- The Fed will decide on interest rates tomorrow, with a high likelihood of a 0.25% increase

- A pause in the rate cycle would undermine the Fed's credibility, while a 0.5% hike could create fear among investors

- Markets anticipate a positive trend post this meeting, reflected in rallies of risk-on assets, which have struggled due to high interest rates

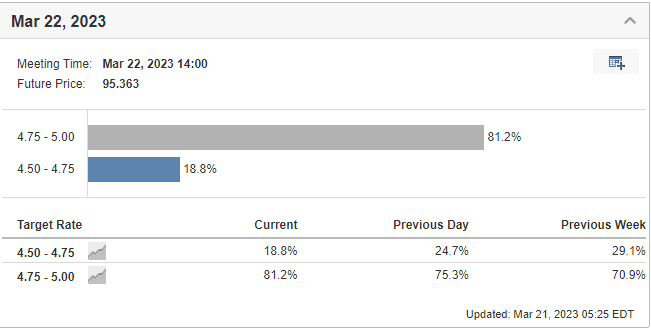

Tomorrow will be one of the most eagerly awaited days for the markets. The Fed will decide on interest rates. The odds favor a 0.25% increase, as we can see from our Fed Rate Monitor tool.

Source: Investing.com

Recently, in the wake of the banking crisis, some analysts and investment bankers dared to suggest that Powell might do nothing at all at this meeting.

In my opinion, this would be very dangerous because it would totally undermine the credibility of the Fed, which, I recall, already made a stupid mistake along with the ECB in 2021 when they talked about transitory inflation.

It's important not to repeat the mistakes of the past. To avoid this, a 0.25% increase is the most sensible option, as it strikes a balance. No hike would suggest that the Fed is vulnerable to market forces and the banking crisis.

Meanwhile, a 0.5% hike could create more fear among investors and demonstrate that the Fed is indifferent to the effects of high interest rates on the economy. The modest hike is the best choice, as it signals a measured response to current economic conditions.

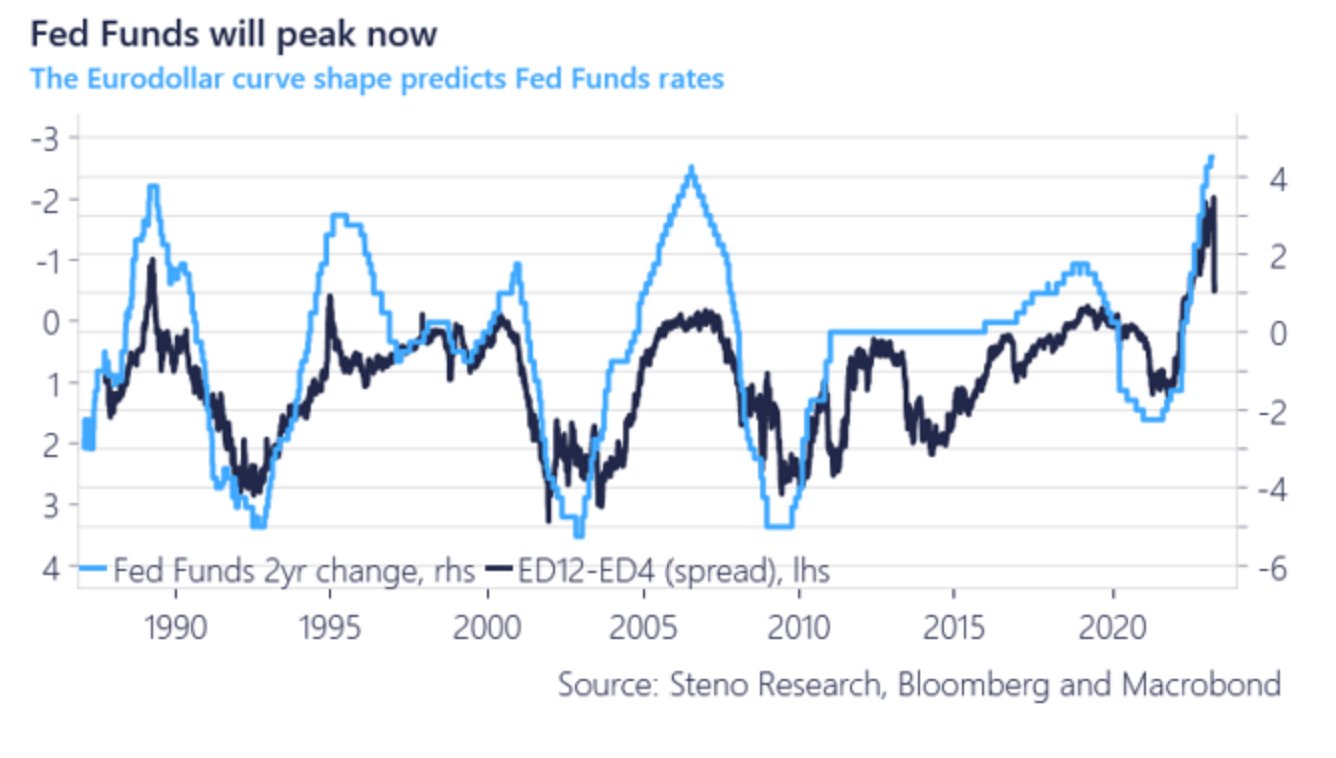

But most of all, with the 0.25% hike (almost) certain, it will be interesting to hear Powell's words to see if we are indeed close to a turning point or if we should expect another hike.

Currently, the markets seem to be betting on a bullish path between this and the next meeting. This is reflected in the rallies in the NASDAQ Composite, gold futures, Bitcoin and silver futures.

These assets have previously struggled in the bear market conditions created by high interest rates.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any type of investment is evaluated from multiple perspectives and is highly risky and, therefore, any investment decision and the associated risk remain with the investor.