- Bank of England left interest rates unchanged, as expected

- Inflation and economic growth remain on the BoE’s main agenda

- GBP/USD rise has slowed below the 1.30 region.

- Looking for more actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to ProPicks AI winners.

Last week, several central banks made policy announcements, including the Federal Reserve and the Bank of England. As expected, both kept interest rates unchanged, and their statements offered little new information. As a result, financial markets had a muted reaction.

With monetary policy unchanged, attention remains on economic and political developments driven by the new U.S. administration. The sharp rebounds in U.S. stock indices early in the week suggest that fears of a full-scale tariff war may be easing.

BoE Faces Tougher Decisions Ahead

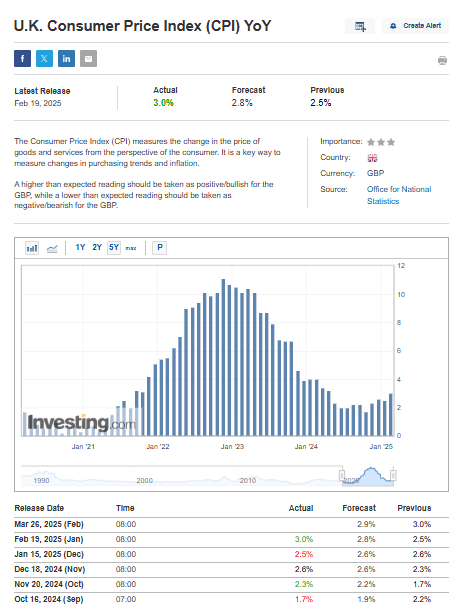

While last week’s BOE decision was expected, policymakers will likely remain passive. Conflicting macroeconomic data make future moves uncertain, with inflation—now at 3% year-over-year—drawing market attention

Figure 1: UK Inflation Data

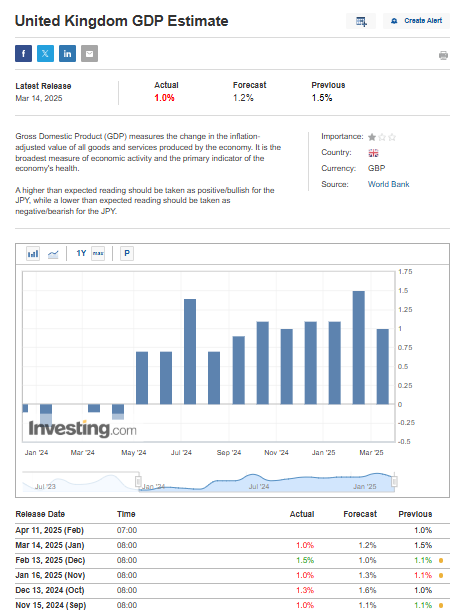

This week’s data may align with forecasts, but the broader outlook still limits room for rate cuts. While CPI trends do not support easing, weaker economic indicators, especially GDP, provide some justification. After a strong reading last month, March’s data was disappointing, with GDP growth at just 1% year-over-year—well below expectations.

Figure 2: UK GDP Data

Given this uncertainty, the market will look to the Bank of England for clarity on its policy direction and future interest rate decisions.

In the US, recession fears have shifted expectations for a 25bp rate cut from September to June, with a 60% probability, despite persistent inflation. This highlights how economic data can sometimes outweigh inflation concerns for central banks.

GBP/USD Bulls Lose Momentum

GBP/USD has been in an uptrend since the start of the year, driven by a weaker US Dollar. Buyers pushed the pair to the key 1.30 level, where gains have slowed. However, with little selling pressure, the pair has entered a period of consolidation.

Figure 3: Technical analysis of GBP/USD

A breakout above the current consolidation would confirm a move past $1.30, with the next medium-term target at $1.34. If a deeper correction occurs, key support lies at $1.28, where the upward trend line converges.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.