- Fed meeting, FOMC Dot-Plot, CPI inflation data will be in focus this week.

- Oracle is a buy with a strong beat-and-raise quarter expected.

- Apple is a sell with WWDC Event on deck.

- Looking for a helping hand in the market? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

Stocks on Wall Street finished mostly higher on Friday to notch a winning week after a robust U.S. jobs report fueled investor optimism about a soft landing for the economy.

For the week, the S&P 500 and tech-heavy Nasdaq Composite rose 1.3% and 2.4% respectively, while the blue-chip Dow Jones Industrial Average added 0.3%.

Source: Investing.com

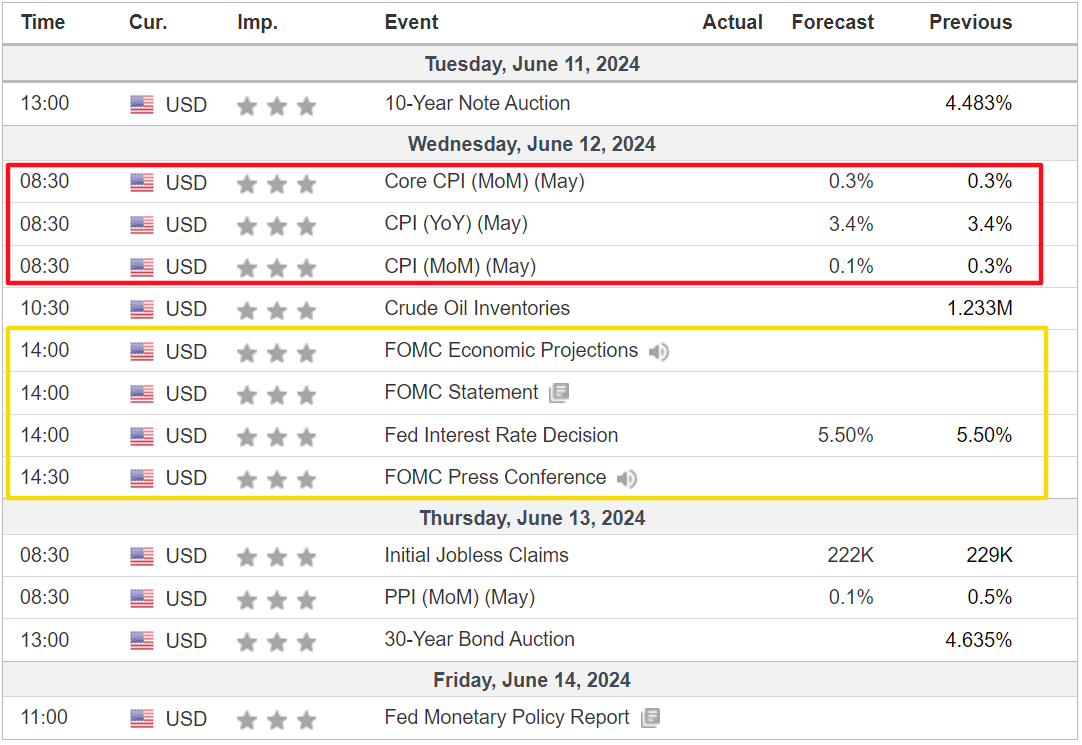

The blockbuster week ahead is expected to be an eventful one filled with several market-moving events, including the Federal Reserve’s latest monetary policy meeting.

The U.S. central bank is widely expected to leave interest rates unchanged on Wednesday, but Fed Chair Jerome Powell could offer hints about when rate cuts might start when he speaks in the post-meeting press conference.

Meanwhile, on the economic calendar, most important will be Wednesday’s U.S. consumer price inflation report for May, which is forecast to show annual CPI rising 3.4%, matching the same increase recorded in April.

Source: Investing.com

Investors have largely pushed back expectations for the Fed’s first cut to September, as per the Investing.com Fed Rate Monitor Tool.

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Oracle (NYSE:ORCL), Broadcom (NASDAQ:AVGO), and Adobe (NASDAQ:ADBE) as Wall Street’s reporting season draws to a close.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, June 10 - Friday, June 14.

