- Jobless claims, Fed speakers, and more earnings in focus this week.

- Arista Networks is a buy with a strong beat-and-raise quarter expected.

- Rivian Automotive is a sell with disappointing earnings, guidance on deck.

- Looking for actionable trade ideas to navigate the current market volatility? Join InvestingPro for just 60 cents a day!

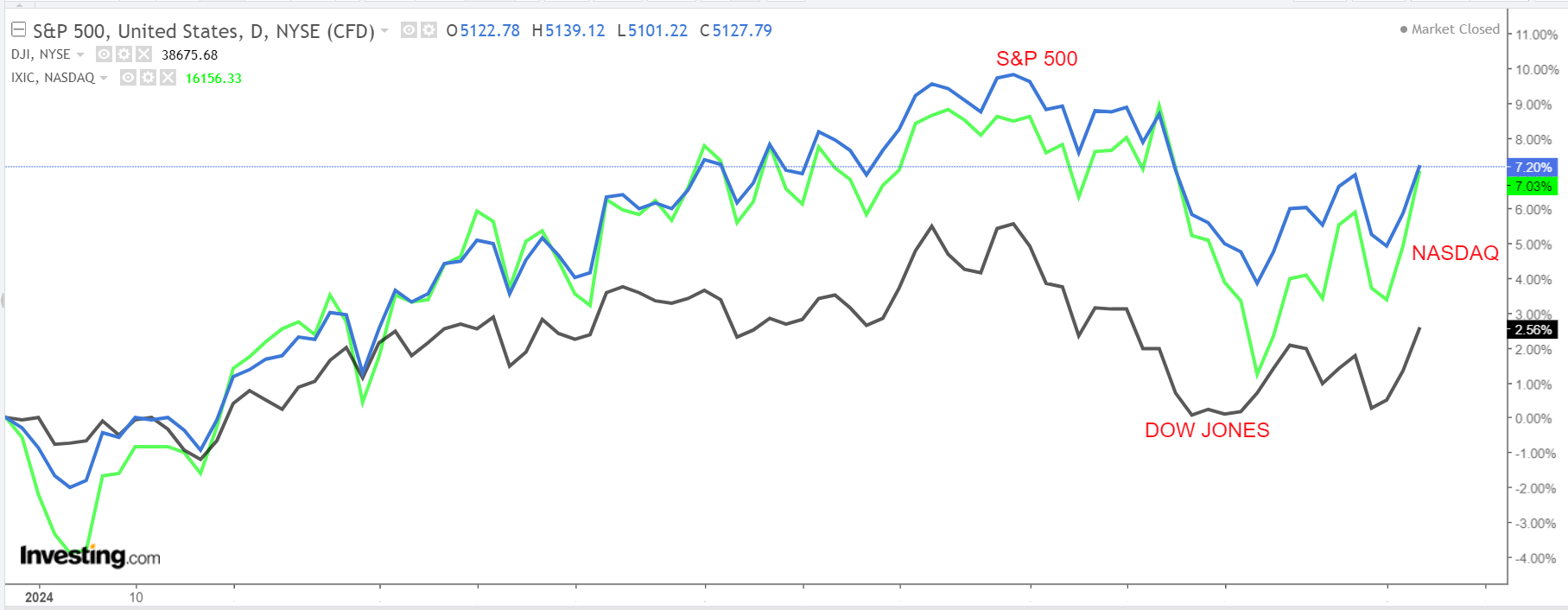

Stocks on Wall Street surged to a higher close on Friday, after a softer-than-expected jobs report boosted hopes that the Federal Reserve could start cutting interest rates soon.

Source: Investing.com

All three indexes notched their second straight winning week.

The blue-chip Dow Jones Industrial Average and tech-heavy Nasdaq Composite added 1.1% and 1.4%, respectively, while the benchmark S&P 500 rose 0.5%.

