- Microsoft + Tesla earnings, Q4 GDP data, PCE inflation in focus.

- Visa stock is a buy amid strong profit, sales growth.

- Intel shares set to underperform amid weak results, sluggish outlook.

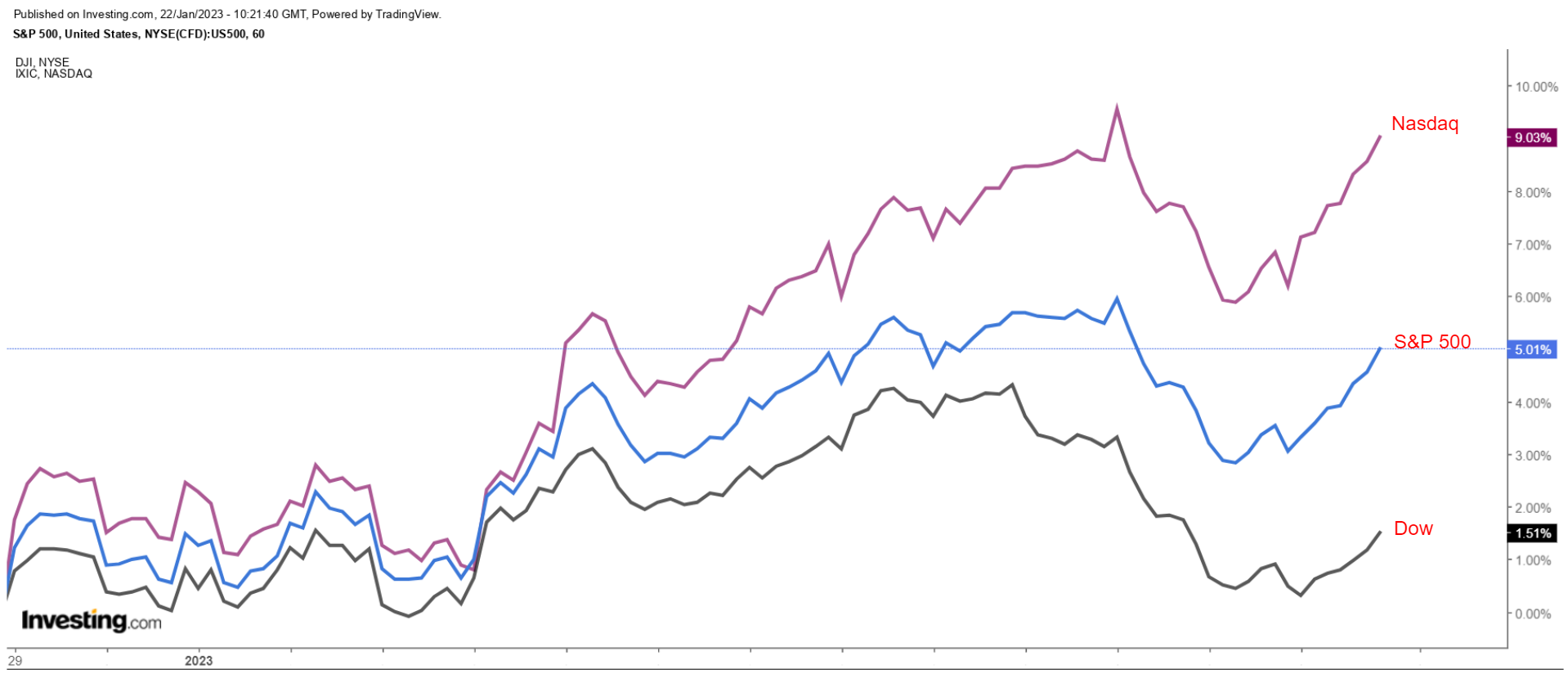

Stocks on Wall Street rose on Friday, but the major averages ended the week mostly lower after the latest batch of economic data-fueled recession worries.

For the week, the blue-chip Dow Jones Industrial Average and the benchmark S&P 500 lost 2.7% and 0.7% respectively, while the technology-heavy Nasdaq Composite managed to eke out a gain of 0.5%.

