- AT&T’s sinking stock shows that Wall Street remains hesitant about the company

- However, the new AT&T seems to be a less risky bet than the old directionless behemoth

- The telecom operator is cutting its debt load and focusing on its core business

Investors haven’t yet embraced AT&T's (NYSE:T) new and simpler version. Shares of the U.S.' largest telecom operator remain under significant pressure even after the company concluded the spin-off of its WarnerMedia assets and pay-television business.

These transactions were part of AT&T’s plan to simplify its structure, cut its massive debt pile, and focus on its core strength: wireless and fiber internet.

But despite AT&T’s ballooning dividend yield, Wall Street remains hesitant about the company, which has lost more than 40% of its value during the past five years.

The biggest question going forward is whether the new AT&T will be able to provide consistent payouts to long-term investors, such as retirees, who are looking to buy a reliable, high-yielding stock.

Early this year, the Dallas, Texas-based giant cut its annual dividend nearly in half to $1.11 per share, losing its membership in the S&P 500 Dividend Aristocrats club for companies that have increased dividends for at least 25 consecutive years.

A Good Value Play

Despite the ongoing selloff, early post-spin-off indications suggest that the telecom operator is back on the right track and could prove a good value play in the long run.

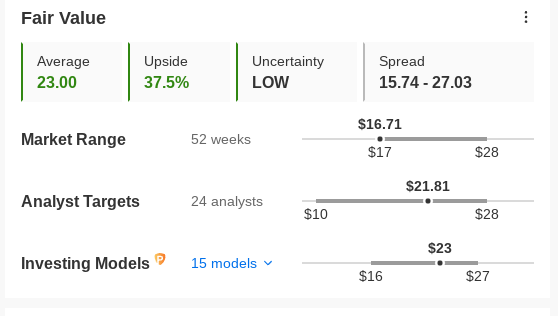

Source: InvestingPro

There are signs that the company is already benefiting from fewer assets competing for resources. Moreover, AT&T used most of the proceeds from the Warner Bros Discovery (NASDAQ:WBD) deal to reduce its net debt by $37 billion in the second quarter to $132 billion.

Another vital consideration to holding AT&T stock in any long-term portfolio is that the company’s core business offers an excellent hedge against spiking inflation. Wireless and internet have long been considered essential services, even for low-income Americans, and discounts on phones are still luring them to sign up with AT&T.

The macroeconomic backdrop of a stronger dollar also befits businesses with solid domestic revenues.

Furthermore, the company added 813,000 regular monthly phone subscribers in the second quarter, exceeding the 554,000 average estimates of analysts. Recent price increases and subscriber gains allowed the company to raise its forecast for full-year wireless service revenue growth to a range of 4.5% to 5%, up from at least 3%.

In a recent note, Goldman Sachs recommended buying value stocks like AT&T due to its higher dividend yield and domestic sales. Its note adds:

“Despite concerns that investors have about the U.S. equity market, we believe it offers greater absolute and risk-adjusted return potential than recession-plagued European markets.”

Bottom Line

AT&T has just finished its massive restructuring, making its corporate structure simple while aiming to unlock long-term value for shareholders. The new company will likely have a growth-focused mentality, centering operations on its core telecom business and trimming its massive debt load.

While it remains early to make a strong bull case for the stock—especially after a decade of underperformance and failed strategies—the new AT&T seems less risky than the old directionless behemoth.

Disclosure: The writer does not own AT&T stock.