really lift the economy and drive growth.

We consequently remain very upbeat on the prospects for 2021 and

2022."

In currency markets, lower yields undermined the dollar. The

dollar index touched a two-month low of 92.459 =USD .

The euro traded at $1.1840 EUR= while the offshore Chinese

yuan climbed to 6.6000 to the dollar CNH= .

A weaker dollar supported the Japanese yen JPY= , which

rose to 103.43 yen against the dollar overnight. It was steady

in early European trade at 103.45 yen.

Gold XAU= , which is used as a hedge against inflation in

an era of ultra-loose monetary and fiscal policies, fell 0.3% to

$1,942 per ounce after jumping over 2% overnight. GOL/

Even bitcoin BTC=BTSP rode high, gaining 10% on Thursday

and hitting a high last seen in January 2018.

Oil prices fell as fresh lockdowns in Europe to contain the

coronavirus darkened the outlook for crude demand. Brent crude

LCOc1 was down 1.2% at $40.45 a barrel. West Texas

Intermediate futures CLc1 were down 1.3% at $38.27 a barrel.

O/R

<^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Stock market from Election Day to inauguration https://tmsnrt.rs/3jSBTjO

Dollar falls to 2-month low https://tmsnrt.rs/2GxqA2M

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^>

- English (USA)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GLOBAL MARKETS-Stocks mixed with U.S. presidential outcome still uncertain

Published 11/06/2020, 05:38 PM

Updated 11/06/2020, 05:40 PM

GLOBAL MARKETS-Stocks mixed with U.S. presidential outcome still uncertain

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.