Source: Investing.com

The coming week is expected to be another eventful one as Q4 earnings season shifts into high gear, with reports expected from Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA), IBM (NYSE:IBM), and Texas Instruments (NASDAQ:TXN). The earnings agenda also consists of other high-profile companies, such as Boeing (NYSE:BA), Chevron (NYSE:CVX), 3M (NYSE:MMM), Johnson & Johnson (NYSE:JNJ), AT&T (NYSE:T), Verizon (NYSE:VZ), Mastercard (NYSE:MA), Southwest Airlines (NYSE:LUV), General Electric (NYSE:GE), and Lockheed Martin (NYSE:LMT).

In addition, there is also important fourth quarter growth data due on Thursday, which will provide more clues as to whether the economy is heading for a recession. The personal consumption expenditures (PCE) price index - which is the Federal Reserve’s preferred inflation measure - then comes out Friday morning.

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Visa

After closing at their best level in over nine months on Friday, I expect shares of Visa (NYSE:V) to extend their rally in the coming week as the credit card giant is forecast to deliver strong profit and sales growth when it reports its latest financial results.

As per the options market, traders are pricing in an implied move of around 4.2% in either direction for V stock following the earnings update due after the U.S. market closes on Thursday, Jan. 26.

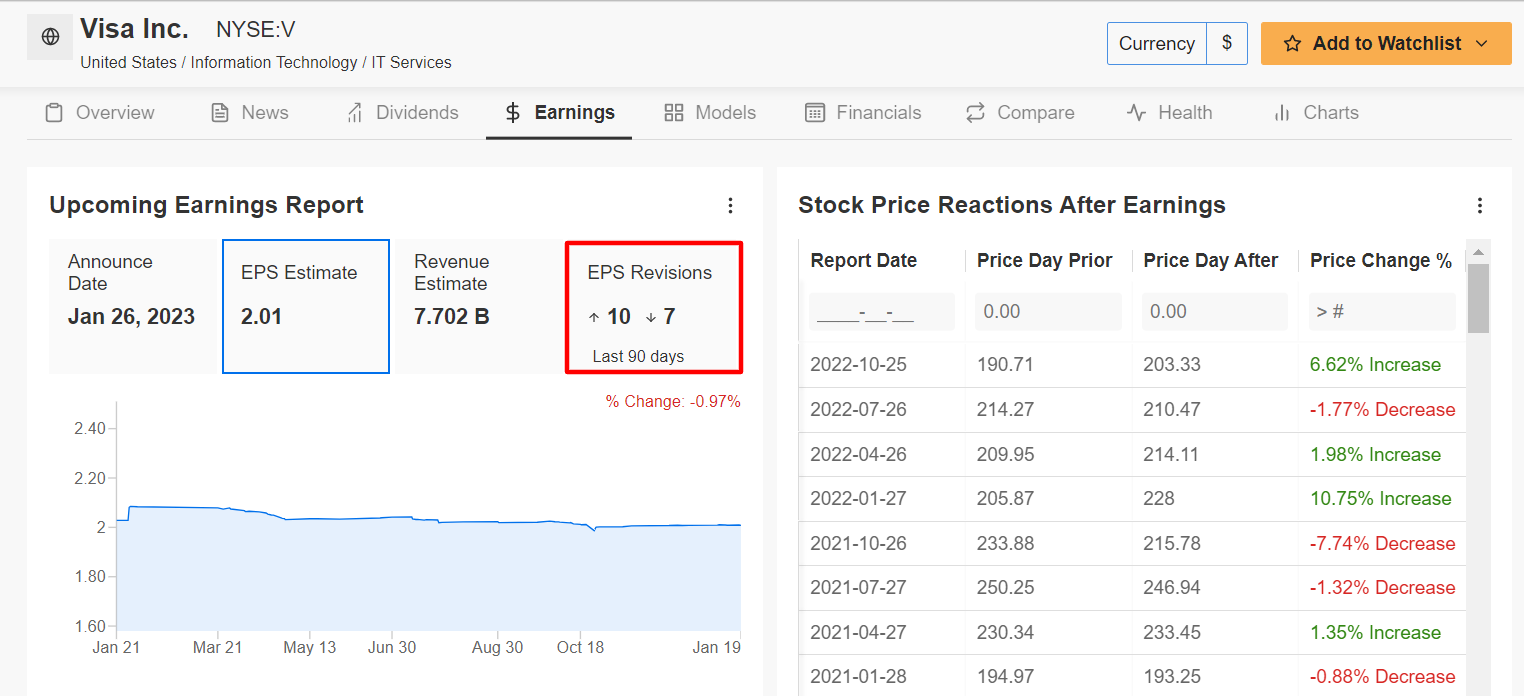

In my view, a global recession is not anticipated to cut deep into Visa’s quarterly performance. Indeed, an InvestingPro survey of analyst earnings revisions points to growing optimism ahead of the report, with analysts raising their EPS estimates 10 times over the last 90 days despite the challenging macroeconomic backdrop.

Source: InvestingPro

