The S&P 500 moved above the resistance zone I have been watching at 4,200 to 4,225. No breakout is complete unless it is confirmed, and for that to happen, you don’t want to see the index slip back below 4,225. I have doubts about last Friday’s rally for several reasons, but the biggest reason is the volatility crush that sent the index higher, as VIX tagged its lowest in nearly two years.

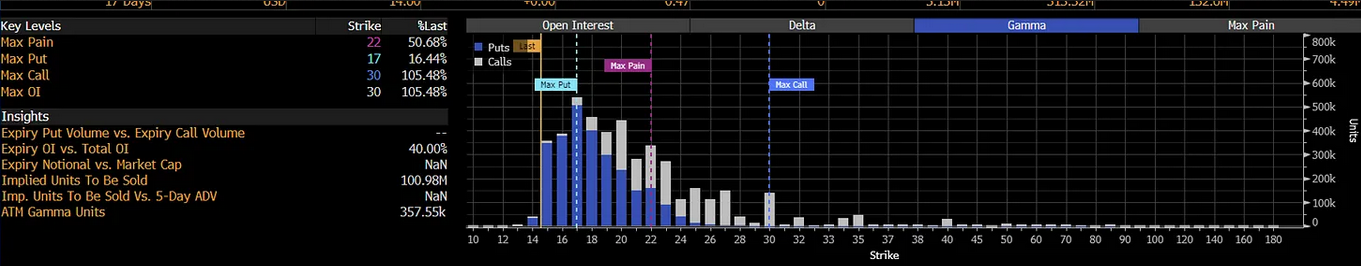

You have to wonder, though, how much more downside is left in the VIX, with most of the gamma now at higher levels and the most likely pain trade for the VIX index is higher.

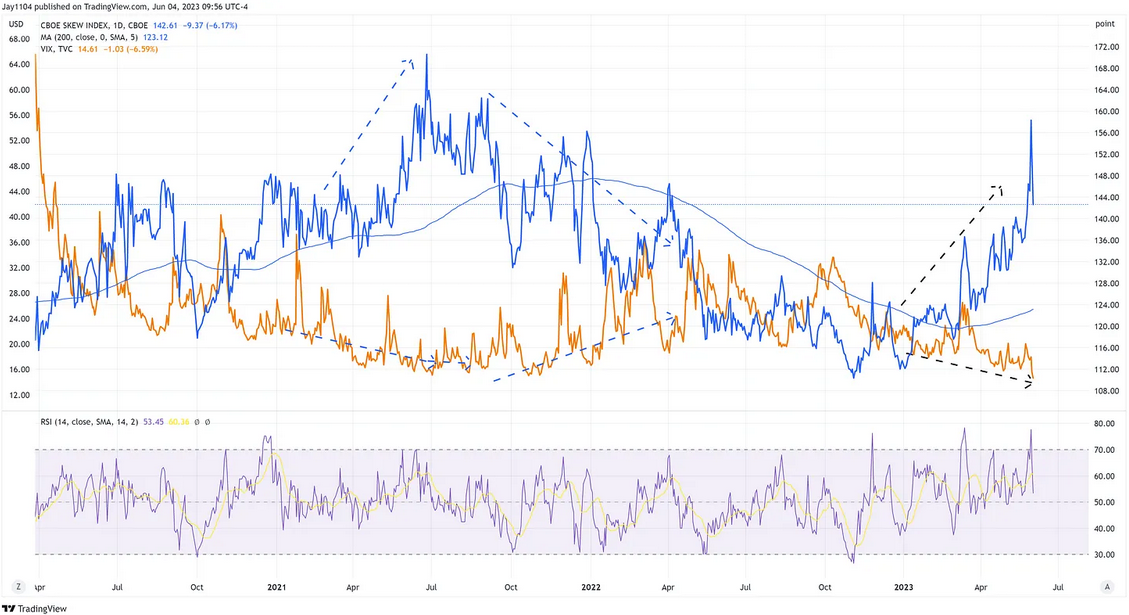

Meanwhile, we have seen the SKEW index rocket higher, and that is likely due to traders buying out of the money volatility to protect their short volatility positions. This was seen in 2021, as the Fed pumped in tons of QE and acted as a market volatility damper.

