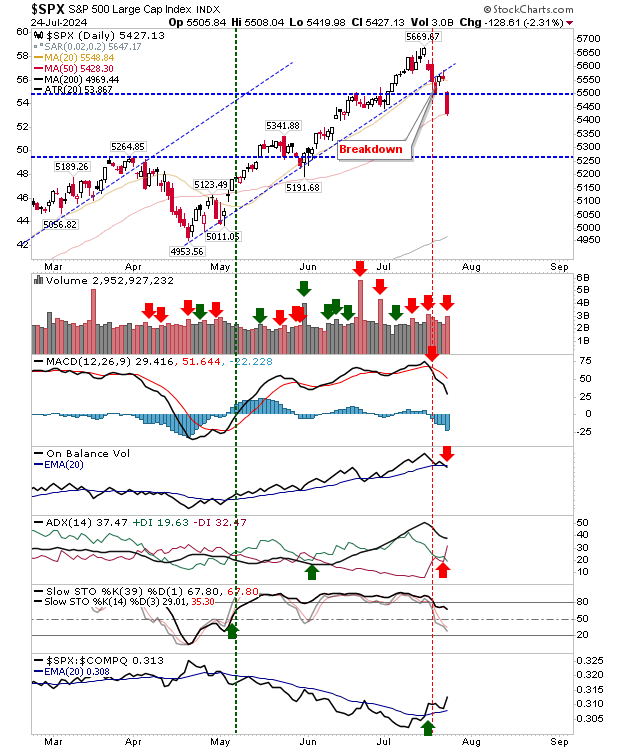

Not surprisingly, the Nasdaq and S&P 500 took a big hit yesterday. Monday's weak bounce tapered quickly with the S&P 500 contained by former support, turned resistance.

The index finished the day on its 50-day MA, but if there is to be a bullish stand then I would like to see a spike low with an end-of-day finish back at the 50-day MA.

For today, if there is an intraday move to test the May swing high of 5,342, then it might be a good aggressive buy.

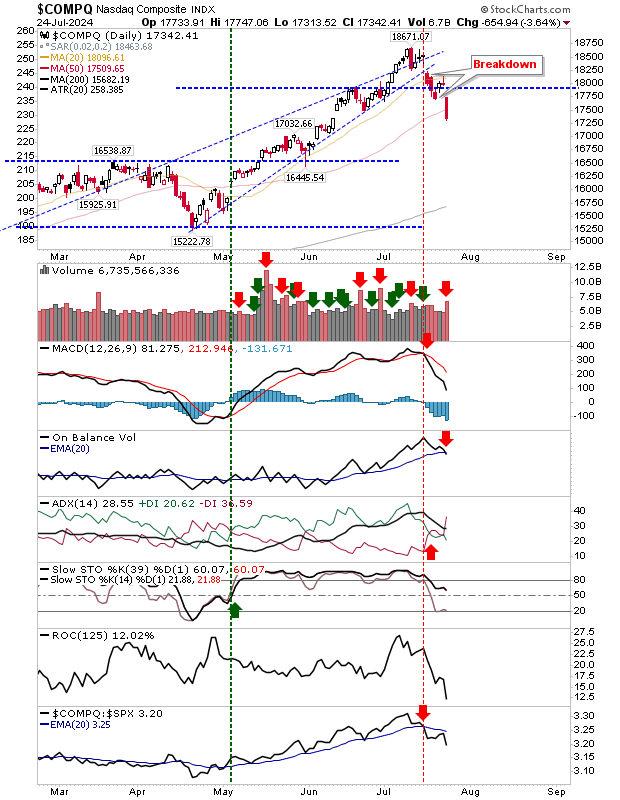

The Nasdaq cleanly sliced through its 50-day MA, weakening the thesis for a successful 50-day MA support test in the S&P 500, but let's see there.

There was a new 'sell' trigger in On-Balance-Volume to go with the earlier 'sell' trigger in ADX and MACD. Intermediate stochastics are not on a 'sell', and if we see a price recovery on a test of the 50-midline of said stochastics, then the bullish thesis remains intact, despite how ugly the chart looks now.

