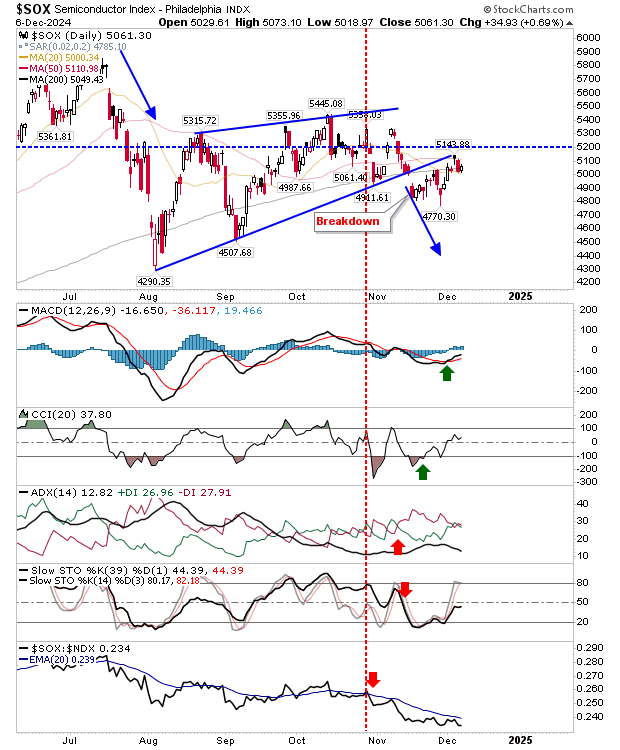

This could be viewed as the glass half full after the Nasdaq gained over 3% on Friday, but the Semiconductor Index is doing its best not to participate in the festive goodwill.

Technicals edge on the bearish side with momentum (Stochastics 39,1) struggling to make it over the mid-line. Converged moving averages, along with wedge resistance, remain in play as upside blockers.

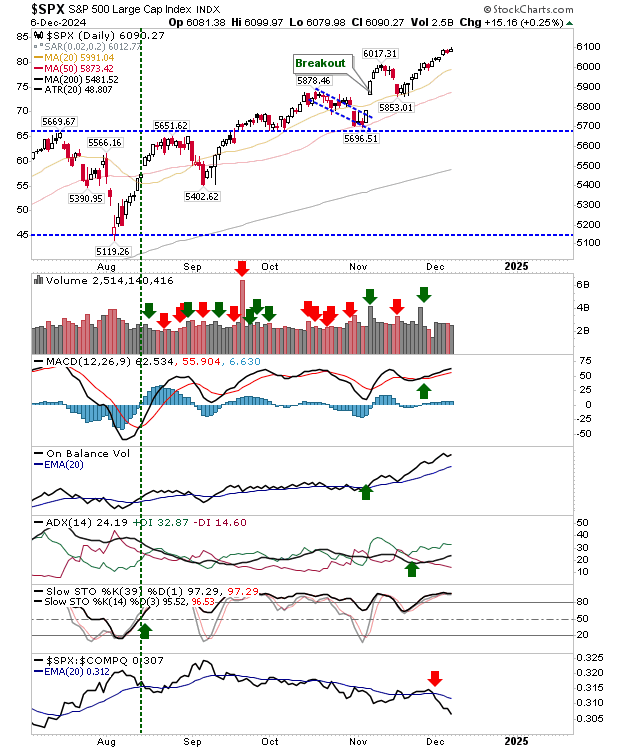

The Nasdaq had one of its best days in a long time, gaining 3.3% on higher volume accumulation. Technicals are positive, and while the Semiconductor Index underperforms, the Nasdaq surges.

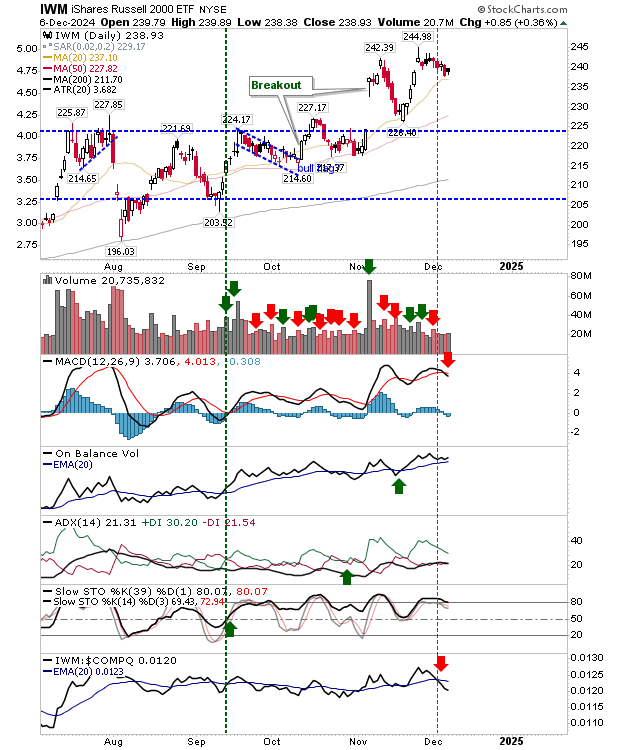

The Russell 2000 has been drifting lower without any concerted selling to get it there. There is a 'sell' signal in the MACD, but other technicals are net bullish. The 20-day MA might offer a catalyst for a bounce but an undercut looks more likely.

The S&P 500 has been moving steadily higher without any fuss. The best aspect has been the accelerated gain in On-Balance-Volume since the October swing low that coincided with the successful breakout support test.

Any change above 1% is going to look more dramatic than it actually is given the tight action in November.

For the coming week, bears will be watching the Semiconductor Index. Bulls can look to the Russell 2000 (IWM). However, the Santa Rally is still a couple of weeks away, so it's hard to see sellers having much influence until the New Year.