Stock to Buy: Oracle

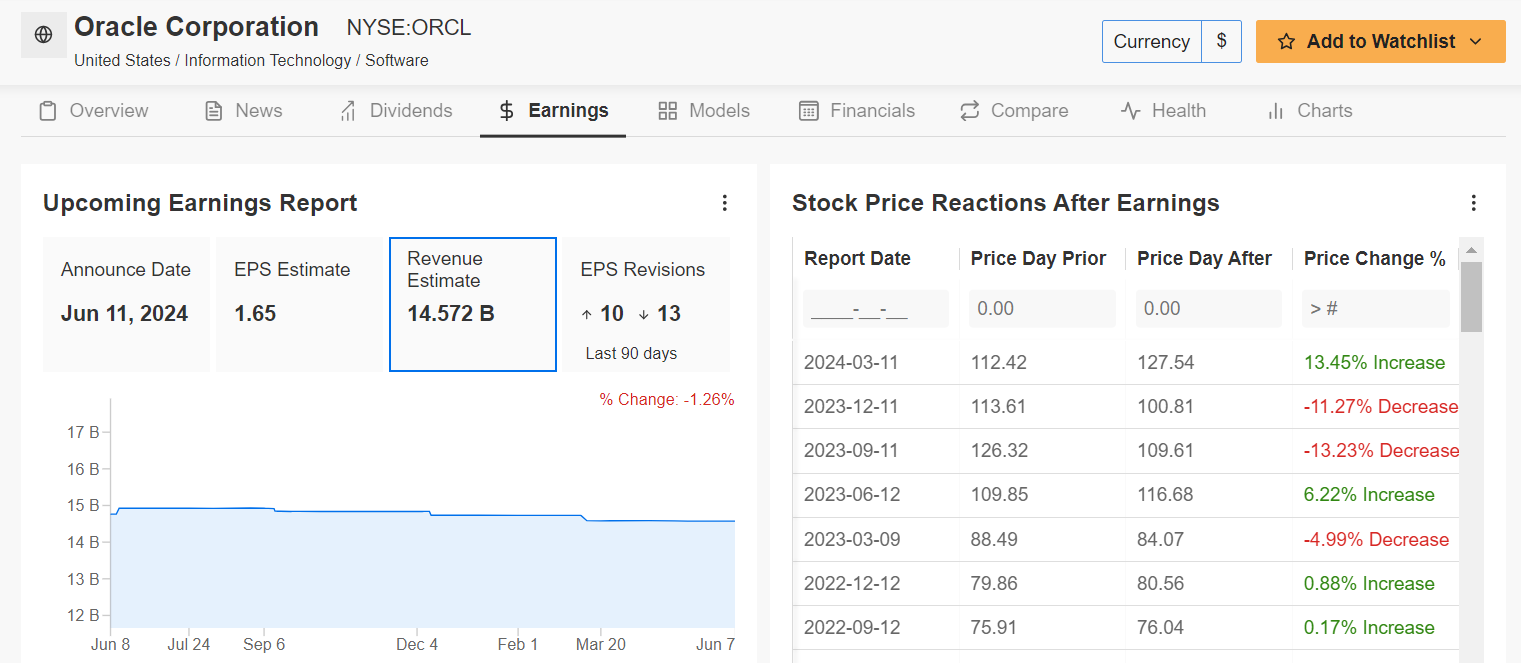

I expect a strong performance from Oracle this week, with a potential breakout to a new record high on the horizon, as the cloud and software company will likely deliver another quarter of strong top-and bottom-line growth and provide an upbeat outlook thanks to broad strength in its cloud business.

Oracle is scheduled to release its fiscal fourth quarter earnings report after the U.S. market closes on Tuesday at 4:05PM ET. A call with Chief Executive Officer Safra Catz as well as Chairman and Chief Technology Officer Larry Ellison is set for 5:00PM ET.

Market participants expect a sizable swing in ORCL stock after the Q4 update drops, according to the options market, with a possible implied move of 7.6% in either direction.

Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with shares surging 13.4% when the company last reported quarterly numbers in March.

Source: InvestingPro

It should be noted that 10 out of 23 analysts covering the company upwardly revised their profit and sales forecasts ahead of the report.

Wall Street sees the Austin, Texas-based database giant earning $1.65 per share for the May-ending quarter, about 1% lower than a year earlier.

Meanwhile, revenue is forecast to increase 5.6% year-over-year to $14.57 billion, reflecting strong growth in its cloud services and license support segment, which are getting a boost in demand from generative AI companies.

