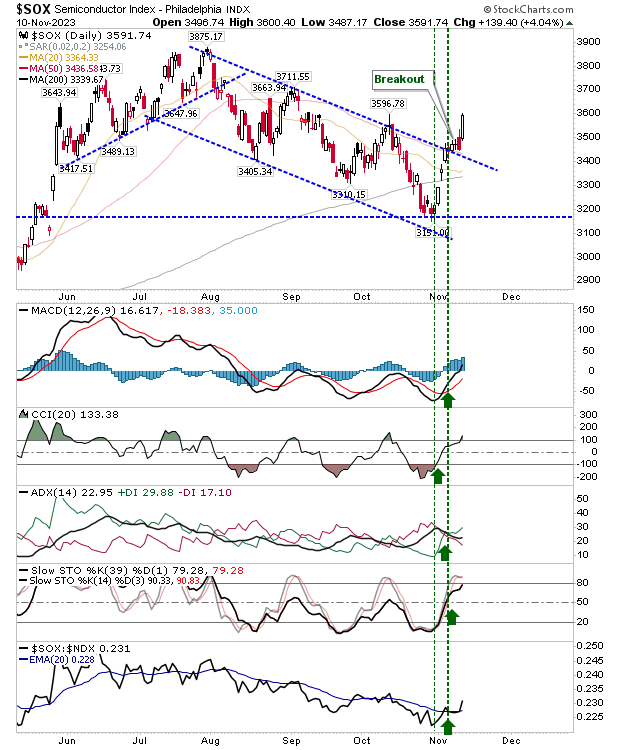

A solid Friday sealed a good week for Semiconductors. After a four-month decline, there was a clear breakout that took out the October swing high. Strength in the Semiconductors has, and will likely, continue to feed into the Nasdaq and S&P 500.

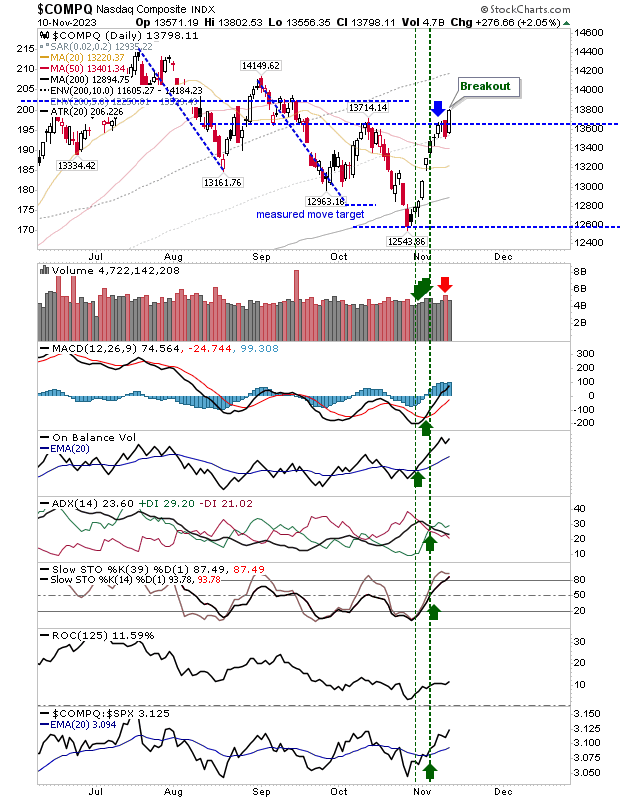

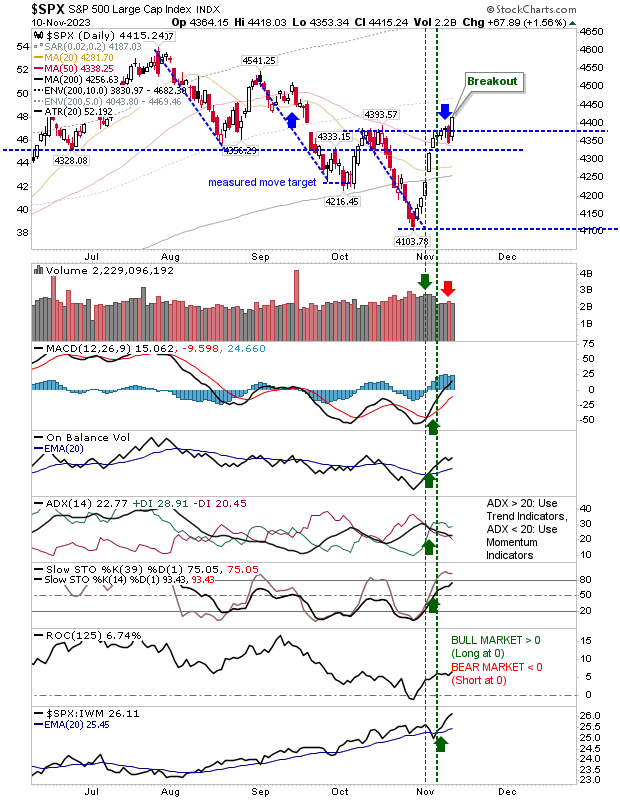

Strength in the Semiconductors led to key breakouts for both the Nasdaq and S&P 500, negating what had been picture-perfect short trades for these indices at resistance. It will be interesting to see if there is any upside follow-through off the back of this reversal driven by short covering.

Technicals are net positive for both the Nasdaq and S&P 500.

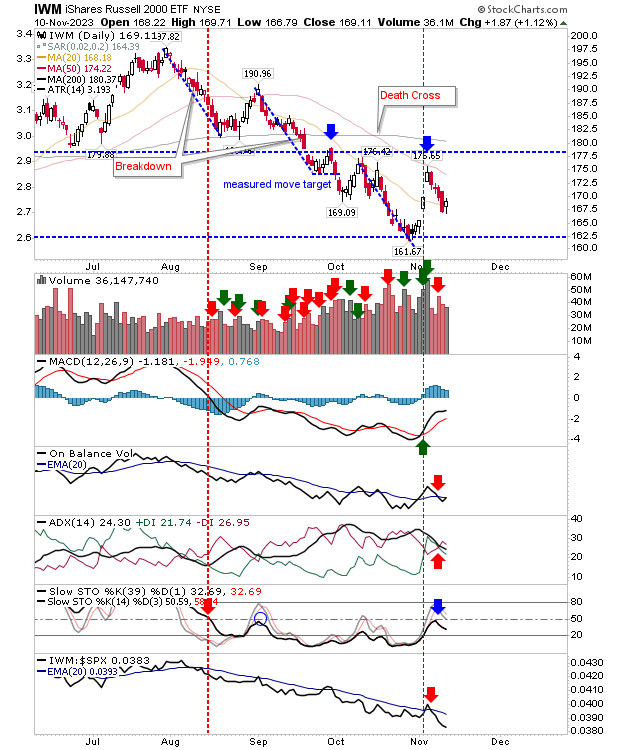

The Russell 2000 (IWM) closed with a bullish harami, a solid reversal pattern; a short-term 'buy' with a stop below Friday's low offers itself as a short-term trade. Technicals remain mixed with stochastaics particularly favoring the bearish side of the story. It will take a number of days of buying to reverse this bearish momentum.

For the coming week, we have the Nasdaq and S&P in the process of building a right-hand side of a base kicked off from the July swing high. It's an easier path for these indices than the Russell 2000. The latter index needs a solid advance to take it back to the 50-day MA at a minimum, and really, should take out the 200-day MA too.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.