-

Despite industry challenges, LVMH has consistently surpassed expectations, maintaining steady economic growth by diversifying its portfolio.

-

With iconic brands like Dior and Louis Vuitton under its umbrella, LVMH has navigated obstacles, including a recent decision to delist Tod's, showcasing its strategic investment approach.

-

While recent stock performance shows a slight decline, analysts remain optimistic, with a target price estimated at $943 per share, suggesting a potential uptrend for LVMH.

- Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

LVMH Moet Hennessy Louis Vuitton (OTC:LVMUY) (EPA:LVMH) has navigated through several macroeconomic challenges of late. Factors such as escalating interest rates, surplus inventory accumulation, and apprehensions regarding a dip in Asian demand amidst the Chinese crisis have posed notable obstacles.

However, this French conglomerate, which owns prestigious brands like Dior, Louis Vuitton, Fendi, Tiffany, Bulgari, Moët & Chandon, and Sephora, has consistently exceeded expectations, overcoming these challenges with great success.

Consequently, it has sustained an unwavering growth trajectory, marked by a steady uptick in revenues over the last four years. The company has demonstrated unwavering commitment to expansion through consistent investments across diverse ventures.

A recent strategic maneuver underscores this commitment, as evidenced by the decision to delist Tod's from the Milan Stock Exchange. This move underscores LVMH's dedication to astute investments and reinforces its position as a savvy industry leader.

How Has LVMH Stock Fared in Terms of Returns?

LVMH has consistently exhibited robust performance across various timeframes. Over the past decade, it has witnessed a remarkable surge, boasting a substantial increase of 601% on the CAC 40 index.

In the medium term, its growth trajectory remains impressive, registering a solid 46% uptick over the last three years. Similarly, in the short term, it has demonstrated resilience, accruing gains of 13% over the past three months. However, despite a better-than-expected performance in the fourth quarter of 2023, a discernible deceleration in expansion is evident, primarily attributable to challenges within the luxury sector.

Additionally, LVMH commands substantial value on the European stock market, boasting a market capitalization of $444.5 billion, securing the second position, trailing only behind the pharmaceutical giant Novo Nordisk (NYSE:NYSE:NVO), which commands a market capitalization of $575 billion.

The recent marginal dip in LVMH's stock, down by 4% in the last month, raises queries regarding whether the luxury brand has already reached its pinnacle in the market.

Fair Value and Target Price

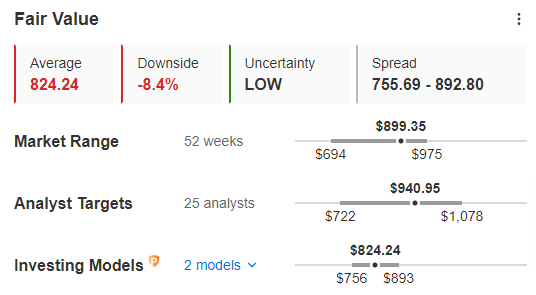

Upon utilizing InvestingPro's tools to conduct a thorough stock analysis, the Fair Value assessment, which encapsulates 14 esteemed financial models tailored to LVMH's unique attributes, indicates that the stock is currently trading at a premium of 8.4% above its fair value.

Source: InvestingPro

InvestingPro's average of 25 analyst ratings reveals a more optimistic sentiment regarding the stock's potential. They anticipate a potential uptrend and project a target price of $940 per share, representing a roughly 12% increase over the current valuation.

Furthermore, market experts regard LVMH as a dependable investment opportunity. For instance, RBC Capital recently reiterated a positive Outperform rating for the French conglomerate and established a target price of $980.

***

DON'T forget to take advantage of the InvestingPro+ discount on the annual plan (click HERE), and you can find out which stocks are undervalued and which are overvalued thanks to a series of exclusive tools:

- ProPicks, stock portfolios managed by artificial intelligence and human expertise

- ProTips, simplified information and data

- Fair Value and Financial Health, 2 indicators that provide immediate insight into the potential and risk of each stock

- Stock screeners and

- Historical Financial Data on thousands of stocks, and many other services!

That's not all, here's a discount on the annual plan of InvestingPro! click HERE

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.