Consensus estimates call for the payment processing company to post earnings per share of $2.01 for its fiscal first quarter, as per Investing.com, improving 11% from EPS of $1.81 in the year-ago period. If that is in fact the reality, it would mark the seventh straight quarter of accelerating profit and the highest since Q4 2014.

Meanwhile, revenue is forecast to increase 9.1% year-over-year to $7.7 billion, reflecting an upbeat performance across its payments network as it benefits from a robust combination of rising spending volumes and growing transactions due to higher credit-card usage rates both domestically and internationally.

Demonstrating the strength and resilience of its underlying business, Visa has either matched or beaten Wall Street’s top line expectations in every quarter dating back to at least Q2 2013, while trailing revenue estimates only thrice in that span.

As such, I expect the company, which is one of the 30 components of the Dow Jones Industrial Average, to forecast another period of upbeat profit and sales growth thanks to favorable fundamentals and continuing positive trends into 2023.

Source: Investing.com

V stock ended Friday’s session at $224.31, its highest close since April 5, 2022. Shares of the Foster City, California-based corporation have run hot in recent weeks, with the stock marking a gain of almost 30% since reaching a mid-October 52-week low of $174.60.

Visa shares have tacked on 8% so far in 2023. The stock held up much better than the broader market last year, falling just 4% in 2022. At current levels, Visa has a market cap of $462 billion, making it the seventh most valuable company in the world.

Stock To Dump: Intel

I believe Intel's (NASDAQ:INTC) stock will underperform in the week ahead, with a potential revisit to its recent lows on the horizon, as the struggling semiconductor company prepares to deliver disappointing financial results after the closing bell on Thursday, Jan. 26 due to the difficult economic environment.

