While indices are pushing towards new all-time highs there's a case where a larger decline could emerge despite recent benign losses. The first thing to look at is breadth metrics.

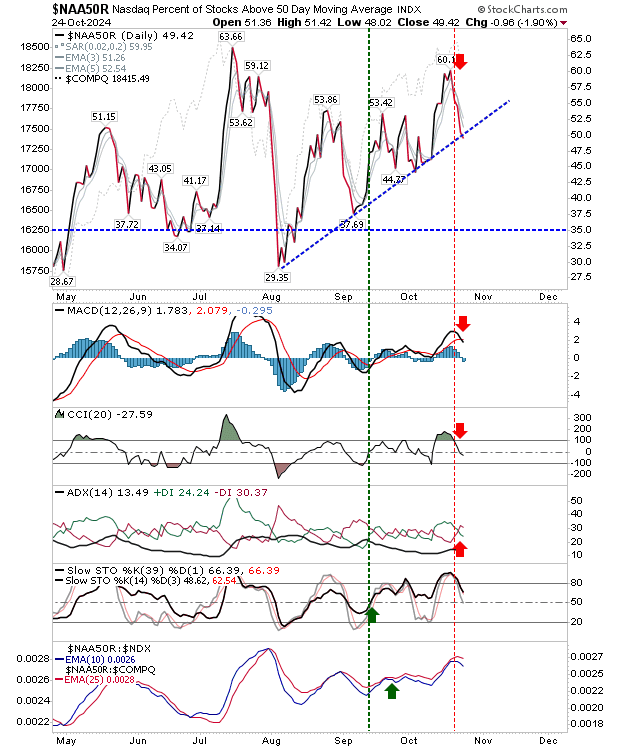

In the case of the Percentage of Nasdaq Stocks Above the 50-day MA ($NAA50R) has moved back to trendline support, but supporting technicals show 'sell' triggers in the MACD, CCI, and +DI/-DI. Further losses where would trigger a breakdown.

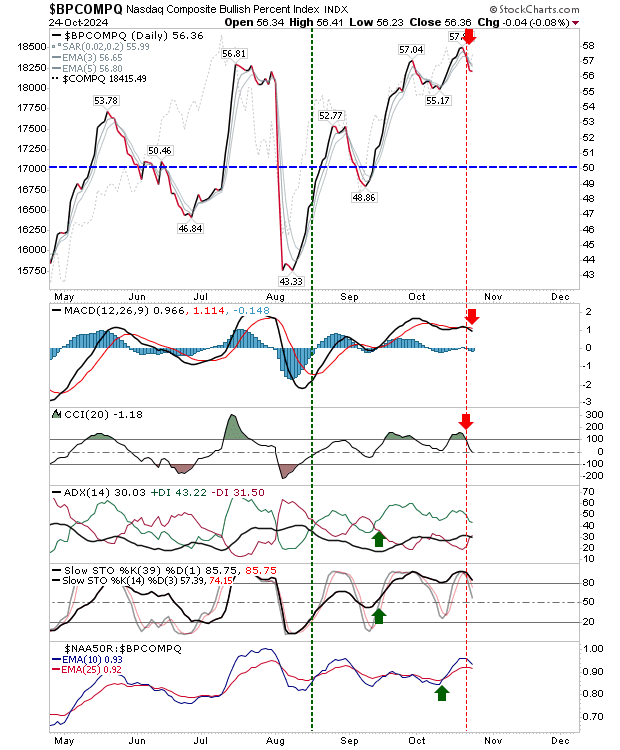

The Nasdaq Bullish Percents ($BPCOMPQ) peaked at 58% and then reversed with 'sell' triggers in the MACD and CCI. The July high was marked by a similar peak so we need to be prepared for a repeat.

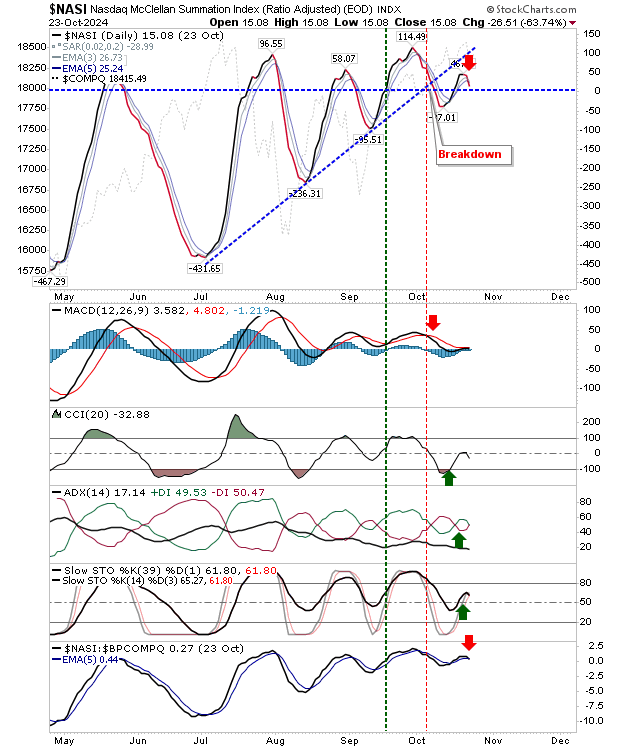

The Nasdaq Summation Index ($NASI) has already shifted on a trend break with the MACD about to drift below the bullish mid-line.

