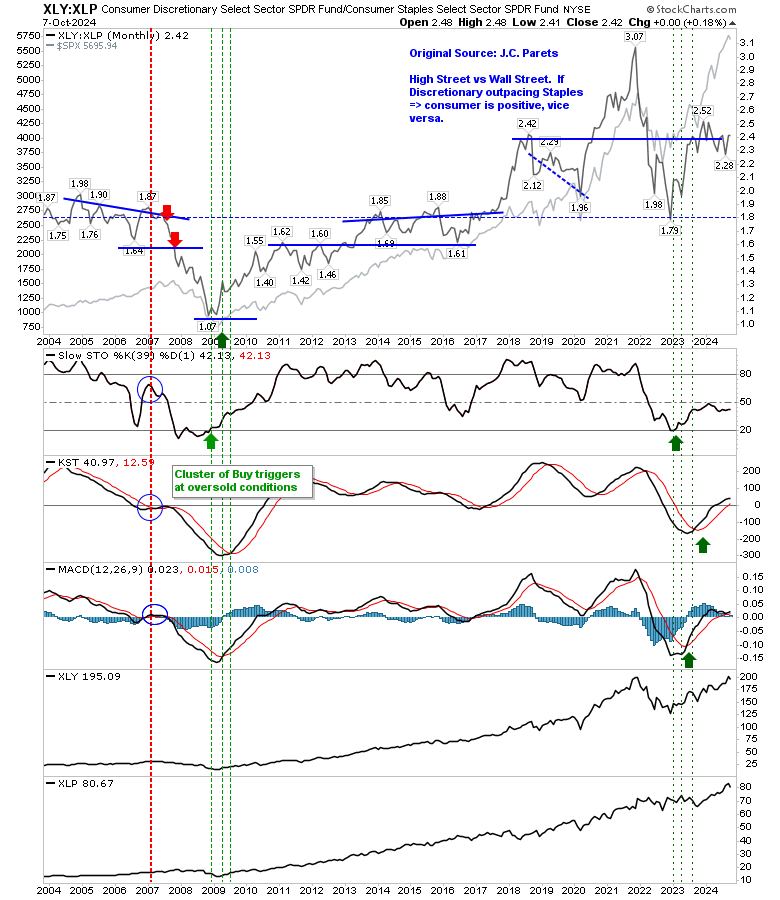

The chart below by J.C. Parets is one I prefer to track. The relative relationship between Consumer Discretionary (XLY) and Staples (XLP) entered a new dimension in 2017 when prior resistance around 2.0 was blown out of the water.

Now the relationship has entered a head-and-shoulder-like pattern, which suggests a potential period of weakness for Discretionary that could translate into weakness for the broader market.

Supporting technicals have emerged from an oversold period, similar to 2009, that contradicts the bearish setup from the relative relationship.

While stochastics are below 50, the bearish picture is favored, but if it can break above, then a lengthy secular bull rally could emerge.