This same trade emerged in mid-March, as the Fed expanded its balance sheet by giving banks loans and increasing reserve balance. The debt ceiling limit allowed reserve balances to stay elevated, which allowed this trade to continue. But now, the TGA will start to be refilled this week.

If the money in the reverse repo facility stays unchanged, reserve balances are going to start to drop quickly, and that liquidity that has helped dampen volatility is going to be over with, which could result in a further unwind of this trade.

This period reminds me of January 2018, when we saw a massive blow-off top on the indexes and a very sharp drawdown. In an article I wrote on January 29, 2018, I noted that the S&P 500, Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL) had all seen their stocks advance dramatically, and RSIs were well over 80.

Today isn't dissimilar; while the RSIs aren’t as high, their stocks and index trade with RSIs well over 70 and hitting their upper Bollinger bands on the daily and weekly charts. The Nasdaq 100 has been trading above its upper Bollinger band on the weekly chart for two weeks and has an RSI of over 70.

Apple (NASDAQ:AAPL) is trading over its upper Bollinger Band on the daily chart with an RSI over 70.

And Amazon is trading at its upper Bollinger band, with an RSI of over 70.

Meta Platforms (NASDAQ:META) is trading at its upper Bollinger band with an RSI of over 80.

Tesla (NASDAQ:TSLA) is trading at its upper Bollinger band with an RSI above 70.

Meanwhile, the XLK trades at its upper Bollinger band and RSI over 70.

Sure, these are conditions, and conditions can grow even more over-bought. But these aren’t the type of conditions that one generally wants to see when the market is trying to advance after a long consolidation on the S&P 500, especially when it comes from the biggest stocks in the index. Because it means a lot of energy and buying power has already been spent.

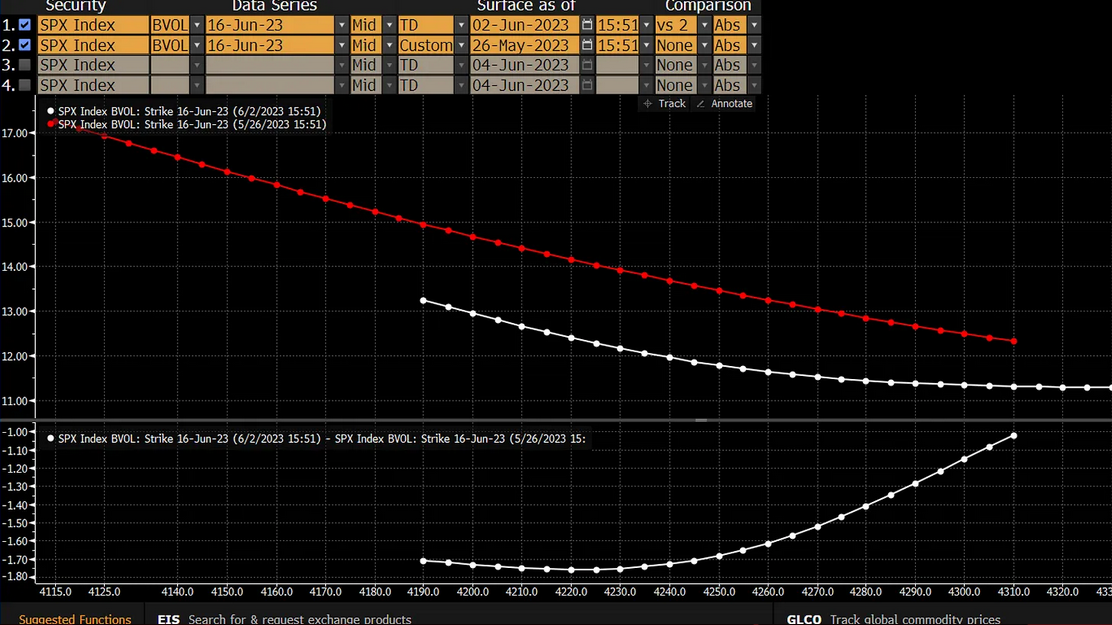

Additionally, there has been a big grab for calls in this market, and that is most noticeable in how IV for calls on the S&P 500 holds up much better than the IV for puts when looking at the SKEW for the S&P 500 across strike prices for the June OPEX.

This market has become extremely overbought the undersurface, and I am skeptical that the Friday rally can last.