U.S. CPI, Micron’s earnings, Bank of England policy meeting- what’s moving markets

Stocks finished higher yesterday, with the S&P 500 gaining around 1%. It felt like a day of implied volatility crush, amplified by a negative gamma regime. There didn’t seem to be a better way to describe it.

The VIX fell below 20, which helped to boost the S&P 500. However, this may not last, as we have the Presidential debate today, followed by the CPI release on Wednesday.

Implied volatility could rise ahead of the CPI report, although I believe the report has lost some significance, given the Fed’s focus on the labor market.

Amid concerns over the U.S. economy's health and uncertainty surrounding the Fed's upcoming interest rate decision on September 18, investors appeared to start Monday with a more optimistic outlook.

But at the time of writing, index futures have edged lower slightly. Today, there are 2 key levels of resistance that S&P 500 bulls need to cross to sustain the rebound.

1. 5,500 Level

At least for today, we’ll need to keep an eye on the 5,500 region, as it’s the big gamma level and likely to provide the most resistance for the index.

2. Zero Gamma Level at 5,520

Breaking above that might open a path to around 5,520, which is where the zero gamma level is. However, it will be challenging for the S&P 500 to break out beyond that level of 5,520 before the data releases starting on Wednesday.

Oracle Reports in Line With Expectations

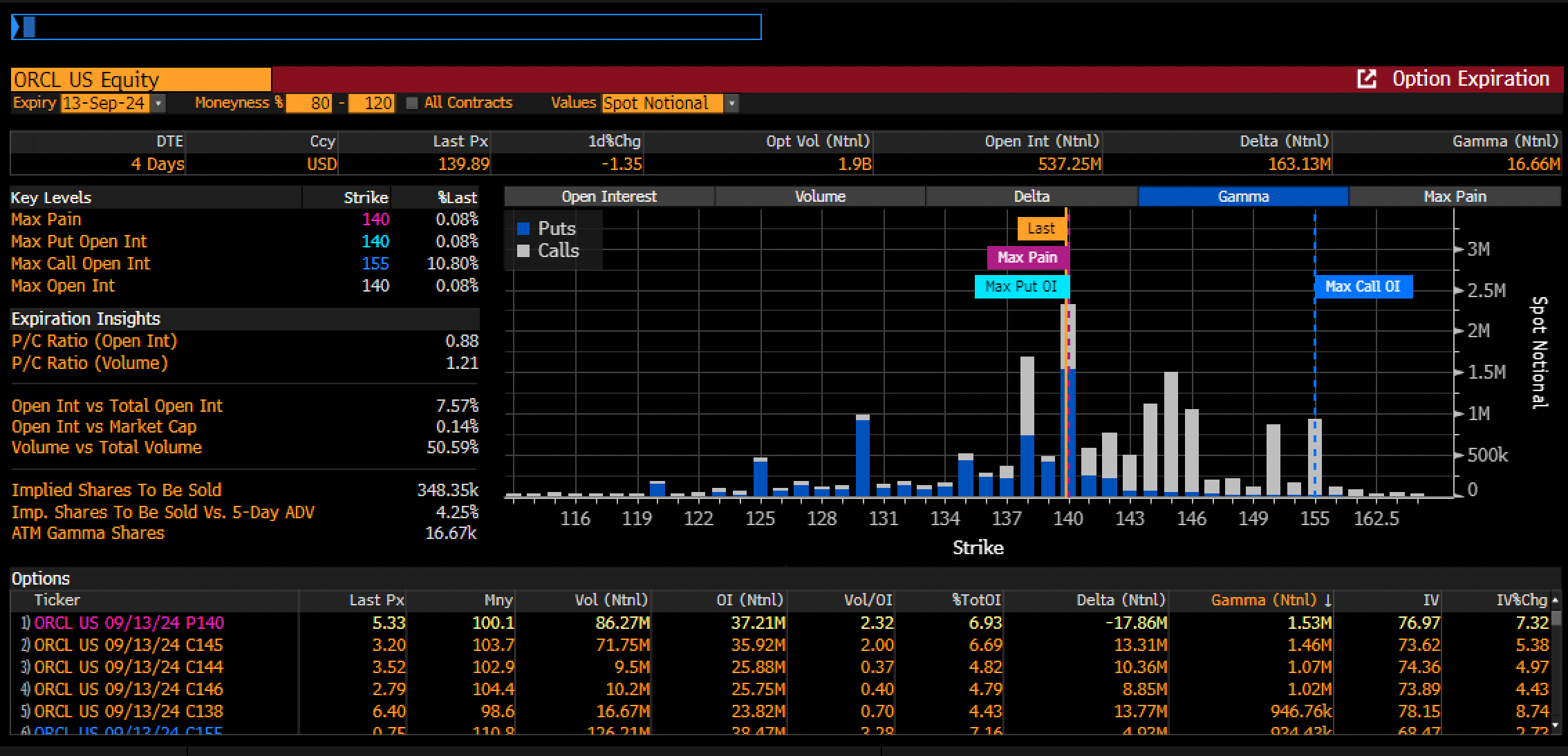

Oracle (NYSE:ORCL) reported results that were essentially in line with expectations, and guidance was pretty much anticipated based on what I could gather.

Despite these inline numbers, the stock is trading higher. The options positioning was moderately bullish last week, resembling setups seen with Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO).

Since Oracle typically reports and guides in line with expectations, the options suggested that the shares might decline after the results, as implied volatility (IV) dropped.

However, we’ll have to wait and see how the stock performs during regular trading hours today because the stock is currently trading at around $150.

Meanwhile, Wingstop (NASDAQ:WING), which has been a good proxy for us in the past, appears to be nearing the neckline of a head-and-shoulders pattern.

So, this stock continues to be a good “tell” on what may come next for the equity market.

A break of the neckline around that $350 would not be good and would probably suggest the carry trade is unwinding further, considering the relationship the stock has had with the USD/JPY.