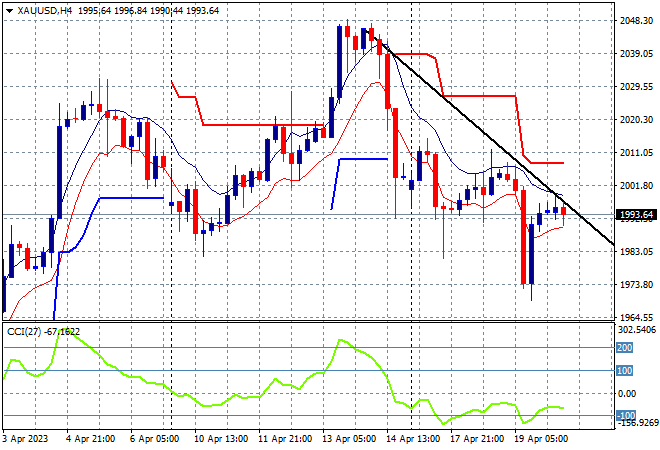

A lack of risk taking continues to dominate the trend of Asian stock markets today as overnight leads remain mixed at best. US and European stock futures are down slightly with the USD remaining relatively firm against the majors with the Kiwi dropping sharply on a lower than expected inflation print while the Australian dollar has moved slightly lower in sympathy. Oil prices are continuing their falls from overnight on weaker US economic news with Brent crude just above the $82USD per barrel level while gold is trying to fight back after its recent push below the $2000USD per ounce level after a failed breakout on Friday night:

Mainland Chinese share markets are again in the red as they fall to gain any traction into the close, with the Shanghai Composite down over 0.3% to remain below the 3400 point barrier at 3357 points while the Hang Seng is treading water with a small loss, down only 0.1% at 20339 points. Japanese stock markets are the best in the region, but only relatively speaking, with the Nikkei 225 closing just 0.2% higher at 28664 points despite a much weaker Yen with the USDJPY pair holding on to a bounce above the 134 level:

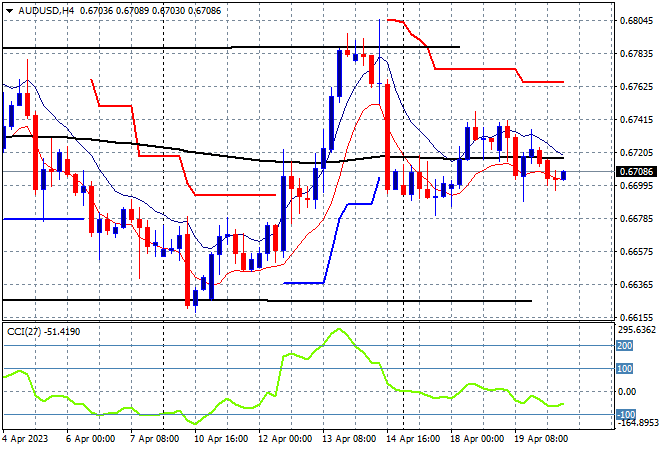

Australian stocks are treading water with the ASX200 likely to finish dead flat and still below the 7400 point level at 7368 points. The Australian dollar has been unable to make any gains and has returned to its recent session lows following the release of the RBA Minutes as the Pacific Peso now dices with the 67 handle:

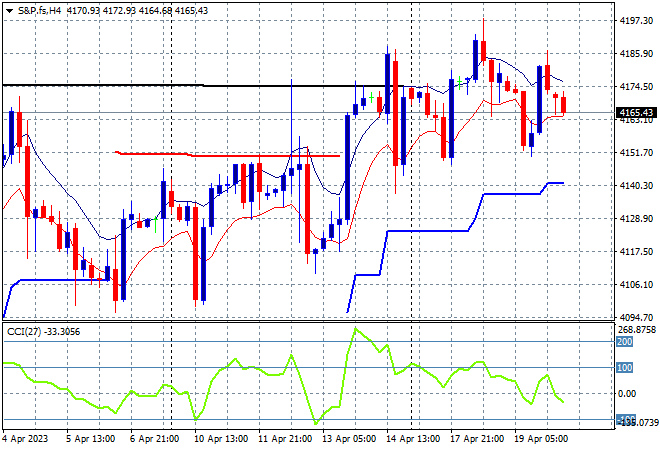

Eurostoxx and US futures are down another 0.2% or so with earnings downgrades still dominating risk sentiment as the S&P500 four hourly chart shows price action failing to move above overhead resistance after clearing a point of control at the 4150 point level and now getting stuck. The next psychological level to clear is obviously 4200 points:

The economic calendar tonight includes the latest ECB accounts, then US initial jobless claims numbers and a slew of Fed speeches to watch out for.