Stocks rallied on Friday, despite being down sharply 30 minutes before the opening. A WSJ article noted that the Fed was going to discuss the pace of future rate hikes following another 75 bps rate hike in November.

The story didn’t lay out anything new, and the majority of Governors I have heard favor a front-loading approach still. It means that I think unless inflation comes crashing down over the next two months, it seems likely that we will get a 75 bps hike in November and December.

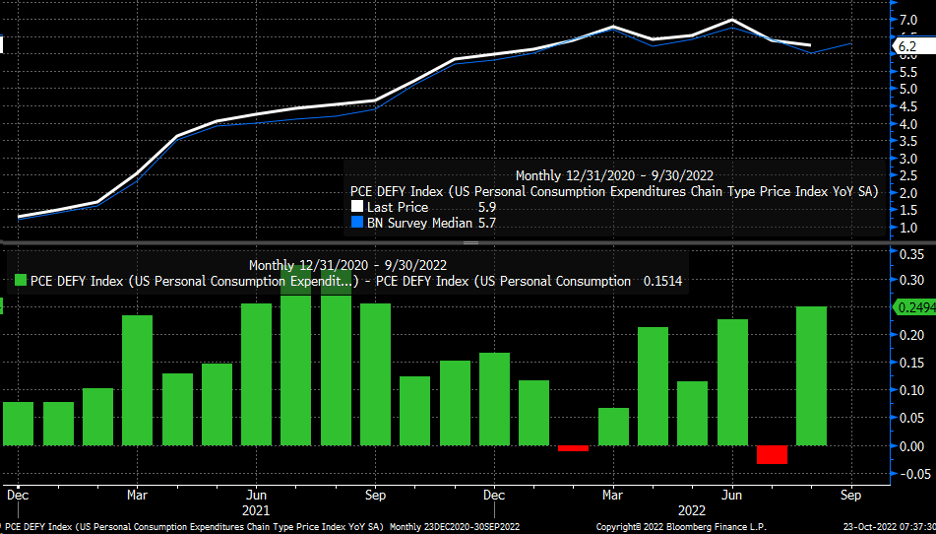

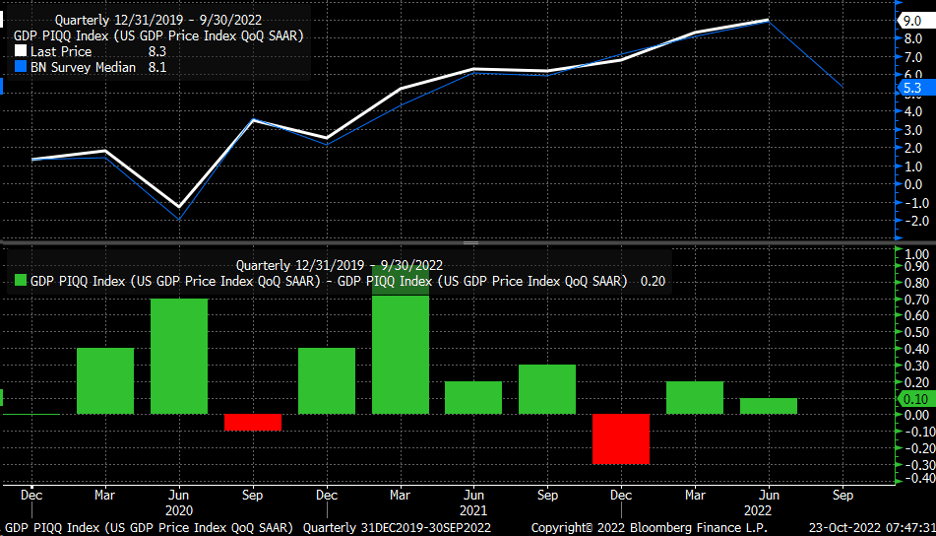

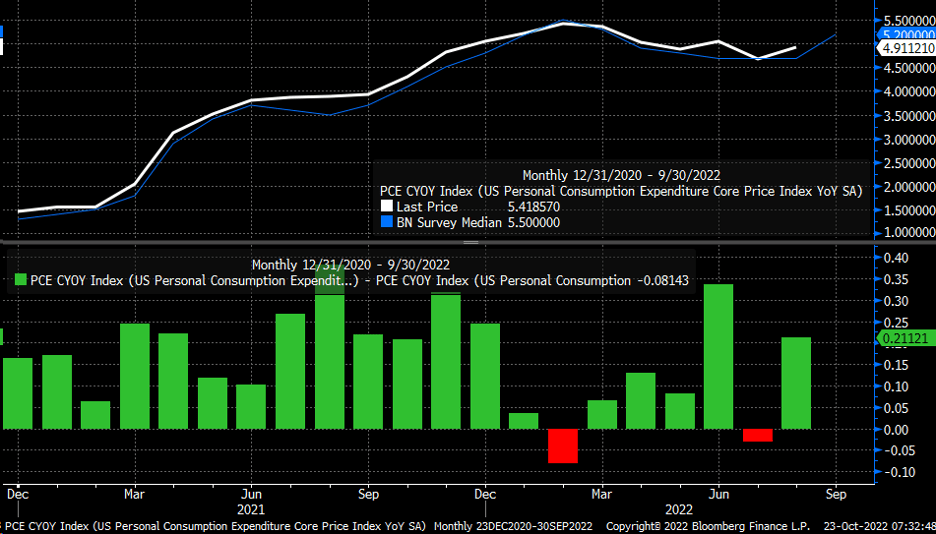

This week we will get a couple of crucial inflation metrics, with PCE, Core PCE, the GDP Price index, and the employment cost index. Core PCE year-on-year is expected to rise to 5.2% in September, up from 4.9% in August. Also, the Core PCE reading has beaten estimates in 19 of the last 21 months.

These will all be essential data, especially in the Fed’s next meeting on November 2.