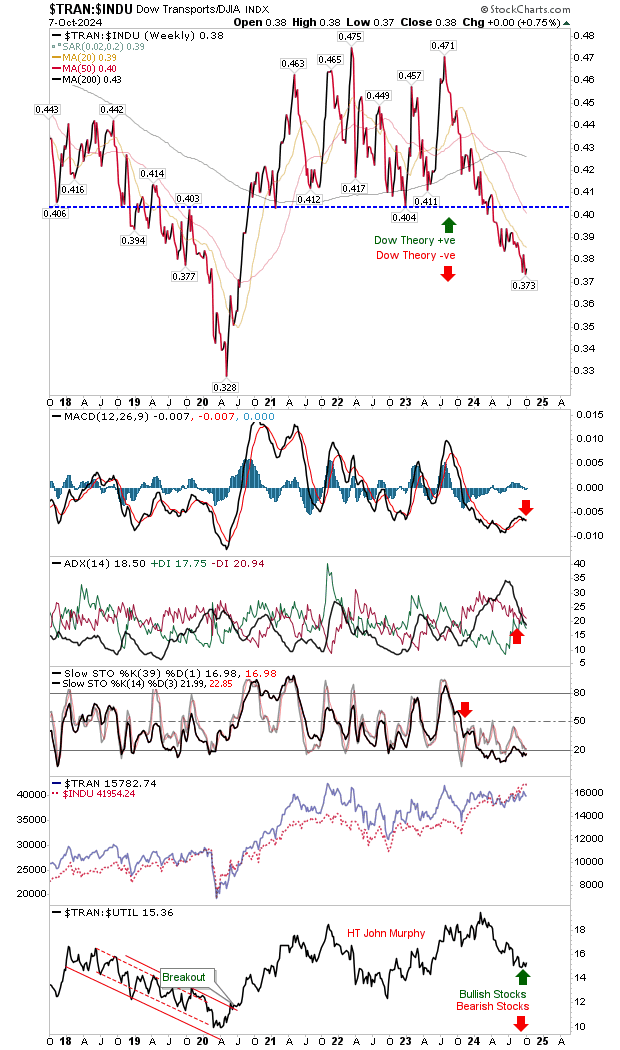

The relative performance between the Dow Jones Transports and Dow Industrial Average (for Dow Theory) suggests a period of weakness lies ahead. However, the chart of Transports looks primed for a major breakout.

A breakout of Transports would accelerate the rally in the Dow Jones Industrials and could be very bullish.

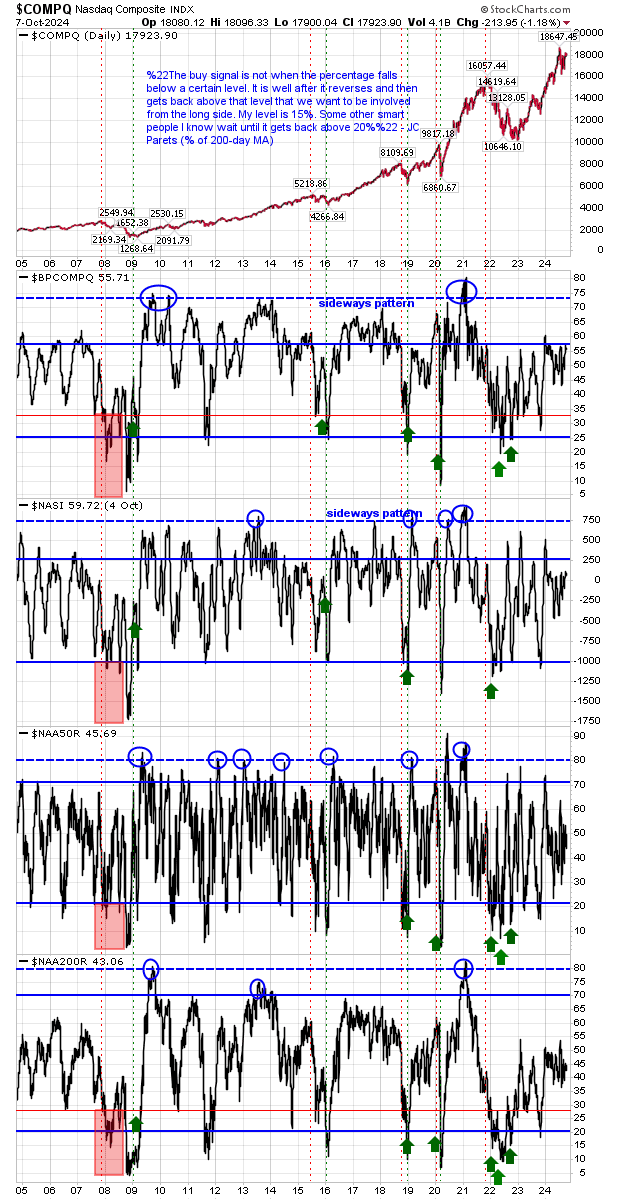

Nasdaq breadth metrics are near overbought but are mostly caught in the middle. There is no real guidance here as to what comes next.

If there is a slight edge, it's that the Nasdaq Bullish Percent Index ($BPCOMQP) and Nasdaq Summation Index ($NASI) are near overbought (so favoring a top), but it could be months - if not years - before they reach historic peaks.

These metrics help track the bigger picture for the indices. Price action is king, and price suggests a broader rally is favored, but if we see price drift lower, particularly if the S&P sheds its breakout, then it could be a troublesome rest of the year.