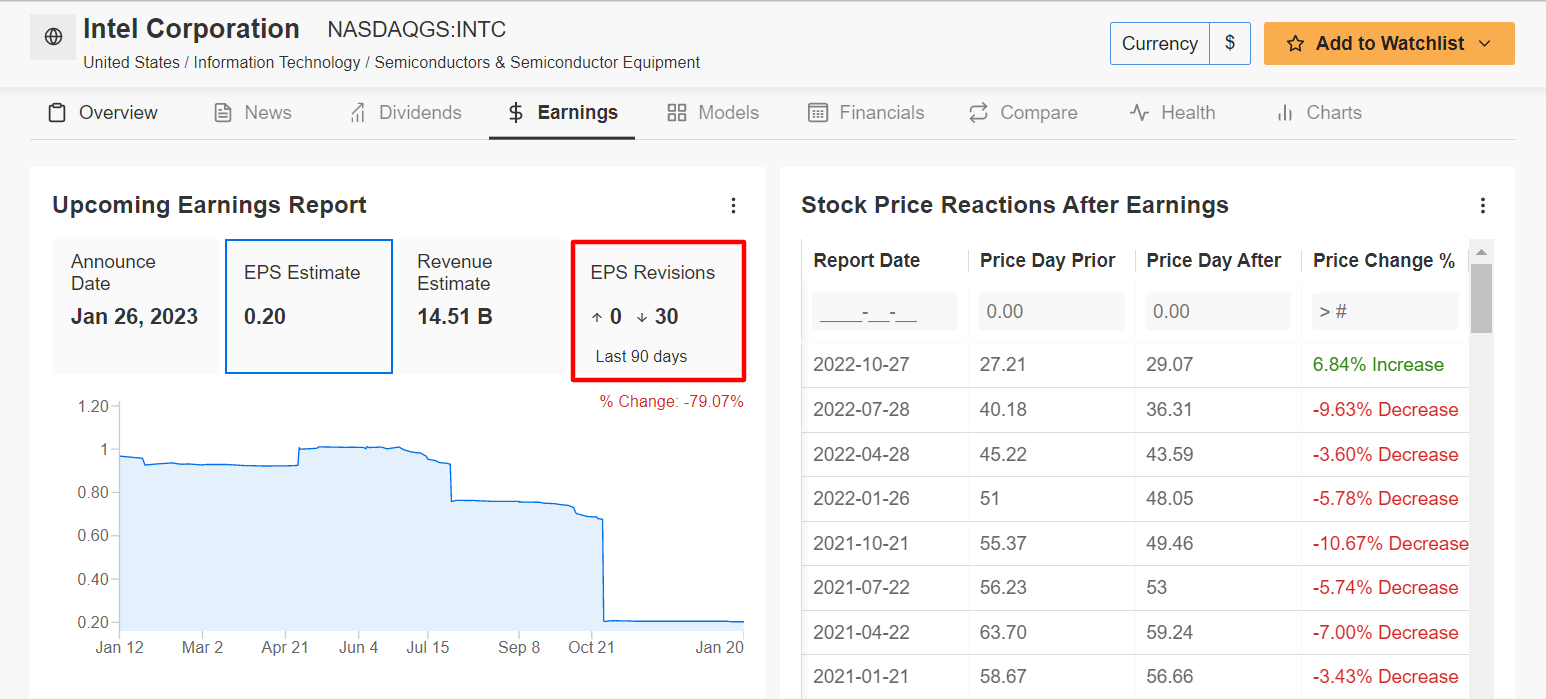

Consensus calls for the Santa Clara, California-based chipmaker to report fourth quarter earnings per share of $0.20, collapsing more than 80% from EPS of $1.09 in the year-ago period. If confirmed, it would mark Intel’s smallest quarterly profit in at least a decade, underscoring the several challenges the company currently faces.

Meanwhile, revenue is forecast to plunge 25.7% year-over-year to $14.5 billion, which would mark the lowest since Q2 2016, amid a sluggish performance in its all-important chip business, weak data center sales, as well as dwindling PC demand from consumers.

Source: InvestingPro

Not surprisingly, profit expectations have been revised downward a whopping 30 times in the 90 days prior to the earnings release, according to InvestingPro.

Based on moves in the options market, traders expect a sizable swing in INTC shares following the results, with a possible implied move of roughly 8% in either direction.

Looking ahead, I expect Intel’s forward guidance to signal another challenging year as I become increasingly concerned by the chipmaker’s future prospects.

Once widely considered the undisputed leader in the computer processors industry, Intel has been steadily losing market share in recent years to rivals such as Advanced Micro Devices (NASDAQ:AMD), Nvidia (NASDAQ:NVDA), and Taiwan Semi (NYSE:TSM). In addition, its business has also suffered as more and more Big Tech companies, including Apple (NASDAQ:AAPL), Microsoft, and Amazon (NASDAQ:AMZN), opt to develop their own chips and microprocessors.

Source: Investing.com

INTC stock, which fell to a bear-market low of $24.59 in mid-October, closed at $29.22 on Friday. At current valuations, the out-of-favor tech company has a market cap of $120.6 billion.

Shares, which have rallied to start the new year along with the tech-heavy Nasdaq, are up 10.5% through the first few weeks of 2023, following an annual decline of 48.7% in 2022. Notwithstanding the recent turnaround, INTC stock remains about 58% away from its January 2020 all-time high of $69.29.

Disclosure: At the time of writing, I am long Visa and short Intel. I also maintain a small short position on the S&P 500 and Nasdaq 100 via the ProShares Short S&P500 ETF (NYSE:SH) and ProShares Short QQQ ETF (NYSE:PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.