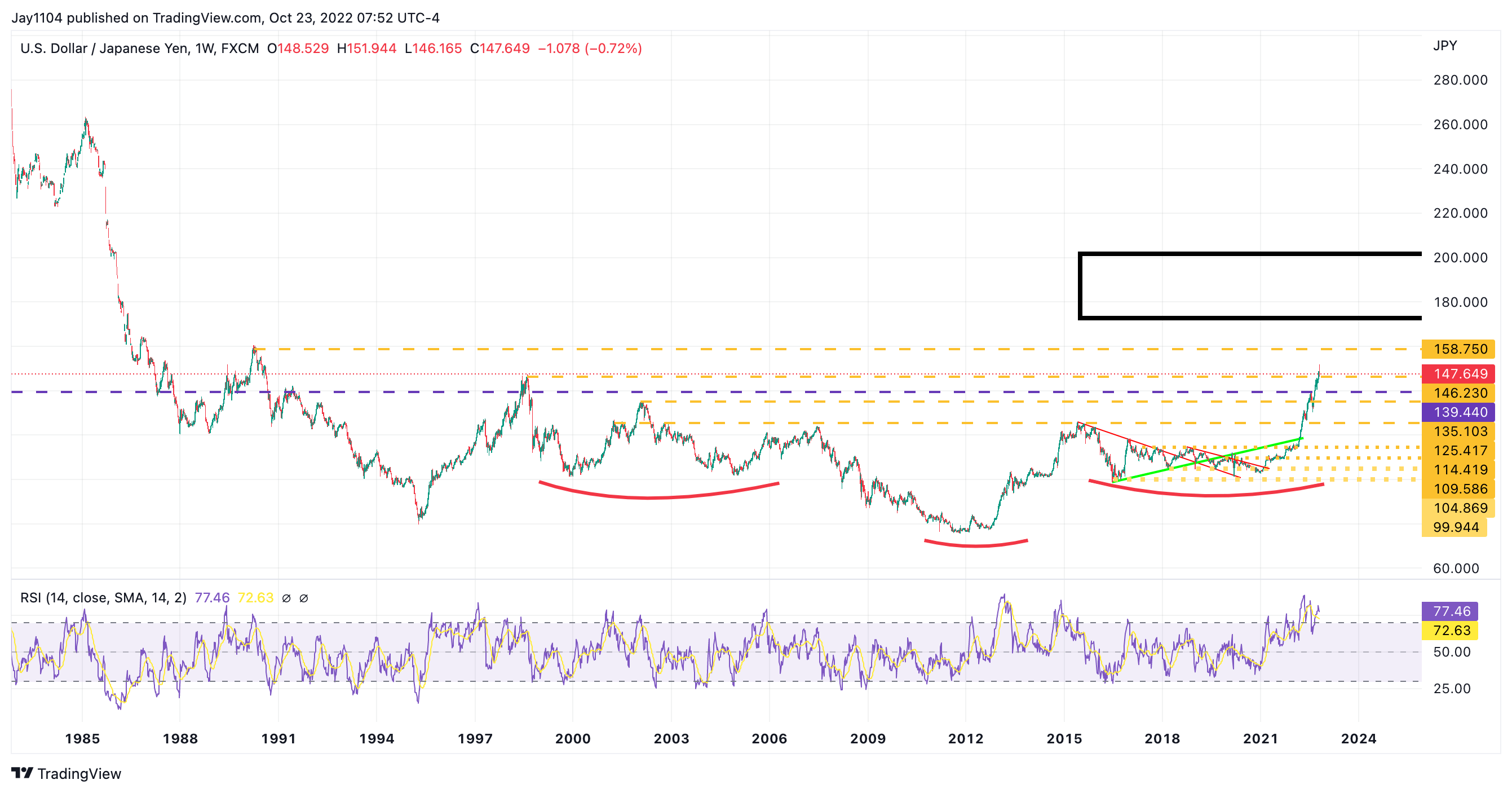

Yen

Additionally, on Friday, the big news was that Japan intervened in the FX market to defend the yen vs. the dollar. I’m not sure it changes anything. The last time Japan intervened in September, it did nothing other than slow things down.

The yen fell back to support at around 146 to the dollar and is probably still on its way to 158.75.

