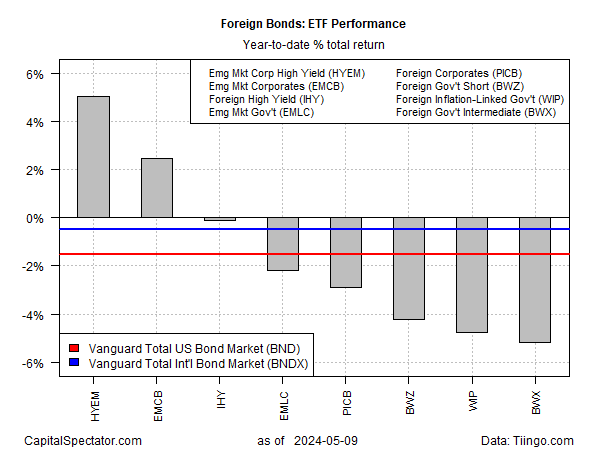

Foreign fixed-income markets from a US investor perspective have been an unappealing asset class lately – with a glaring exception: corporate bonds in emerging markets. Year to date, this slice of global fixed-income securities is hot, based on a set of ETFs through Thursday’s close (May 9). The rest of the field is struggling.

High-yield bonds issued by companies in emerging markets are especially strong this year. VanEck Emerging Markets High Yield Bond ETF (NYSE:HYEM) is posting a strong 5.1% rise so far in 2024. A distant second-place performer: WisdomTree Emerging Markets Corporate Bond Fund (NASDAQ:EMCB), a (primarily) investment-grade holder of EM corporates that’s up 2.2%.

Otherwise, foreign bonds are in the red this year, led by a 5.2% loss for intermediate government bonds via developed markets ex-US (BWX). A US dollar hedged global bonds ex-US benchmark (BNDX) is also underwater in 2024, echoing the loss for US bonds as well (BND).

“Emerging markets have done much better than anyone would have expected,” says David Hauner, head of global emerging markets fixed income strategy at Bank of America. “Clearly the credit component of EM sovereign bonds has held up well because the fundamentals have been improving.”

The rally in emerging markets bonds in 2024 is all the more impressive when you consider the headwind blowing from the US dollar, which has strengthened this year. An ETF proxy (UUP) for the US currency is higher by 5.9% year to date. All else equal, a firmer dollar translates into lower prices for foreign assets after converting into US dollar terms.

Accordingly, a strategy of hedging out the US dollar exposure has juiced returns further for EM high yield. Meanwhile, the delay in expected rate cuts by the Federal Reserve has been a factor for why central banks in emerging markets have kept rates high. In turn, that’s been a plus for global investors seeking yield.

Indeed, emerging markets generally offer higher yields vs. the developed world. The trailing 12-month yield for VanEck Emerging Markets High Yield Bond ETF (HYEM) is 6.23%, according to Morningstar.com. By comparison, the equivalent for US bonds is roughly half.

Currency risk and higher volatility in emerging markets could reduce if not eliminate any premium in these countries’ fixed-income securities for US investors, but for the moment the crowd is overlooking that hazard and bidding up prices that’s left the rest of the bond world far behind.