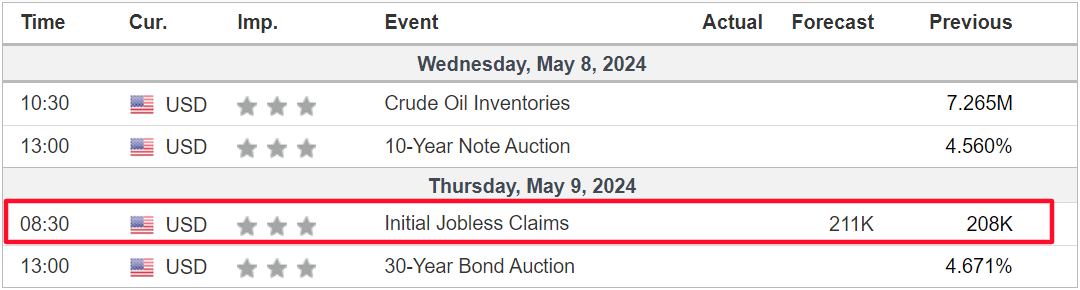

The week ahead is relatively light on economic data. The latest initial jobless claims figures are due Thursday, while the University of Michigan's consumer sentiment survey drops Friday.

Source: Investing.com

Those releases will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Thomas Barkin, John Williams, Neel Kashkari, Michelle Bowman, and Austan Goolsbee all set to make public appearances.

As of Sunday morning, financial markets see about a 67% chance of the first rate cut hitting in September, according to the Investing.com Fed Monitor Tool.

Elsewhere, the earnings season continues, with the list of notable tech-related names due to report including Arm (NASDAQ:ARM), Palantir (NYSE:PLTR), Arista Networks (NYSE:ANET), Datadog (NASDAQ:DDOG), Twilio (NYSE:TWLO), Trade Desk (NASDAQ:TTD), Shopify (NYSE:SHOP), Robinhood (NASDAQ:HOOD), and Roblox (NYSE:RBLX).

Some of the other high-profile reporters include Walt Disney (NYSE:DIS), Uber (NYSE:UBER), Airbnb (NASDAQ:ABNB), Tyson Foods (NYSE:TSN), Beyond Meat (NASDAQ:BYND), Toyota (NYSE:TM), Ferrari (NYSE:RACE), Rivian Automotive (NASDAQ:RIVN), Lucid (NASDAQ:LCID), AMC Entertainment (NYSE:AMC), and Warner Bros. Discovery (NASDAQ:WBD).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, May 6 - Friday, May 10.