S&P 500

S&P 500

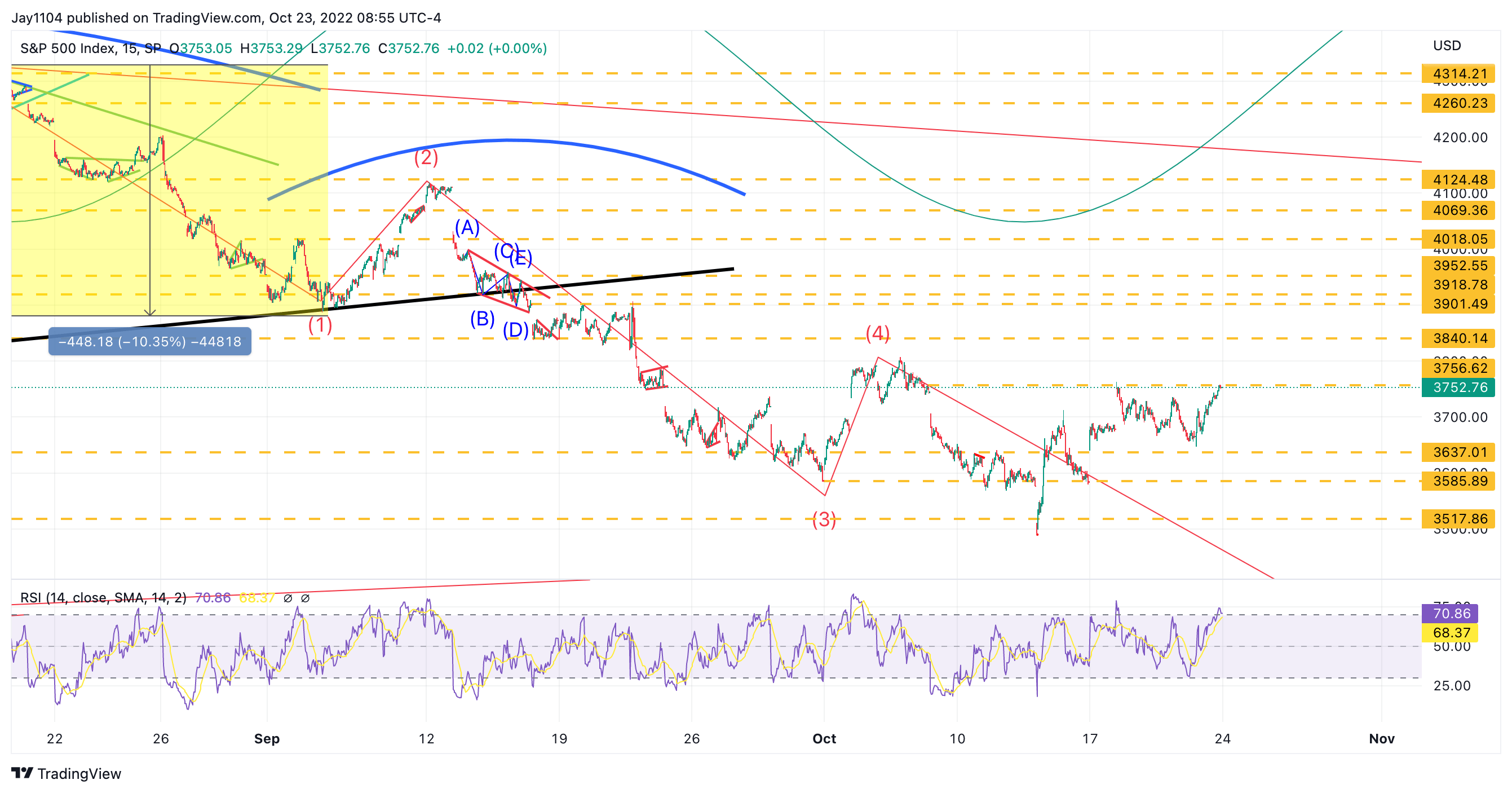

However, on Friday it helped send the dollar index down and killed the idea I had run with the night before for a drop to around 3,600 on the S&P 500. The S&P 500 futures were trading down to about 3,640 at 9 AM, with rates racing higher and the dollar up sharply; the day was well positioned for a drop to 3,600. But as fate would have it, the market gods pulled the rug on me.

