The first step on the move back to highs for indices started yesterday, but it's going to take a concerted effort by bulls to get there.

The concern is that we are looking at a zig-zag move lower, and the latest gain will fade out by the weekend. But the bounce-off support has begun.

The Russell 2000 (IWM) registered an accumulation day, although recent volume has been well below that of the summer. Technicals edge bullish with only a weak MACD trigger 'sell' on the bear side.

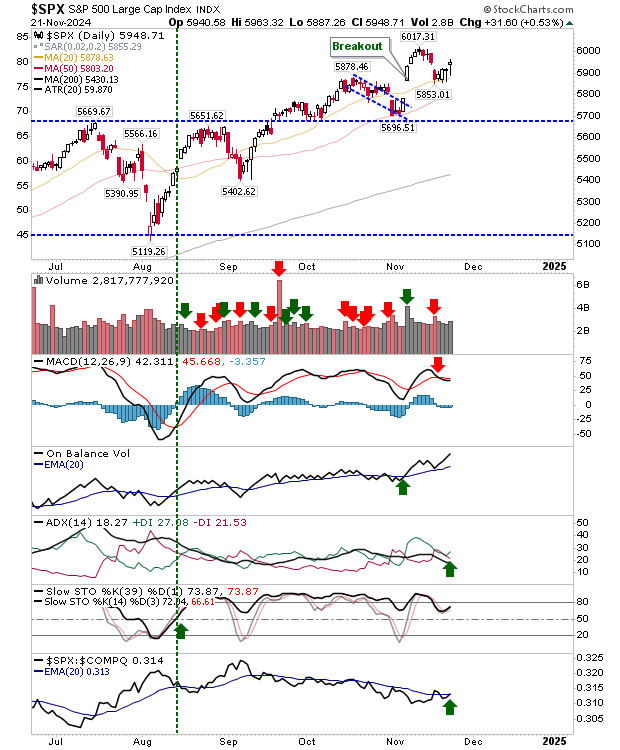

The S&P 500 remains close to its 20-day MA on the back of today's gain. It did enough to close the breakdown gap and in doing so negated the potential bearish island reversal. There was no accumulation, but unlike the Russell 2000, it has a shorter trip back to its highs.

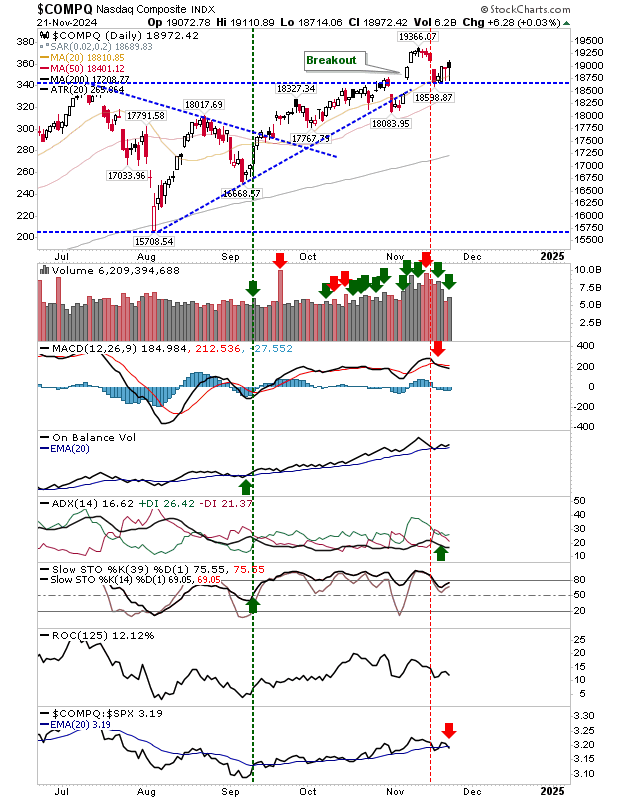

The Nasdaq managed the smallest gain of the lead indices, although it did register an accumulation day. A 'black' candlestick is not the ideal bullish close, so if there is going to be a bearish reaction tomorrow, then this is the index to watch. As with the Russell 2000 and S&P, only its MACD is carrying a 'sell' trigger.

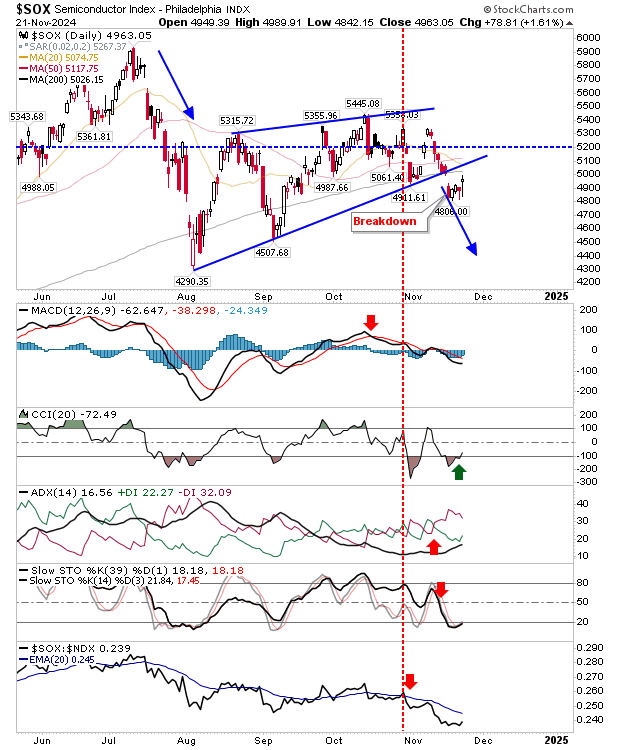

The Semiconductor Index has been playing the bearish side since the summer and today's modest gain has it running close to resistance.

If bears don't take the bait in the Nasdaq, then the Semiconductor Index is the easier downside opportunity.

For tomorrow, if the Russell 2000 ($IWM) is unable to push its advance then focus will switch to a bearish attack the Nasdaq and/or Semiconductor Index.