Stock To Buy: Arista Networks

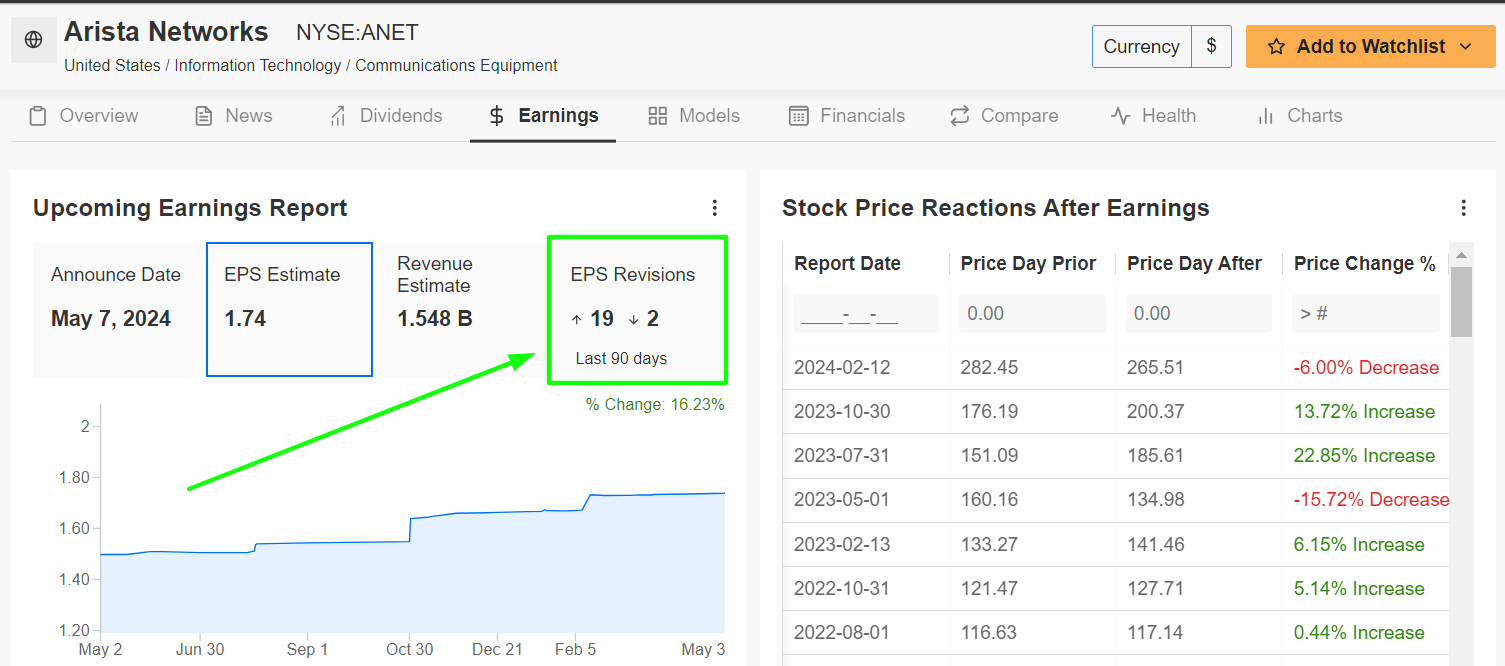

I expect Arista Networks (NYSE:ANET) to see its stock outperform this week, as the networking-infrastructure company will likely deliver another quarter of strong bottom-line and top-line growth and provide an upbeat outlook.

Arista is scheduled to report its first quarter earnings update after the closing bell on Tuesday at 4:05PM EST, with both analysts and investors growing increasingly bullish on the cloud networking solutions provider, which is known for its computer network switches that speed up communications in data centers.

It is worst mentioning that 19 of the last 21 EPS revisions from analysts have been to the upside, while 25 out of the 29 analysts covering ANET have either a Buy-equivalent or Hold-rating on the stock.

According to the options market, traders are pricing in an implied move of about 9% in either direction for ANET stock following the print. Notably, shares lost 6% after the company’s Q4 report in mid-February.

Source: InvestingPro

Consensus expectations call for the Santa Clara, California-based tech company to post earnings per share of $1.74 for the first three months of 2024, increasing 21.7% from EPS of $1.43 in the year-ago period.

Meanwhile, revenue is forecast to jump 14.7% year-over-year to $1.55 billion, reflecting robust demand for cloud infrastructure from large corporations, small businesses, government agencies and educational institutions.

But as is usually the case, it is more about guidance than results. Taking that into account, I reckon Arista CEO Jayshree Ullal will give an upbeat outlook for the current quarter as the company continues to benefit from growing demand for its suite of cloud-based networking products and data center solutions.

Arista has carved a niche in the networking technology sector with its innovative solutions and has been successful in grabbing market share from chief rivals Cisco Systems (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR).

It counts Meta Platforms (NASDAQ:META), and Microsoft (NASDAQ:MSFT) as its two biggest customers.

ANET stock ended Friday’s session at $274.40, a tad below the record high close of $306.42 reached on March 22. At current levels, Arista Networks has a market cap of $86 billion.

Source: Investing.com

Shares are up 16.5% year-to-date, rising alongside much of the tech sector amid excitement over the future business prospects related to artificial intelligence.

As InvestingPro’s ProTips points out, Arista Networks sports a near perfect InvestingPro ‘Financial Health’ score thanks to its strong earnings and sales growth trajectory, robust cash flow, and pristine balance sheet.