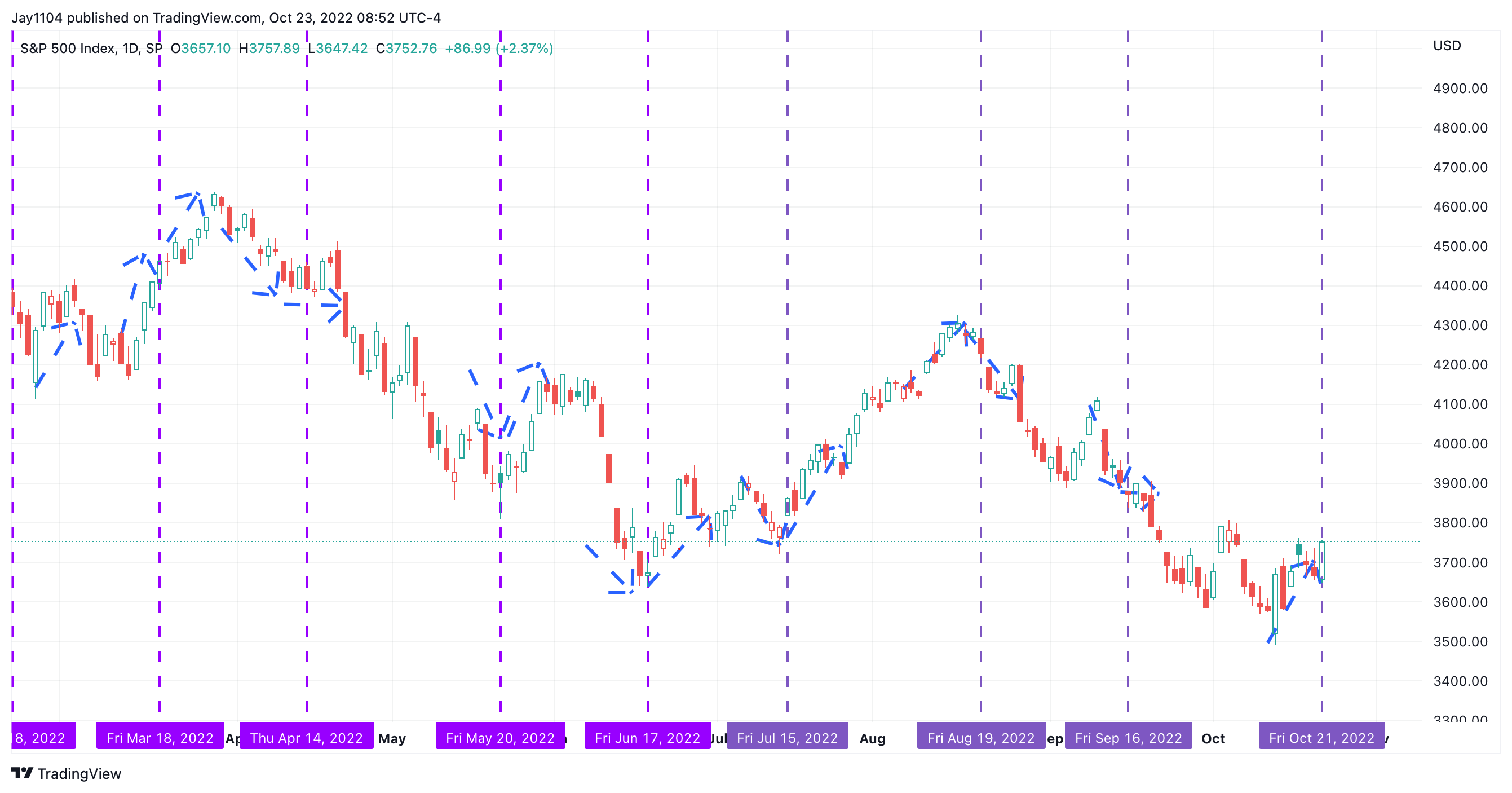

But the futures failed to push beyond the October 18 high, stopping short, and the straight-line rally higher seems unstable at best. And with options expiration now behind us, plenty of puts came off the board, and traders may look to create new put positions heading into the economic data this week and the Fed meeting next week. Additionally, it is not unusual to see a counter-trend move coming out of OPEX.