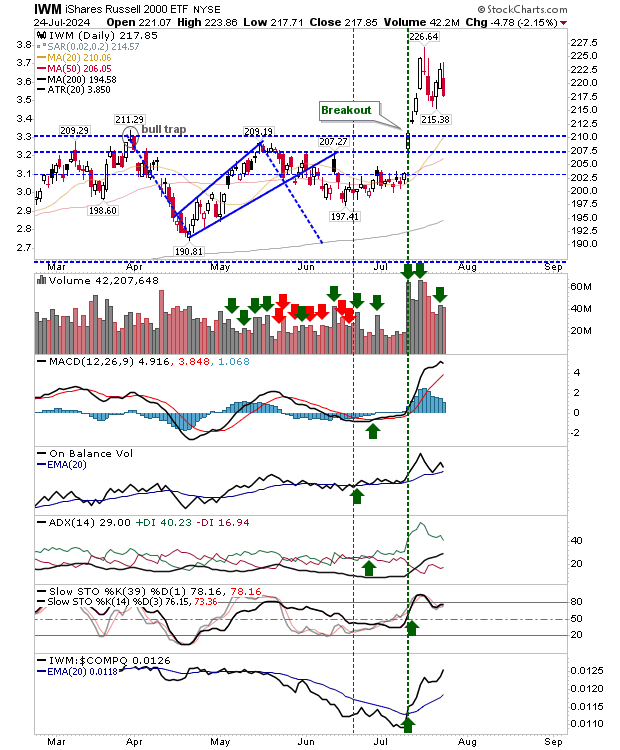

The Russell 2000 (IWM) is caught between its surge and broader weakness in the Nasdaq and S&P 500.

The 20-day MA is fast advancing and is near $210 support. I would be happier to see a test of the 20-day MA, and yesterday's action suggests it will get there. Technicals are net bullish.

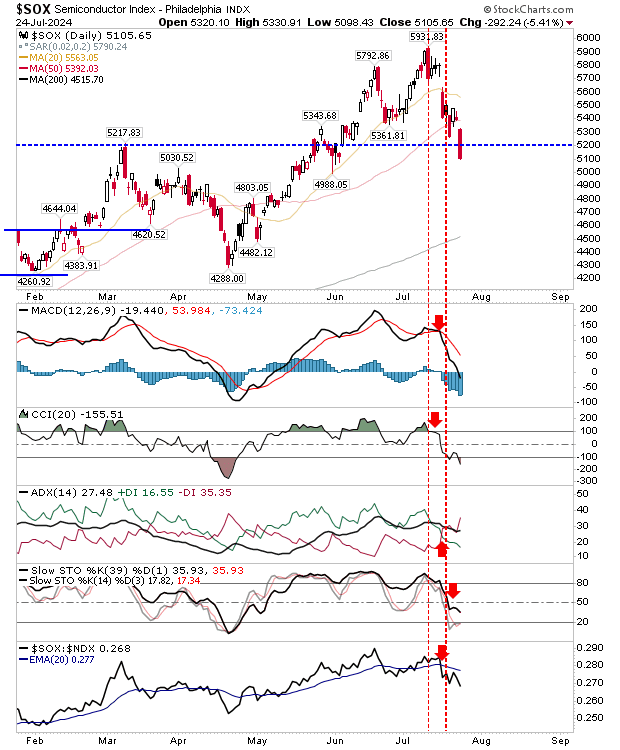

It was a difficult day for the Semiconductor Index as it shed nearly 6%, losing not just 50-day MA support, but also breakout support of 5,200. Technicals are net bearish, but not oversold on intermediate-term stochastics.

Yesterday's selling suggests there is another day's worth in the tank, but watch premarket for leads. If the market opens higher, then look for a bullish harami, or better still, a bullish harami cross.

This is one of the most consistent reversal patterns and should be watched closely in the Semiconductor, Nasdaq, and S&P 500 indexes.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI