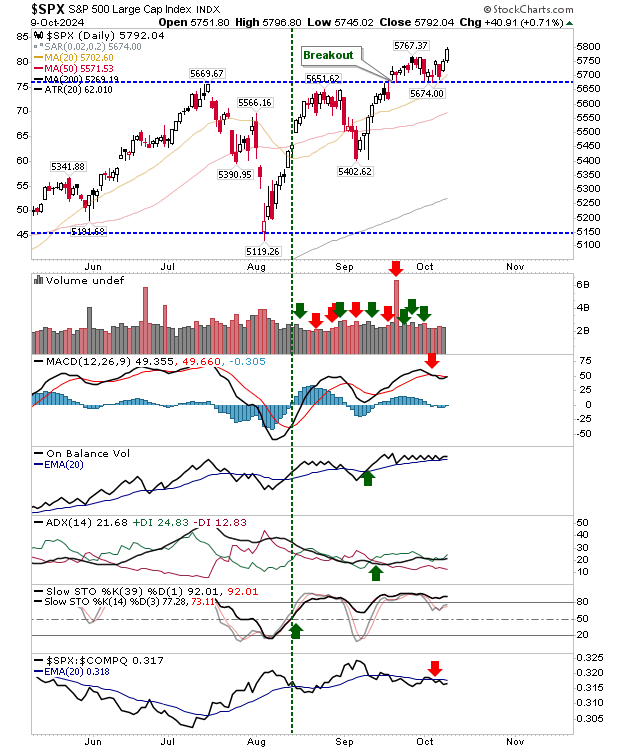

It was a day when bulls reasserted their control and delivered a solid day of gains after yesterday's recovery. It was particularly satisfying to see this in the S&P 500 as it successfully defended breakout support.

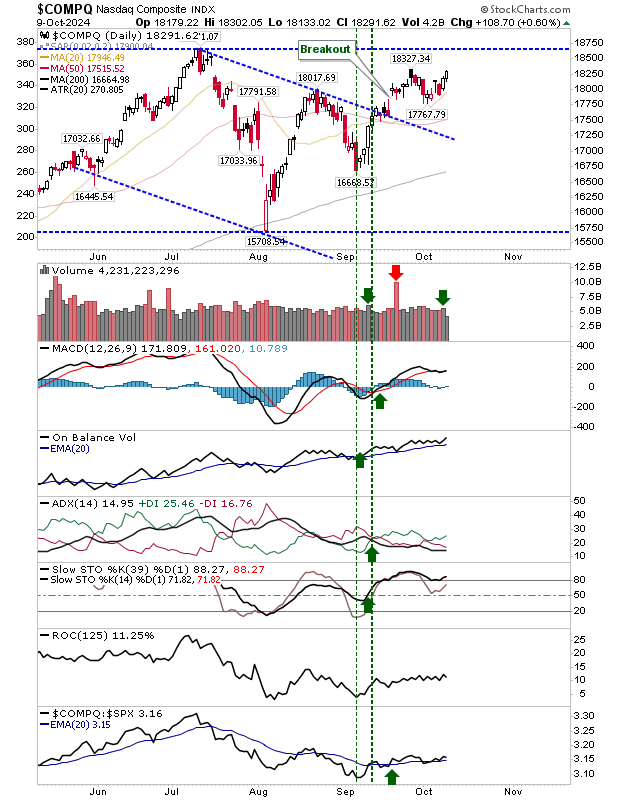

As for the Nasdaq, it is emerging from a small consolidation on bullish net technicals. Given the index is trading below its 52-week high this improvement is likely to go unnoticed, but it's a good opportunity to go long.

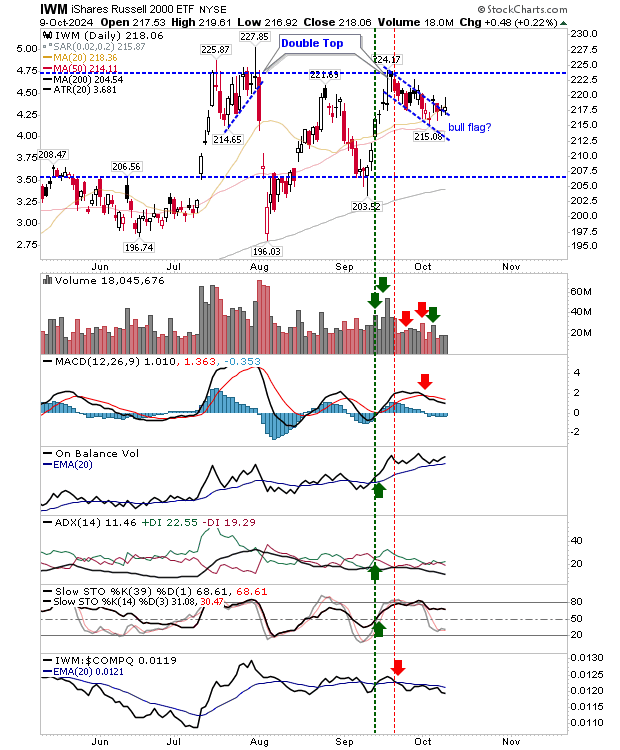

The Russell 2000 (IWM) attempted to follow the lead of other indices but found itself drifting back to its open price and the 'bull flag'.

The spike highs are a little concerning, but the 20-day and 50-day MAs are holding as support. Technicals are unchanged with a 'sell' trigger in the MACD that is showing no urgency to reverse.

The S&P 500 still has a MACD trigger 'sell' to reverse, but as the trigger occurred well above the bullish zero line the strength of this signal is weak. I'm less concerned with the relative underperformance to the Nasdaq given overall performance, which likely help both indices.

While today's gains didn't register across the board, I do think good days are outshining the bad. The S&P 500 is the slow-and-steady gainer and moving to new highs just marks the start of a new bull market.