Every month, except for March, saw either a sideway consolidation or a reversal post-OPEX from the prior trend. For example, going into July, OPEX stocks fell and then reversed higher following OPEX. Into August, OPEX stocks had been rising and then declined after OPEX. In September, stocks fell into OPEX and moved sideways for a few days. Into October OPEX, stocks were rising, which would suggest either a reversal lower or a sideways consolidation.

Growth Vs. Value

Growth Vs. Value

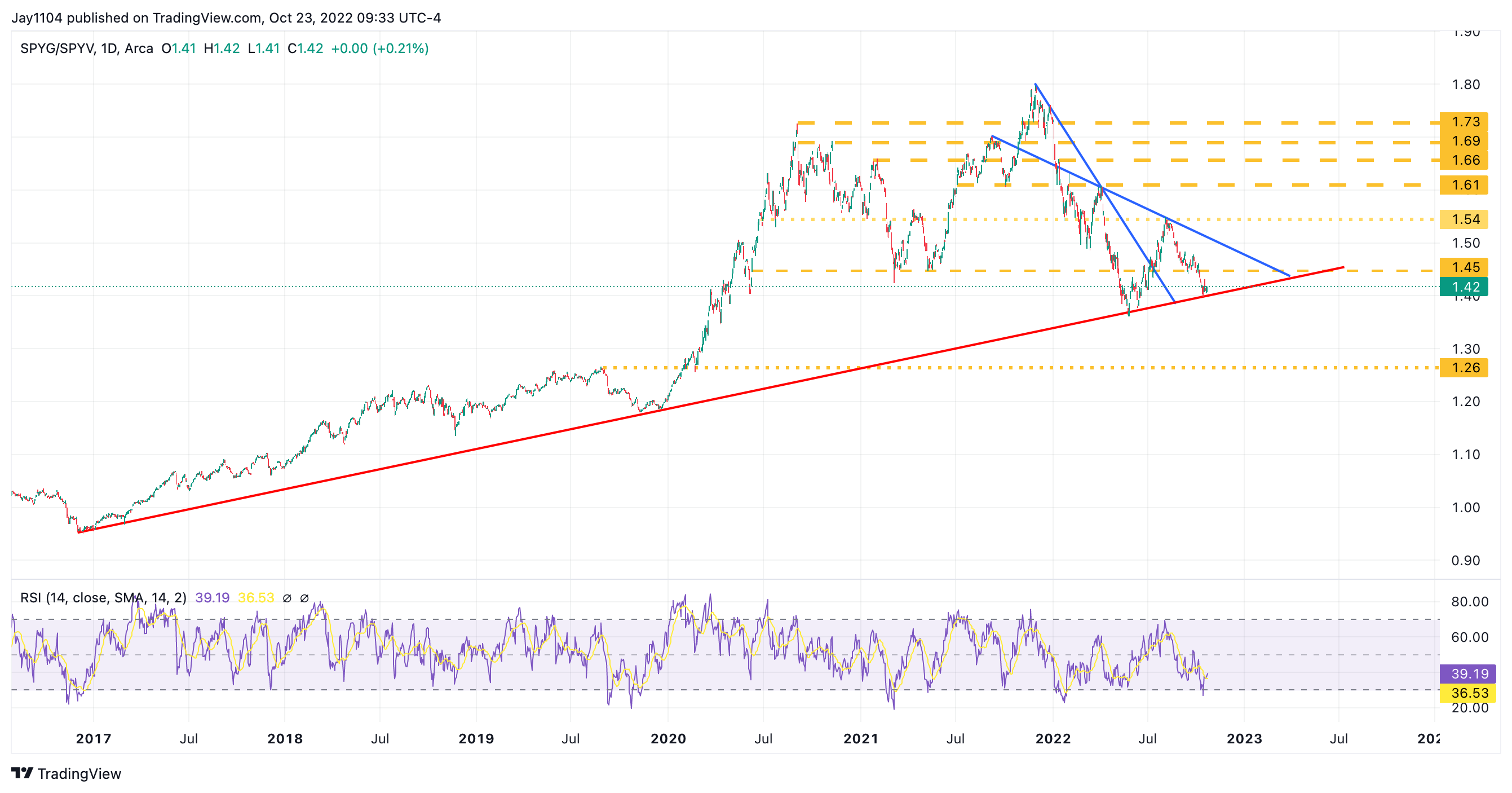

Going in a different direction, I noticed a few things this week that I follow and check in on from