Oil prices hold gains amid stalled Ukraine peace talks, US rate cut hopes

- Gold finished lower last week due to a slightly hawkish shift in Fed rate cut expectations

- Traders are closely monitoring central bank meetings (BOJ, ECB), global PMIs, and US GDP/PCE inflation data

- Technical analysis indicates potential bullish trend resumption for gold, pending a break above the short-term bearish trend line

- Creating a market-beating portfolio has never been as easy as with ProPicks. Join now and access the six strategies that outperformed the S&P 500 by triple digits over the last decade!

Gold finished lower last week, and remains in the red for the month of January and therefore the year as well. The metal had risen in the last three months of 2023, boosted by speculation that the Fed is going to start cutting interest rates sooner than it had projected in its previous dot plots.

This year, we have seen a bit of hawkish repricing of the Fed’s rate cuts, and correspondingly gold has fallen as yields have bounced. A few weeks ago, a rate cut for March was almost a forgone conclusion by the market. Now, it is a coin-flip, according to Investing.com's Fed Monitor tool.

The hawkish repricing of the Fed rate cuts has been supported by stronger data and hawkish commentary from Fed officials. Yet, this hasn’t stopped equity markets from reaching fresh record highs, thanks to the high-flying technology shares.

In fact, the US dollar’s recovery has been modest and gold has given back only little. So, there is still a good chance we may see the resumption of the bullish trend for gold once the hawkish repricing of the Fed cuts is complete.

However, I won’t be pre-empting and instead wait for the right bullish signal from the charts before looking for long setups, in light of the growing chorus of central bank officials pushing back on rate cuts.

What are Gold Traders Focusing on This Week?

Gold’s near-term direction is subject to heightened volatility this week as we have a couple of central bank meetings, namely the Bank of Japan and European Central Bank, and some top tier data from the US.

- BOJ interest rate decision

Tuesday, January 23

The BoJ is not likely to alter its policy at this meeting, but may do so at some point in this first half of the year. Recent data releases from Japan will give them very little incentive to make any changes to current settings, with inflation and ages data both remaining soft.

If the BoJ turns out to be even more dovish than expected then this may provide some support for gold, while any concrete signals that it will end negative interest rates then that would likely have negative impact on gold as Japanese government bond yield rise.

- Manufacturing PMIs

Wednesday, January 24

The global PMIs on Wednesday will provide us with insights about the health of the global economy at the start of the year, which traders could use as a proxy for demand for all sort of commodities.

Concerns about the health of the Chinese and European economies have held back commodities and commodity-heavy indices such as the FTSE 100 and China A50 among others.

However, tech-heavy indices such as US Tech 100 and Germany 40 have outperformed on bets the global slowdown will trigger a sharp reduction in interest rates. We have seen base metals like copper also struggle, holding back silver and to a lesser degree gold.

Let’s see what surveyed purchasing managers in the manufacturing and services industries have reported at the start of the year.

The PMIs are leading economic indicators and in the eyes of investors will carry more weight. If we see a positive response in risk assets, then foreign currencies should benefit against the dollar, providing support for gold.

- ECB rate decision

Thursday, January 25

The upcoming rate decision by the ECB could have an impact on gold.

If the ECB is more dovish than expected, then you would think European bond yields would slip and that in turn would underpin assets with low and zero yields like gold and silver. But the market is positioned for a hawkish ECB after several officials last week tried to push back against early rate cuts, mirroring the Fed.

While in the case of the US, the pushback is mainly because of a relatively stronger economy, elsewhere – especially in the UK and Eurozone – it is all about concerns about inflation remaining sticky, with wage pressures continuing to remain elevated.

ECB President Christine Lagarde suggested that borrowing costs could come down in the summer rather than in spring, while several other ECB officials have also expressed concerns about wage inflation. Let’s see if the ECB will provide any further hints at this meeting.

- US GDP and PCE inflation

Thursday and Friday, January 25/26

Gold, a buck-denominated asset, will probably get more influenced by the upcoming US data than anything else, following stronger-than-expected CPI, jobs, and retail sales reports in the last couple of weeks, the dollar has been pushing higher, keeping the price of gold under pressure.

There has been renewed concerns over the Fed’s inclination to maintain higher interest rates longer, after Fed governor Christopher Waller suggested a measured approach, cautioning against any haste in considering near-term rate cuts.

If GDP reveals further strength in the US economy, expectations of an imminent reduction in interest rates will be pushed further out. Gold bulls will therefore be looking for weakness in US data, including GDP on Thursday and Core PCE the following day.