Stock to Sell: Rivian Automotive

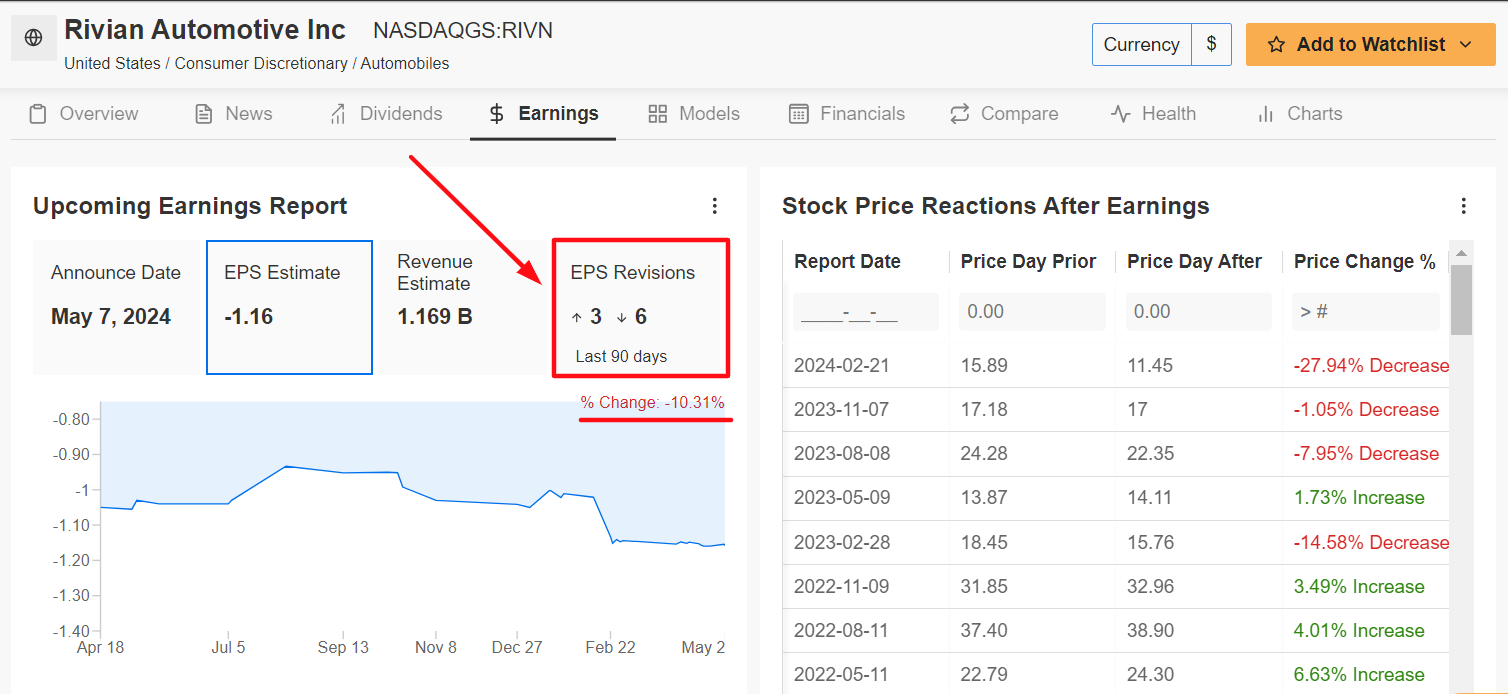

I foresee a weak performance for Rivian Automotive (NASDAQ:RIVN) this week, with shares possibly breaking down to new record lows, as the struggling electric truck startup’s latest earnings and guidance will underwhelm investors due to the negative impact of various headwinds on its business.

Rivian’s first quarter update is scheduled to come out after the close on Tuesday at 4:10PM ET. A conference call with analysts is set for 5:00PM ET.

Underscoring several near-term challenges Rivian faces amid the current climate, six out of the nine analysts surveyed by InvestingPro cut their profit estimates ahead of the print to reflect a drop of approximately 10% from their initial expectations.

Market participants expect a sizable swing in RIVN stock after the update drops, with an implied move of roughly 14% in either direction as per the options market. Notably, RIVN shares plunged 28% after the last report came out to suffer the worst earnings-reaction-day selloff since it went public in late 2021.

Source: InvestingPro

Wall Street sees the Irvine, California-based EV maker losing -$1.16 a share in the March quarter, compared to a net loss of -$1.25 in the year-ago period, as it continues to spend heavily in an attempt to fend off competition from more established EV makers such as Tesla (NASDAQ:TSLA), Ford (NYSE:F), and General Motors (NYSE:GM).

Revenue is seen rising 74% year-over-year to $1.16 billion, however that would mark a slowdown from the $1.32 billion sales total recorded in the preceding quarter as Rivian struggles in the face of weakening demand amid a deteriorating EV market.

That leads me to believe that there is a growing downside risk that Rivian could cut its sales guidance and production and delivery outlook for the rest of the year to reflect higher cost pressures and lower gross margins.

RIVN stock, which slumped to an all-time low of $8.26 on April 16, ended at $10.07 on Friday. At current valuations, Rivian has a market cap of $10 billion.

Source: Investing.com

Shares are down a whopping 57% so far in 2024, making it one of the worst performers of the year thus far. Even more alarming, RIVN remains roughly 95% below its all-time high of $179.47 touched shortly after its IPO in November 2021.

Nit surprisingly, Rivian currently has an extremely poor Investing Pro ‘Financial Health’ score of 1.9 out of 5.0. The Pro health metric is determined by ranking the company on over 100 factors against other companies in the Consumer Discretionary sector.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation and high interest rates.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See the stocks Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohen_Inv for more stock market analysis and insight.