time to time. Most interesting to me was the ratio of the SPYG to SPYV. Growth stocks could be at a point to significantly underperform value stocks, as this ratio comes to a historically significant trend line. A break of that trendline would be terrible for the direction of growth stocks.

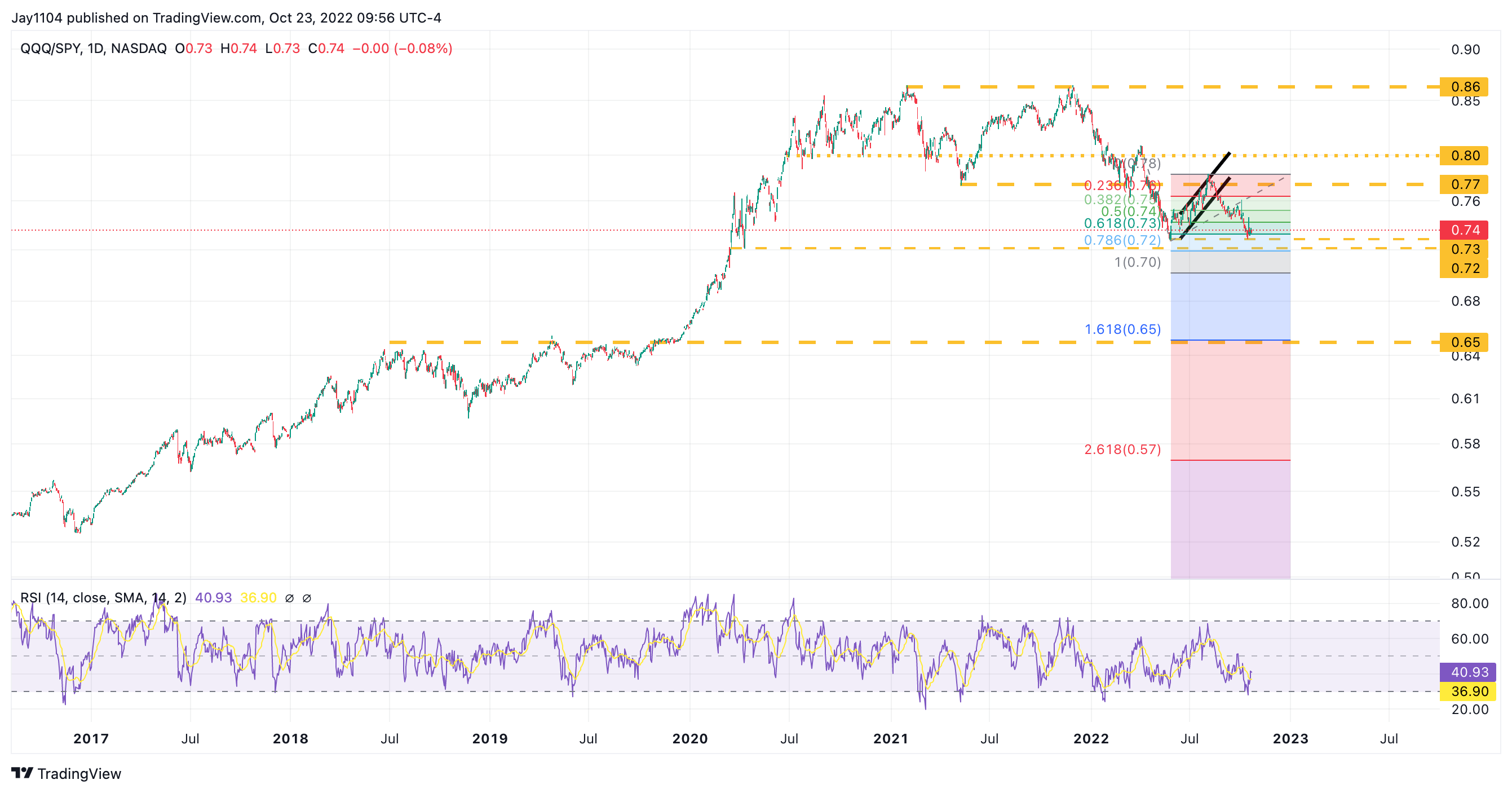

QQQ to SPY

The QQQ to SPY ratio has fallen sharply and is also at a critical point. Interestingly, a 1.618% extension of this latest bear flag would line up with the ratio where it stood before the pandemic. That would suggest the QQQ has a lot of underperformance ahead of itself versus the SPY.