Technical Analysis

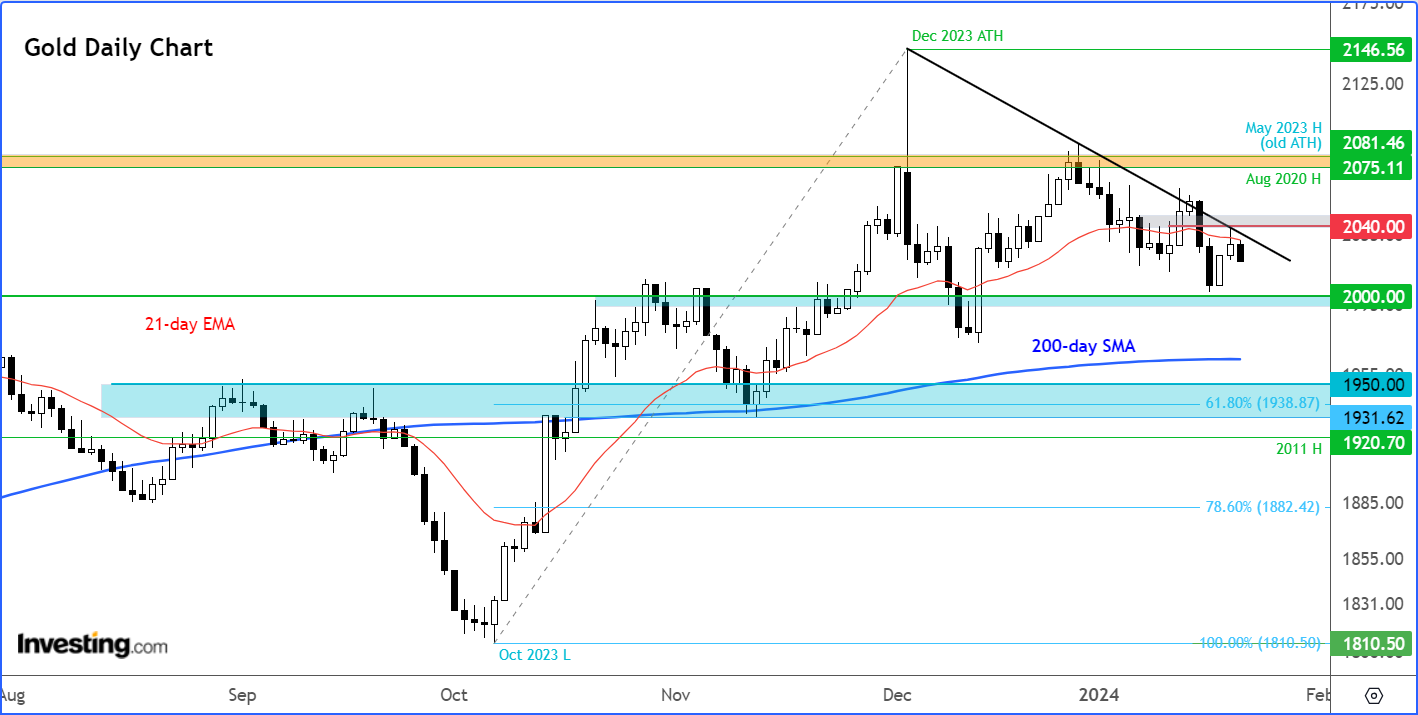

Gold has been stuck between a rock and a hard place. But its short term technical directional bias would become clearer once it either breaks above the short-term bearish trend line circa $2040 area (bullish) or breaks decisively below key horizontal support at around the $2000 mark (bearish).

Despite the short-term struggles, the underlying trend is bullish if you ignore the recent price action.

Since bottoming at $1810 in October, gold has now formed several higher lows and a couple of higher highs, one of which being a fresh record high set in December. Gold climbed above its 200-day moving average in mid-October and it has held above it.

Gold Trading Ideas

A clean break above the short-term bearish trend should give rise to fresh technical buying above it. So, at the current state technical picture, I am looking for a move north of $2040-$2045 area, before looking for any long trades.

The most recent high comes in at $2062ish, which would be the first key objective for the bulls. A potential move above this level would create a higher high. In this scenario, gold may then embark on a rally towards the next area of resistance between $2075 to $2080ish. Above that area, here are no other prior reverence points until December’s peak of $2146.

On the downside, if support around $2000 breaks cleanly first, then we may see a run back down to the 200 MA at $1964. Below the 200-day MA, the next potential support area is seen between $1930 to $1950, where the 61.8% Fibonacci retracement of the upswing from October meets prior support and resistance, making it a technically-important area for the bulls to defend.

***

Beating the market has now become a lot easier with our Flagship AI-Powered ProPicks

Oftentimes, investors will miss incredible market opportunities simply by not knowing which companies to bet on.

Luckily, those times are long gone for InvestingPro users. With our six cutting-edge AI-powered strategies, including the flagship "Beat the S&P 500," which outperformed the market by 829% over the last decade, investors now have the best selection of stocks in the market at the tip of their fingers every month.

Strategies are rebalanced monthly, guaranteeing that our users stay ahead of the curve amid shifting market dynamics and an ever-changing macroeconomic environment.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!