As such, I believe Oracle’s management will provide an upbeat outlook for the current quarter as the tech company’s cloud business is well positioned to benefit from the growing AI trend and its tight partnership with Nvidia (NASDAQ:NVDA).

Source: Investing.com

ORCL stock ended at $125.92 on Friday, about 5% below its record high of $132.77. With a market cap of $346 billion, Oracle is one of the most valuable database software and cloud computing companies in the world.

Shares are up 19.4% year-to-date, rising alongside much of the tech sector.

It is worth mentioning that Oracle has an above-average ‘Financial Health Score’, highlighting its solid earnings prospects, and a robust profitability outlook. Additionally, it should be noted that the company has raised its dividend for 10 consecutive years.

Subscribe now to InvestingPro and position your portfolio one step ahead of everyone else!

Stock to Sell: Apple

I foresee a disappointing week ahead for Apple (NASDAQ:AAPL) as the iPhone giant hosts its Worldwide Developers Conference (WWDC), at which it is expected to provide an update on its AI strategy.

The five-day extravaganza will kick off at Apple’s headquarters in Cupertino, California on Monday, June 10, beginning with a keynote address by CEO Tim Cook that is set to take place at 1PM ET / 10AM PT.

There is no official confirmation on the agenda for the event, but Apple is anticipated to heavily focus on generative AI advancements and highlight its incorporation into current software. Chief among them will be a rebuilt Siri voice-activated digital assistant.

The consumer electronics conglomerate will also discuss the next operating systems for the iPhone, iPad, Mac, Apple Watch and Apple Vision headset at WWDC 2024.

Apple’s WWDC event has a history of moving AAPL stock, often resulting in sizable single day moves. In the past, shares have rallied in the three trading days leading up to the event and then underperformed in the three days following.

Source: Investing.com

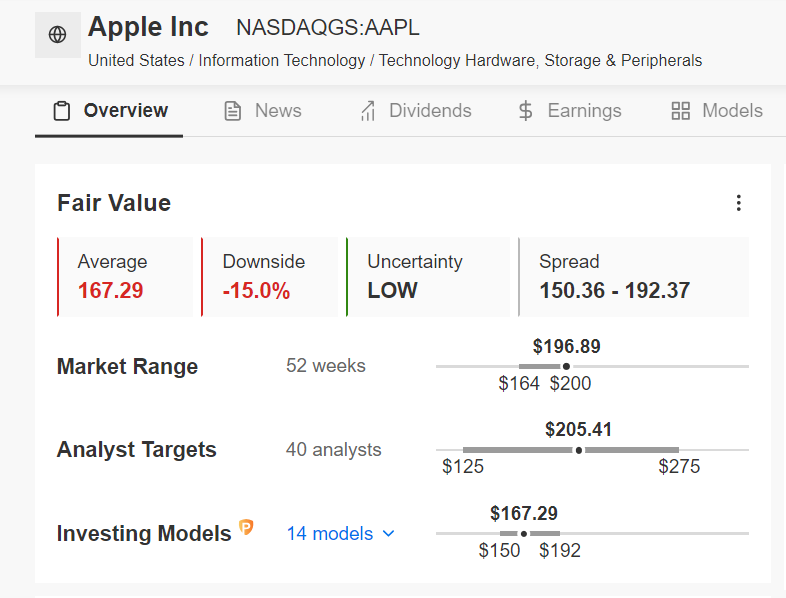

AAPL stock ended Friday’s session at $196.89, its highest closing price since December 19, 2023. Shares currently stand less than 2% away from the record high of $199.62.

At its current valuation, Apple has a market cap of $3.02 trillion, making it the second most valuable company trading on the U.S. stock exchange, trailing Microsoft (NASDAQ:MSFT) and ahead of Nvidia.

Shares are up just 2.2% in 2024, vastly underperforming the broader market.

It should be noted that Apple’s stock is overvalued as per the AI-backed quantitative models in InvestingPro, which point to potential downside of 15% from Friday’s closing price.

Source: InvestingPro

Such a move would take shares closer to their ‘Fair Value’ price of $167.29.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy a limited-time discount of 40% OFF on the yearly and bi-yearly Pro plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of slowing economic growth, elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.