There really wasn't much wiggle room for markets without delivering breakouts for the Nasdaq and S&P 500, but yet, markers managed to find them.

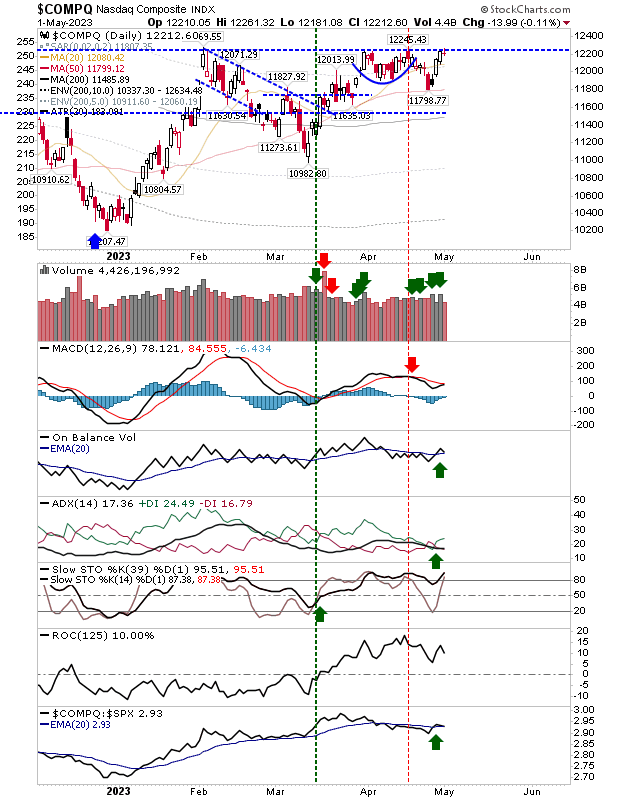

The Nasdaq delivered a narrow day at resistance, but still no breakout. There was no change in the technical picture, but the index is very close to a new 'buy' signal in the MACD.

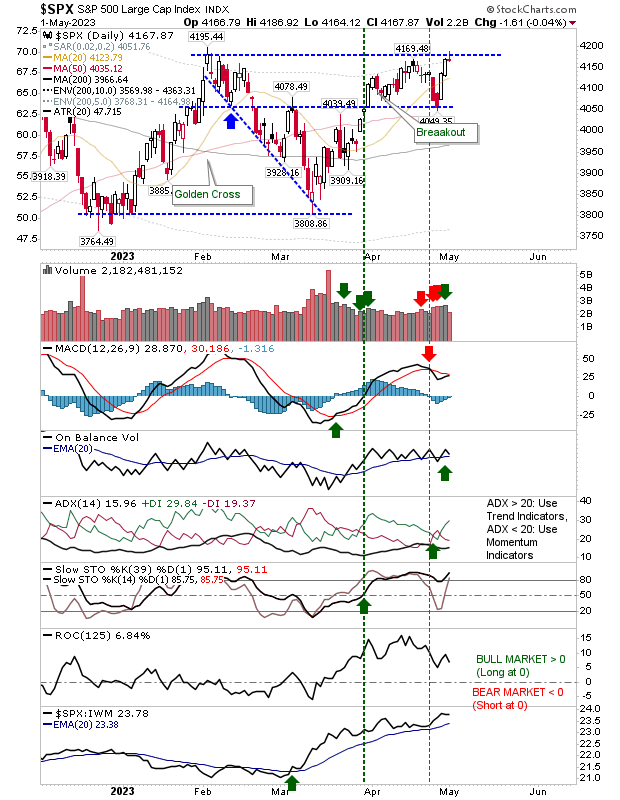

The S&P 500 experienced a similar narrow day to the Nasdaq and has a similar technical picture. Because the day finished with a small doji, which marks an indecisive day, the likelihood of a down day is increased.

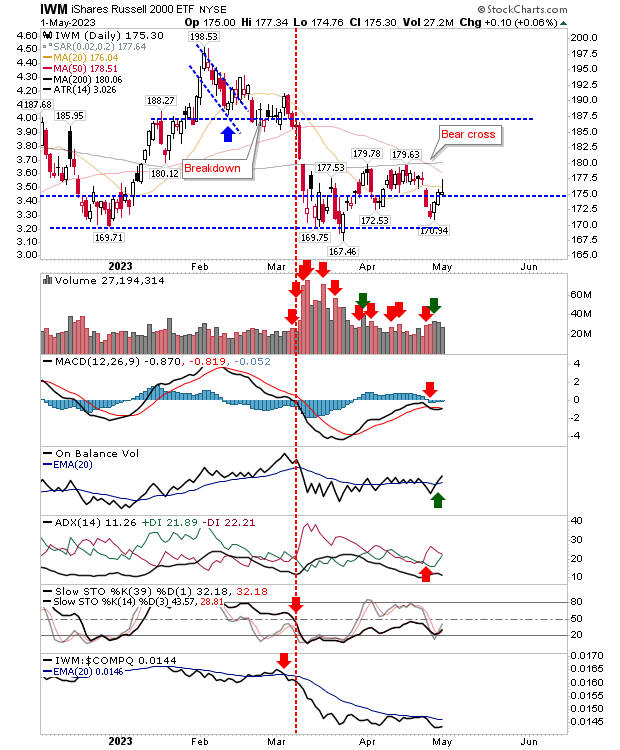

The Russell 2000 (IWM) had a wider range day but finished with an inverse 'hammer.' Technicals are not as bullish as the S&P 500 and Nasdaq, but there was no change in these despite the potential for a reversal.

Because today's action remained within the bounds of support and resistance defined by March-April's trading, it weakens the potential for today's candlestick to play as a reversal, but don't get caught by hindsight.

Going forward, we still have the opportunity of a breakout, and today's action has done everything but breakout. There is still plenty of time for this to happen, but the Russell 2000 will need to improve sharply should the S&P 500 and Nasdaq break out.