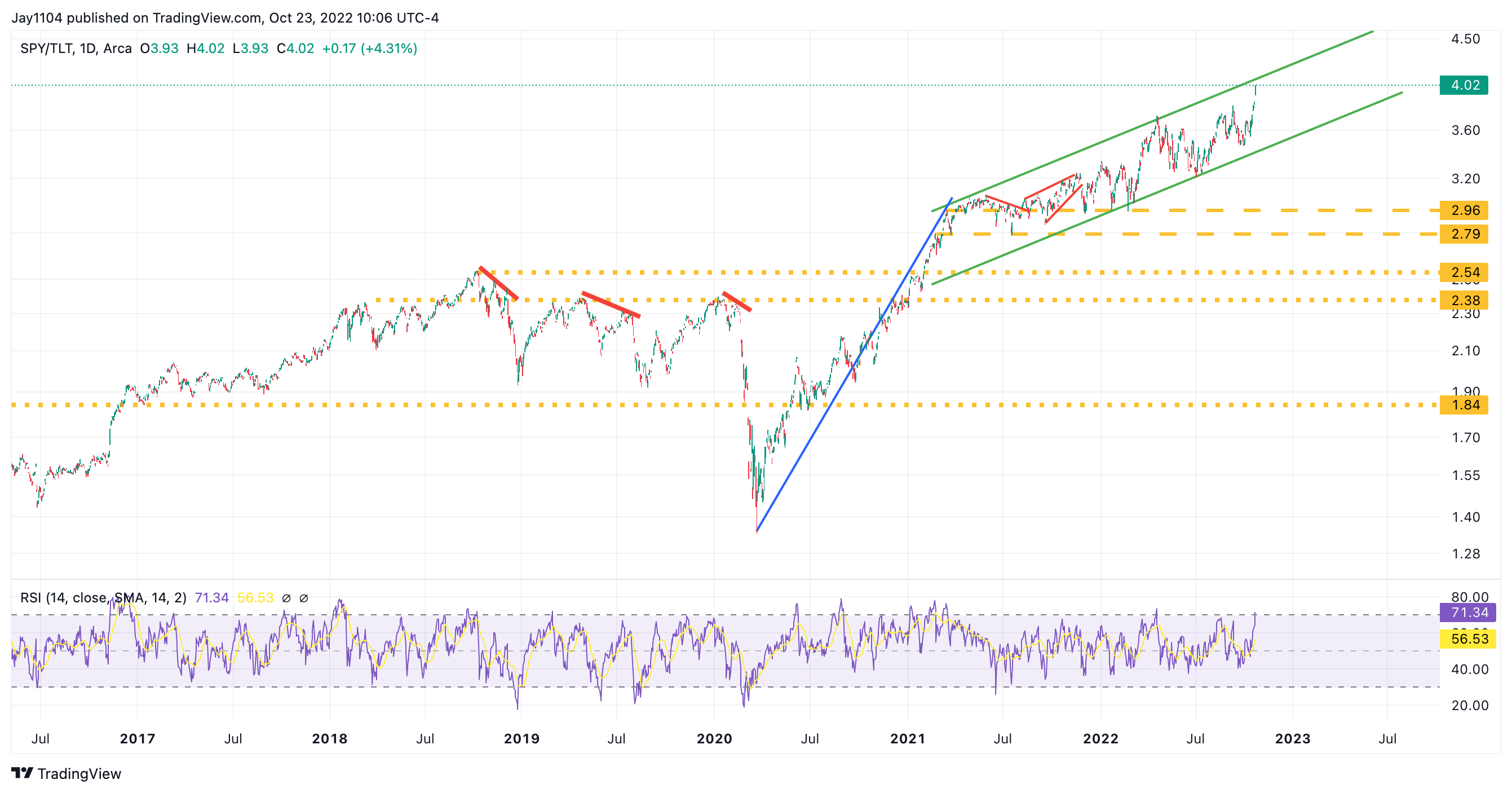

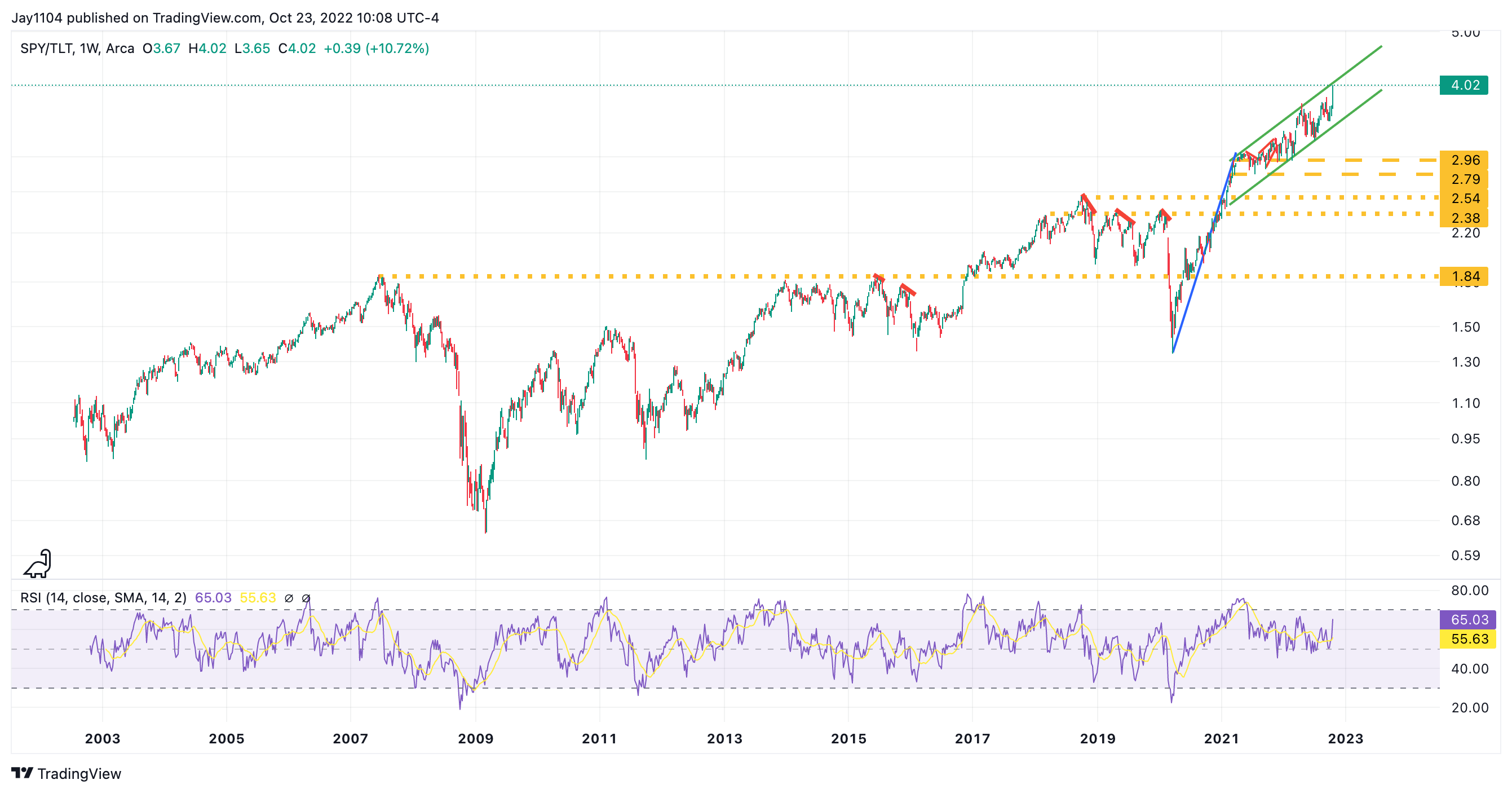

TLT to SPY

Finally, this last chart shows the TLT to SPY ratio at a record high. It would suggest that the SPY is overvalued to the TLT and that the SPY would need to drop for the ratio to fall. For the ratio to fall back to its pre-pandemic levels of 2.4, the SPY would need to drop to $223, assuming the TLT remains unchanged. That would be a massive decline which suggests that perhaps, the SPY needs to fall and the TLT needs to rise. But considering how much the TLT has moved relative to the SPY, it seems that the SPY has some catching down to do. Even to get back to the March 2021 level of 2.96, the SPY needs to fall to around $275.