The CCI is also struggling at its midline with the relationship between the Summation Index and Bullish Percents on a 'sell' trigger.

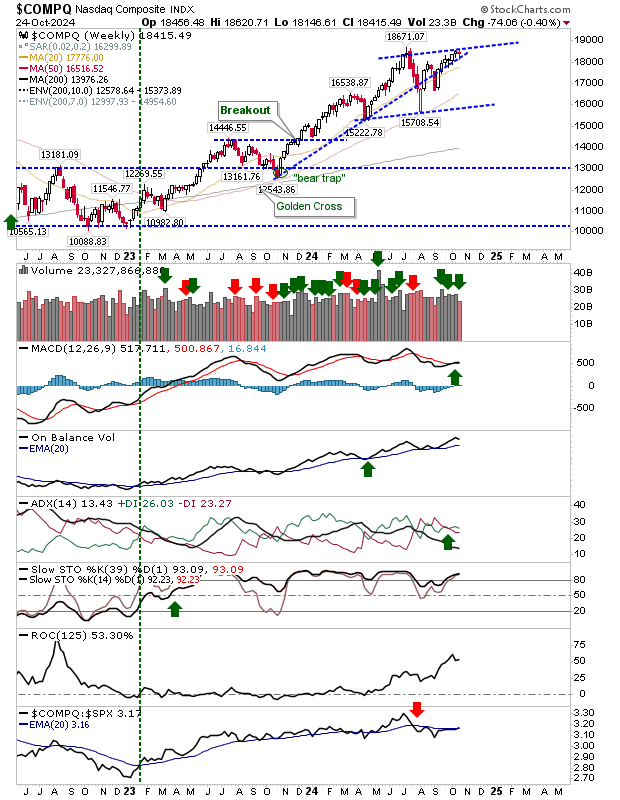

The weekly chart for the Nasdaq has reached a convergence of support and resistance, and while the week is not yet done, there is a decision point coming that will set the tone for the remainder of the year.

Technicals remain bullish. Stochastics in particular don't suggest any large decline is in the offing, but something similar to the summer of 2023 is a possibility.

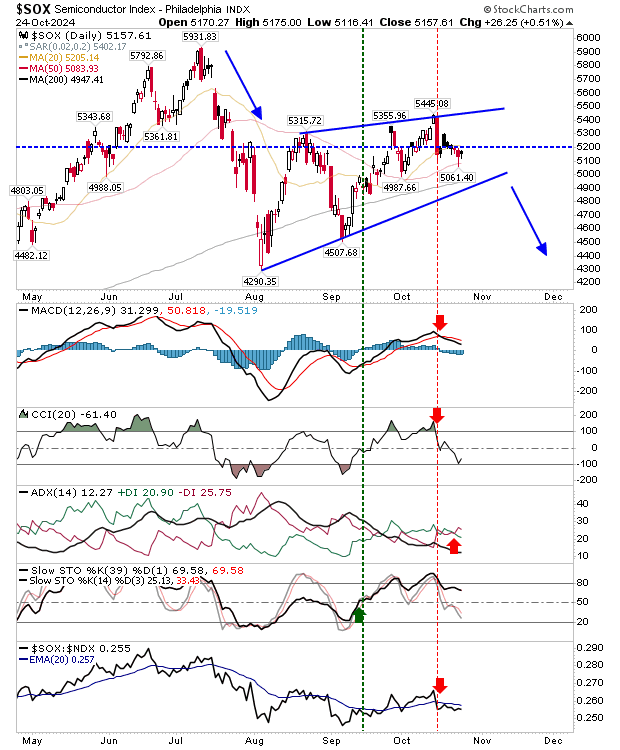

Another market indicator to watch is the Semiconductor Index ($SOX). Recent action points to a convergence similar to a rising bearish wedge. Support for this wedge is running close to its 200-day MA, another reason to be watchful.

The MACD, CCI and +DI/-DI are all bearish. If this breaks lower I would expect this economic bellwether index to have knock-on effects for the Nasdaq and S&P 500.

Watch how the Nasdaq and supporting metrics play out over the coming weeks. I'm not expecting any major losses, but we may have to wait a little longer before the Nasdaq (and Russell 2000) join the S&P at new highs.